Anacor Pharmaceuticals Inc

Latest Anacor Pharmaceuticals Inc News and Updates

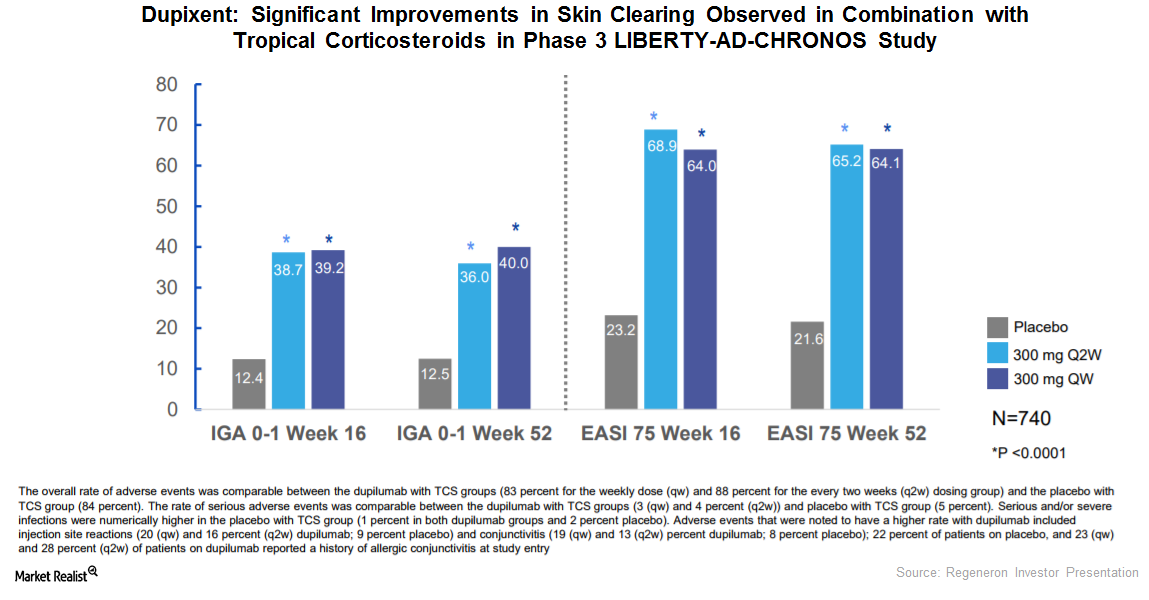

Dupixent Could Substantially Drive Regeneron’s Growth

In March 2017, the FDA approved Regeneron and Sanofi’s Dupixent injection for the treatment of adult individuals with moderate to severe atopic dermatitis.

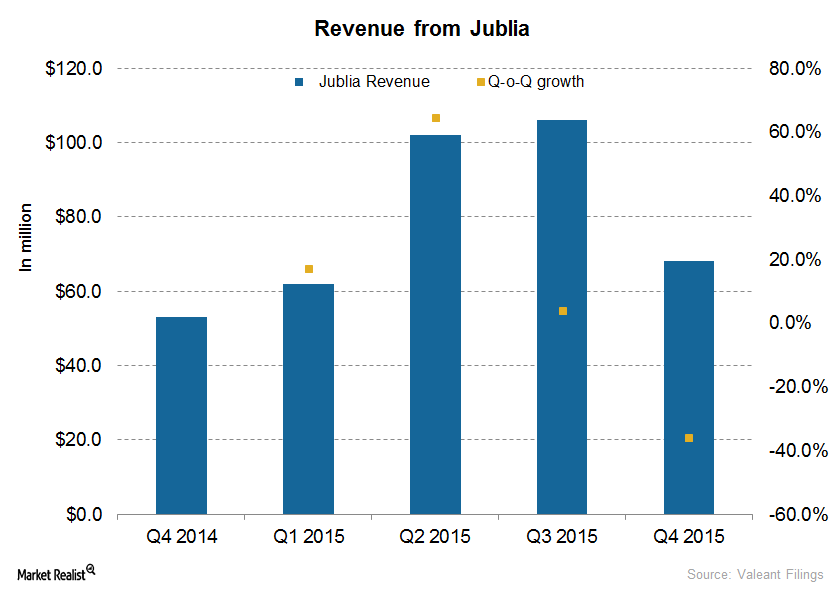

Behind Valeant’s Significant Drop in Jublia Sales

In 4Q15, Jublia added $68 million to the top line of Valeant—the sixth-largest revenue contributor in 4Q15, down from the second-largest in 3Q15.