Will NFT Music Company Royal Go Public After Its $55 Million Investment Round?

Royal just received a major investment from Andreessen Horowitz. Is the crypto company eyeing the public market?

Nov. 23 2021, Published 11:33 a.m. ET

As interest in non-fungible tokens (NFTs) soars, startups are popping up that tap into niche corners of the crypto space. One such startup is Royal, an NFT trading platform that lets you buy ownership in popular songs and earn royalties.

Given its hearty investment round from the crypto arm of Andreessen Horowitz, investors are keeping Royal on their watchlist—but is the startup eyeing an IPO?

Royal gets $55 million injection from a16z Crypto

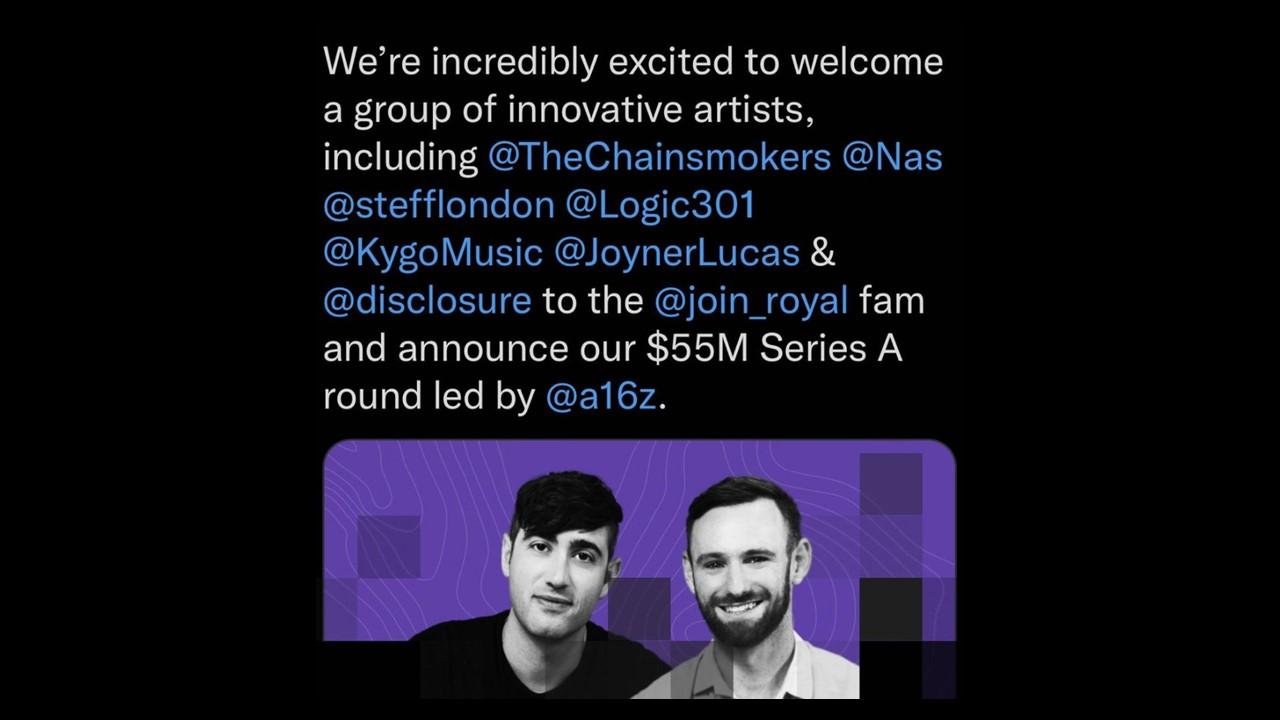

NFT music rights platform Royal officially exited seed mode when it received a Series A funding round worth $55 million. The lead investor is a16z Crypto, the crypto arm of investment company Andreessen Horowitz. Various musical artists, such as The Chainsmokers, DJ Kygo, and rapper Nas, also invested in the company during the round.

The Series A round came quickly, just three months after the company's seed funding round from Founders Fund and Paradigm worth $16 million. This means Royal is building its platform quickly, hoping to normalize the communal ownership of music through the blockchain.

How Royal's NFT music rights platform works

Artists can sell ownership of their music and fan experiences on Royal through NFTs. Collectors who buy these NFTs can claim partial ownership through blockchain-based NFTs. Once they own the NFTs, they can receive royalties as artists earn capital for their music.

In the few years that NFTs have existed, they've primarily focused on visual art and gaming. There have also been ventures into tokenized physical objects, but Royal takes a different route. It's focusing on music, bringing a new kind of art into the NFT sphere. While speculative, this corner of the market does have potential.

JD Ross and 3LAU lead Royal

The Royal team is spearheaded by EDM artist 3LAU (aka Justin Blau) and Opendoor co-founder JD Ross. 3LAU boasts more than 2.6 million monthly listeners on Spotify. Meanwhile, Ross's company Opendoor (NASDAQ:OPEN) went public in June 2020, and its market value has since grown 50.95 percent. Opendoor, which was also backed by a16z, is thriving as it continues to perform well in the house-flipping market that competitor Zillow temporarily exited.

Prior to the Series A funding round, 3LAU gave away NFTs for his music for free, equating to 50 percent of the streaming rights to one of his recent songs. At resale, the NFTs went for upwards of $600,000.

Royal executives want big, but will they go for IPO?

Having already accomplished major growth, Royal is undoubtedly on the up and up. However, the company still seems a long way away from any sort of IPO conversation. Given his association with Opendoor, Ross is familiar with the IPO process, so it's not wild to think Royal's end game could be the public market. However, the speculative product will surely need to prove itself in operation before institutional and retail investors are ready to own its stock.