Automatic Data Processing Inc.

Latest Automatic Data Processing Inc. News and Updates

Technology & Communications Why you should know the key differences between job reports

Few economic releases elicit as much reaction from both the stock (IVV) and bond (BND) markets as the employment reports issued by Automatic Data Processing (ADP) and the Bureau of Labor Statistics (the BLS).Must-know: Concur is the biggest acquisition in SAP’s history

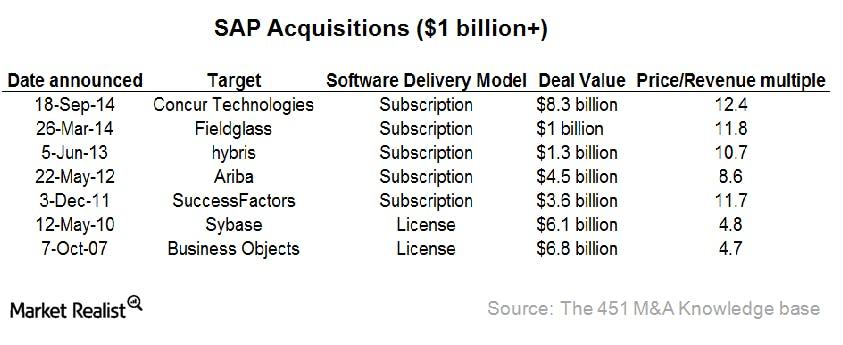

Since 2010, SAP AG (SAP) spent more than ~$12 billion on acquisitions. Concur Technologies is the largest acquisition in SAP’s 42-year history. In its 2Q14 results, most of SAP’s growth was from its cloud business—approximately $1 billion annually. Concur’s management mentioned that they expect to end fiscal year 2014 with ~$690 million.

Ackman Makes Berkshire Bet: What It Means for Investors

According to the regulatory filing from Bill Ackman’s Pershing Square Capital, the fund has taken a new stake in Berkshire Hathaway (BRK.B).

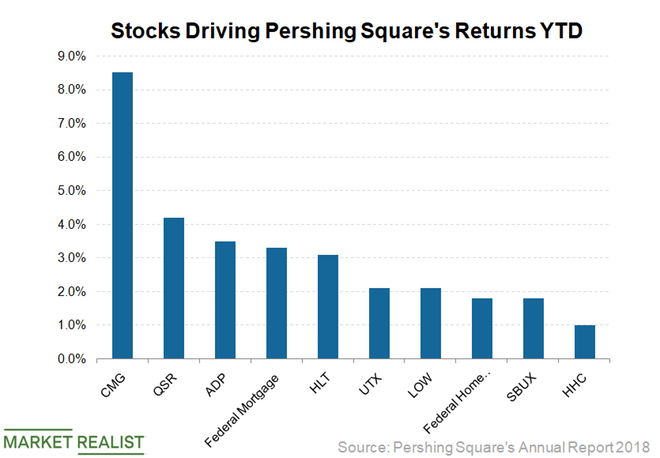

Bill Ackman Thanks Warren Buffett for His Fund’s Comeback in 2019

Bill Ackman has made a huge comeback in 2019.

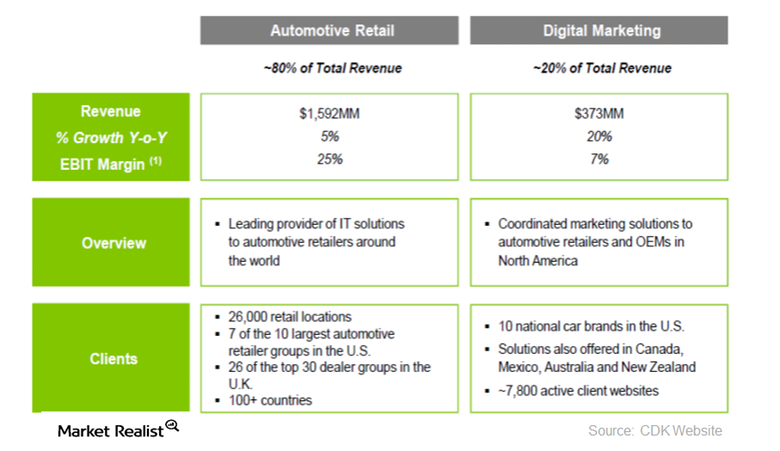

OZ Management Opens New Position in CDK Global

OZ Management commenced a stake in CDK Global Inc. (CDK) by purchasing 4,521,952 shares of the company, representing 0.5% of the fund’s 4Q14 portfolio.