CubeSmart

Latest CubeSmart News and Updates

How Could Investing in EBSAX Affect Your Portfolio’s Performance?

EBSAX seeks to generate attractive risk-adjusted returns across a broad range of market conditions.

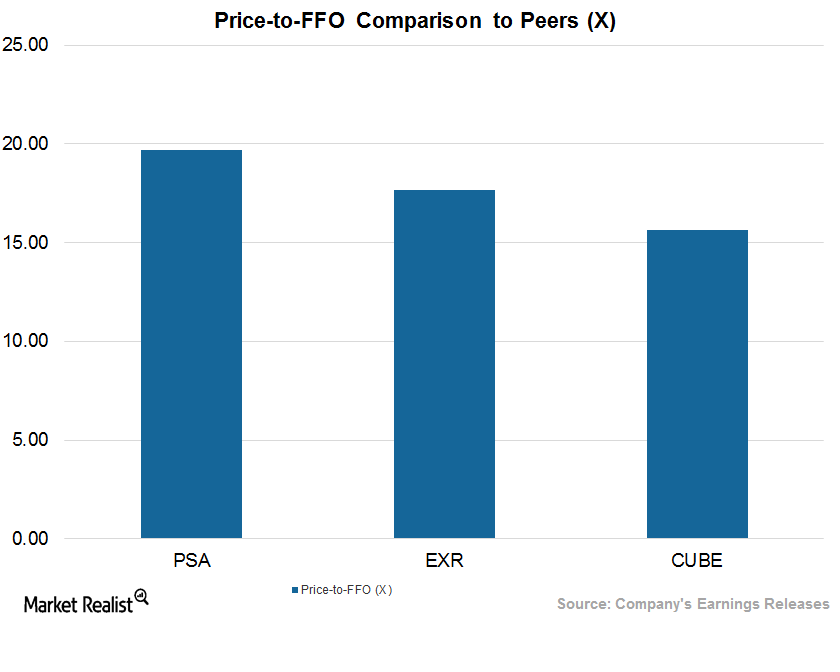

Comparing the Valuations of 3 Leading Self-Storage REITs after 2Q17

Public Storage (PSA) trades at an EV-to-EBITDA multiple of ~21.5x.