Crestwood Equity Partners LP

Latest Crestwood Equity Partners LP News and Updates

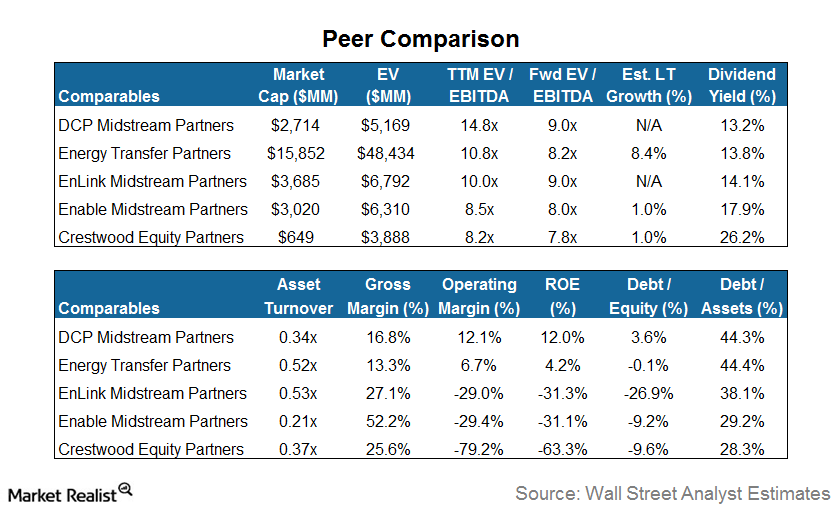

Where Does DCP Midstream Stand Compared to Its Peers?

DCP Midstream Partners (DPM) has an enterprise value of $2.7 billion.

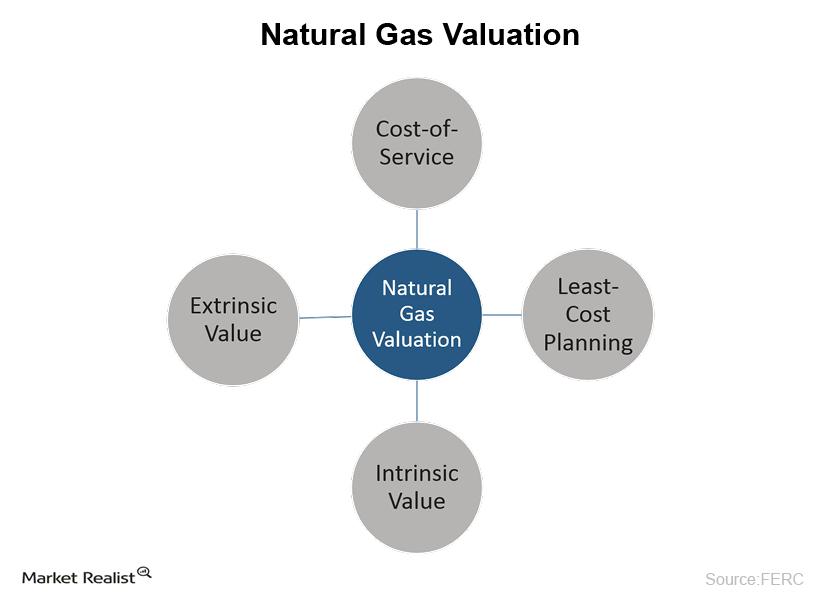

Must-know : A brief overview of natural gas storage contracts

High volatilities in prices increase the extrinsic value of storage assets because it creates more opportunities for profitable storage optimization.

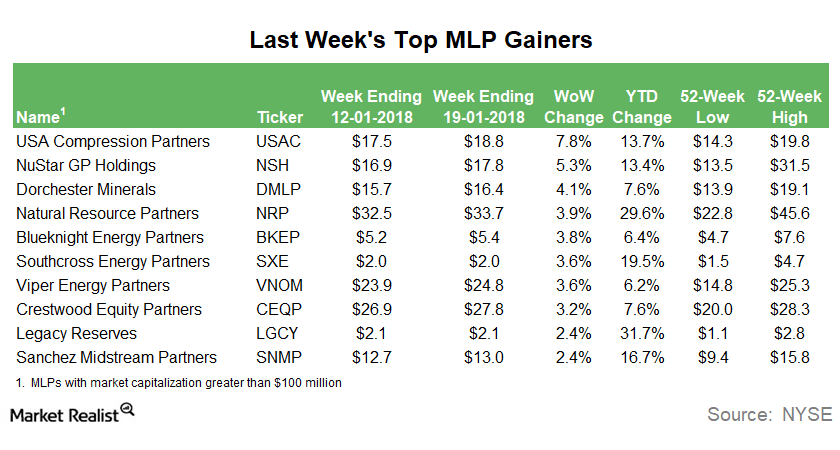

Why USAC Was the Top MLP Last Week

USA Compression Partners (USAC), a midstream MLP involved in natural gas contract compression services, was the top MLP gainer last week with WoW (week-over-week) gains of 7.8%.

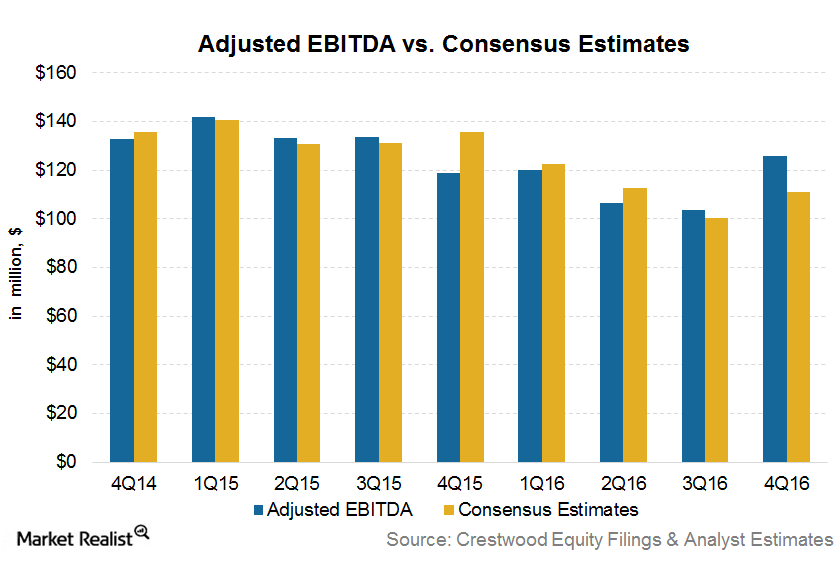

What Drove Crestwood Equity Partners’s 4Q16 EBITDA Growth?

Crestwood Equity Partners (CEQP) reported its 4Q16 earnings on February 21, 2017. Its 4Q16 adjusted EBITDA increased to $125.6 million from $118.9 million in 4Q15, a year-over-year increase of 5.6%.

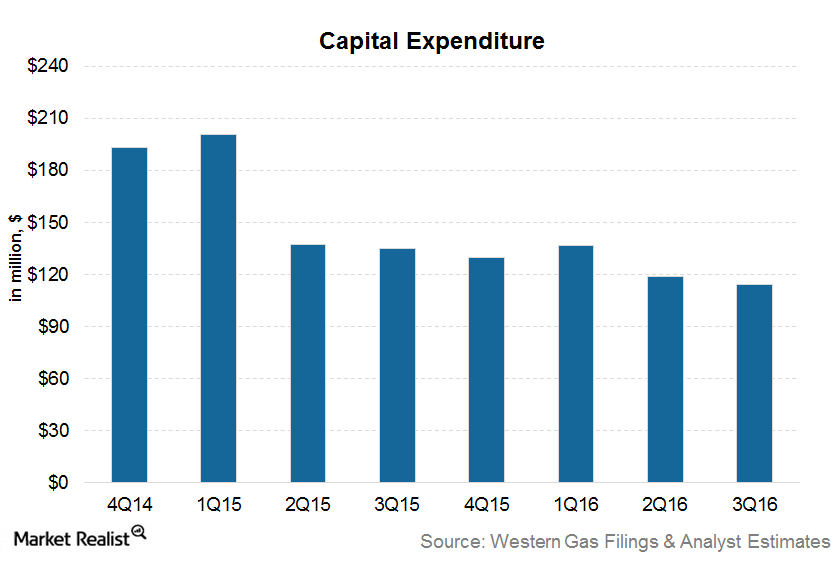

Why Western Gas’s Capital Spending Could Recover in 2017

Western Gas Partners’ (WES) growth capital spending started to decline at the beginning of the rout in energy prices.

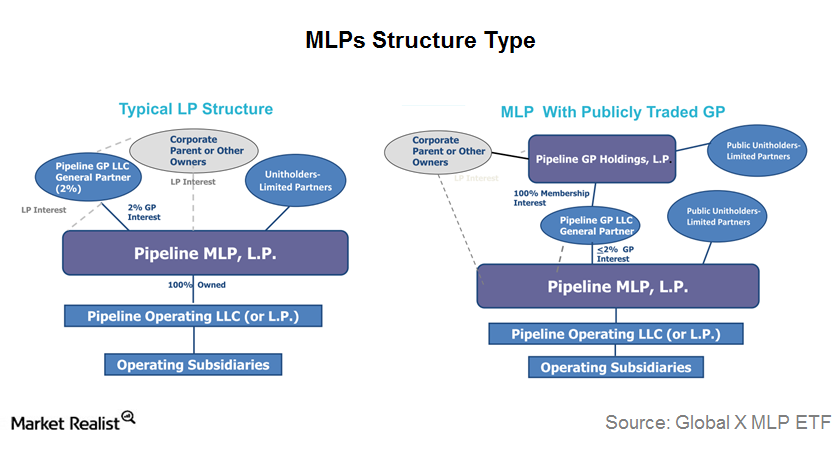

Do MLPs Benefit from the LP-GP Model?

MLPs generally have an LP-GP (limited partner and general partner) model structure in which the LP is a publicly traded entity and owns the majority of the operating assets.

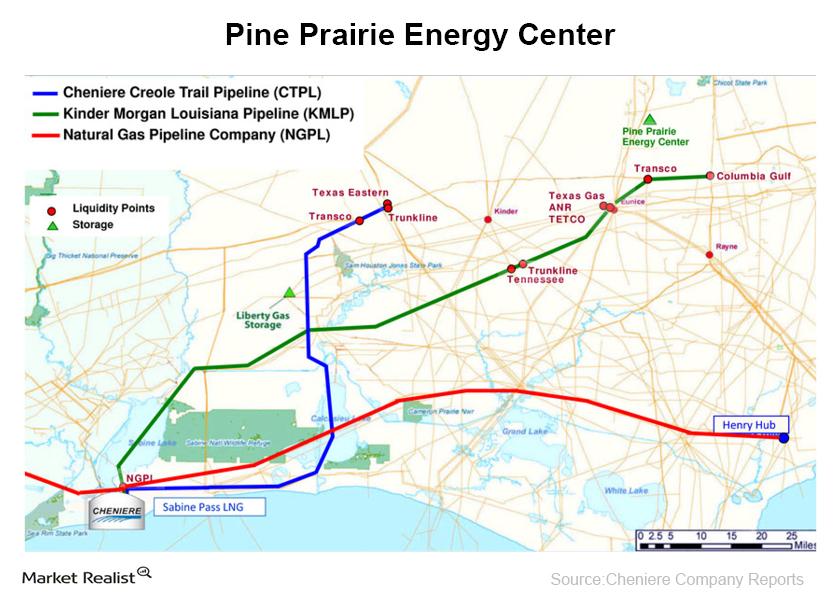

Overview: Plains All American Pipeline’s gas storage facilities

Currently, there are three major publicly traded independent storage firms, Plains All American Pipeline’s (PAA) natural gas storage subsidiary (PAA Natural Gas Storage), Niska Gas Storage Partners (NKA), and Crestwood Equity Partners (CEQP). PAA is part of the Alerian MLP (or master limited partnership) ETF (AMLP), while CEQP is part of the Global X MLP ETF (MLPA).