Xpeng Stock Forecast 2025: Long-Term Growth at a Reasonable Price

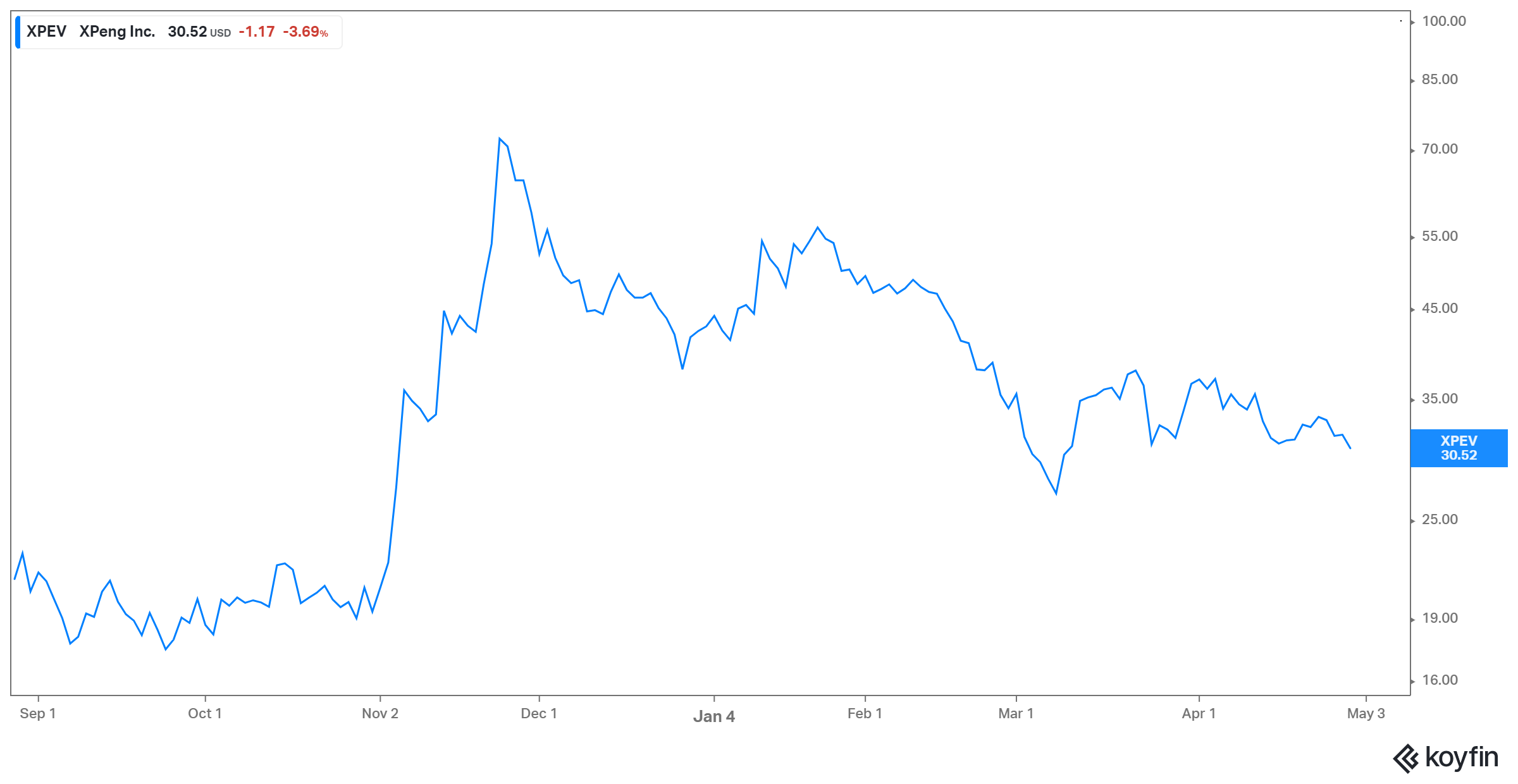

Xpeng stock has lost nearly 29 percent YTD despite delivering strong vehicle sale growth. What is Xpeng's (XPEV) stock forecast for 2025?

April 30 2021, Published 10:17 a.m. ET

After seeing a lot of investor interest in 2020, EV names and particularly Chinese EV stocks have pulled back significantly. However, EV penetration is still expected to rise going forward. China has a goal that its new energy vehicle sales should account for 20 percent of new car sales by 2025. Amid this favorable economic backdrop, what is Xpeng's (XPEV) stock forecast for 2025?

Alibaba-backed Xpeng went public in August 2020. Xpeng aims to sell smart EVs to technology-savvy middle-class consumers in China.

Will XPEV stock recover?

XPEV stock pulled back sharply starting in December 2020. The stock is down nearly 29 percent YTD and 58 percent from its 52-week high value reached in November 2020. Investors wonder if the stock will ever recover. This can be answered by looking at the reasons it has fallen.

One of the major reasons is the broader market sell-off due to rotation from growth to value. Secondly, EV players are battling chip shortage, which is weighing negatively on investor sentiment. These two factors are somewhat temporary. The sentiment should recover as investors see the worth of quality growth stocks and as chip production ramps up.

Another reason for the drop in XPEV and other EV stocks is their soaring valuations. During the second half of 2020, some EV stocks got ahead of themselves. Investors became concerned about their soaring valuations, which led to a pullback. However, as the dust settles down, good quality names should shine again and Xpeng belongs in that category.

XPeng's production by 2025

Xpeng will set up a new factory to increase its production, likely in Wuhan. It will be Xpeng's third production plant. Recently, the company announced that it was setting up its second manufacturing base in Guangzhou. Including the current Zhaoqing plant, Xpeng will have the capacity to produce 300,000 cars annually.

Xpeng delivered 27,041 vehicles in 2020, which was almost double the amount in 2019. While the company might be able to double the production rate over one to two more years, going forward, the rate should slow down. By assuming a CAGR of 60 percent, we arrive at 280,000 vehicles by 2025. Therefore, the likely range for vehicle production should be 250,000–300,000 by 2025.

Will Xpeng produce its own chips?

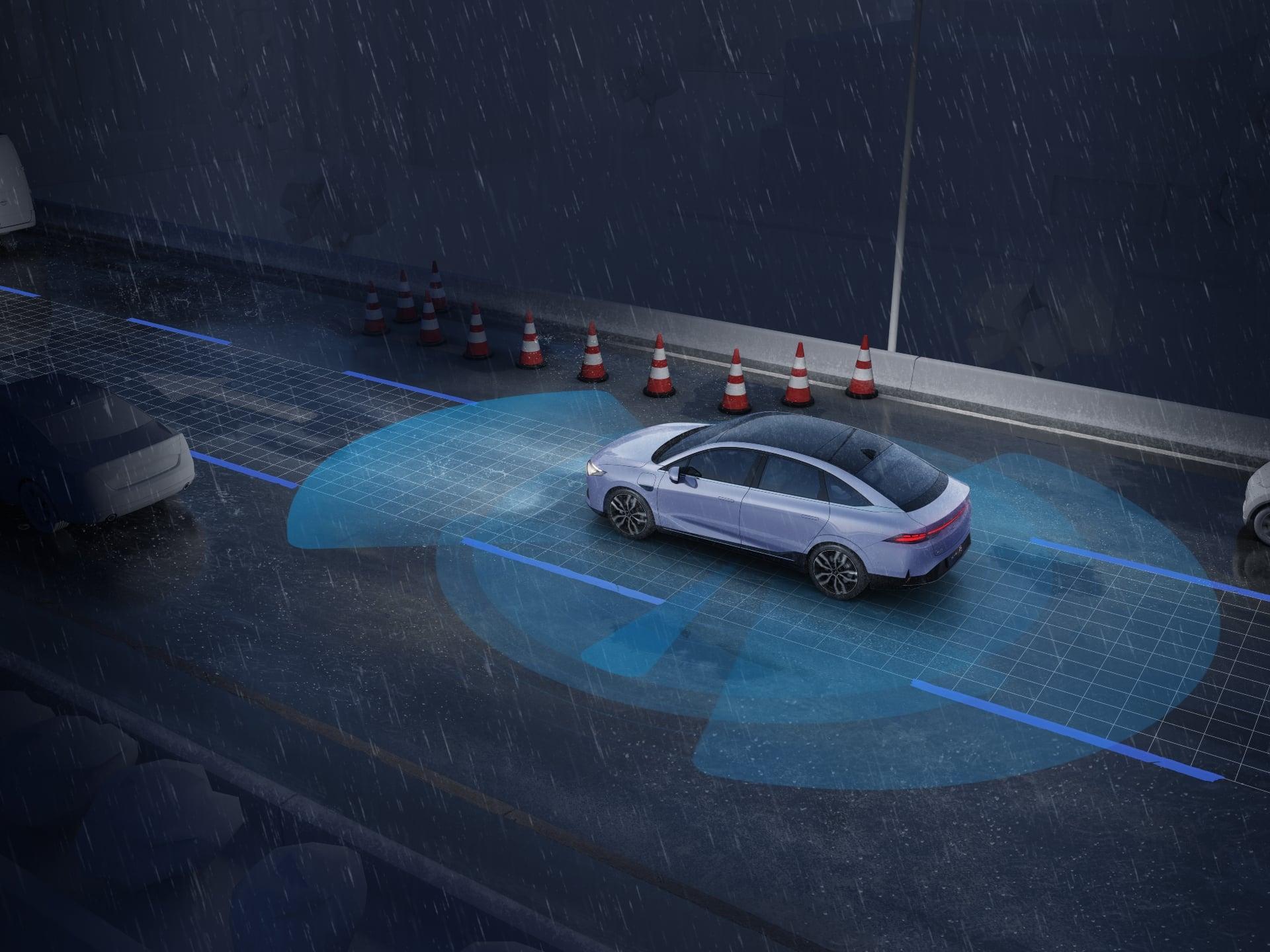

Xpeng isn't just focused on producing vehicles, it's also focused on producing software and other cutting-edge technologies of the future. The company debuted its lidar-equipped P5 model smart sedan in mid-April. Interestingly, the vehicle is powered by Xpeng’s full-stack in-house developed autonomous driving system-XPILOT. Xpeng has also developed its own lidar technology

According to Chinese news outlet 36kr, Xpeng is developing its own autonomous driving chip using a small team of less than 10 engineers. Deutsche Bank’s Edison Yu thinks that Xpeng is actively recruiting chip engineers, which suggests that it plans to grow this effort moving forward. While the company’s XPILOT 3.5 and 4.0 will still use Nvidia chips but it could follow Tesla going forward to design its own chip to train its neural net.

XPEV stock 2025 forecast

Currently, according to the consensus compiled by Market Beat, 11 Wall Street analysts cover the stock. Nine out of the 11 analysts have a buy rating, while two have hold ratings. The average 12-month forward target price for the stock is $53.4, which implies an upside potential of 75 percent. The stock’s pullback and analysts’ still bullish forecasts imply a strong upside for the stock going forward.

While it's difficult to forecast the stock price four years down the line, we’ll make an effort by looking at the major price drivers for the stock. The vehicle sales are expected to remain the biggest revenue and earnings driver for stock in 2025 as well. However, there could be other revenue streams like subscription revenue from XPILOT, its charging network, and ride-hailing network.

XPEV’s sales are expected by rise by 145.6 percent and 94 percent for 2021 and 2022, respectively, to 2.22 billion and 4.3 billion. Going forward, the subscription revenues should add onto this stream. This growth rate in revenue and earnings should ultimately flow to the stock price appreciation. Its stock could be worth many times more come 2025.

XPEV stock valuation

XPEV stock is currently trading at EV-to-NTM revenues of 8.9x. This is far lower than the multiple of 17.1x that it traded at during December. Its close peers, namely NIO and Li Auto, are trading at EV-to-NTM revenue multiples of 11.0x and 4.7x, respectively. Based on its own historical multiples, the stock looks cheap now. While the stock’s multiple has contracted due to the broader sell-off and soaring EV valuations, its prospects have gotten better. The company’s strong deliveries, robust guidance, and European entry since the stock pullback happened in November deserve a re-rating.

XPEV is a good long-term investment.

The Chinese EV market is huge and expanding with government support. In 2020, the EV sales were 1.3 million and the sales are estimated to grow by 50 percent in 2021. The domestic EV-makers, including the biggest listed names like NIO, Xpeng, and Li Auto, are expected to be the biggest beneficiaries of this trend. Xpeng, with its particular focus on software and technology, should see its stock price soar going forward.

The current pullback in the stock provides a good entry point to investors for long-term gains. Recently, JPMorgan also picked NIO and Xpeng as the best-placed start-ups to rival industry leader Tesla for global market share. JPMorgan’s analyst Oliver Cox listed production expertise, strong software integration, and strong backing as the major competitive advantages of Xpeng along with NIO.