Why TurboTax Is Asking About Stimulus Checks

TurboTax is a popular tax-preparation software. As tax season approaches, why is TurboTax asking about stimulus check payments?

Feb. 11 2021, Published 11:42 a.m. ET

Tax season is approaching with the usual deadline of April 15 in place for filing your tax returns. If you don’t go to a professional accountant to prepare your taxes, you might be one of millions of Americans who use a software program like TurboTax.

Many TurboTax users wondering why the program asks customers about stimulus checks. Economic stimulus payments for COVID-19 relief are adding another layer to tax preparation this year. TurboTax needs to know whether or not you received stimulus checks and if they were in the full amount to determine eligibility for a Recovery Rebate Credit.

Why TurboTax asks about stimulus checks

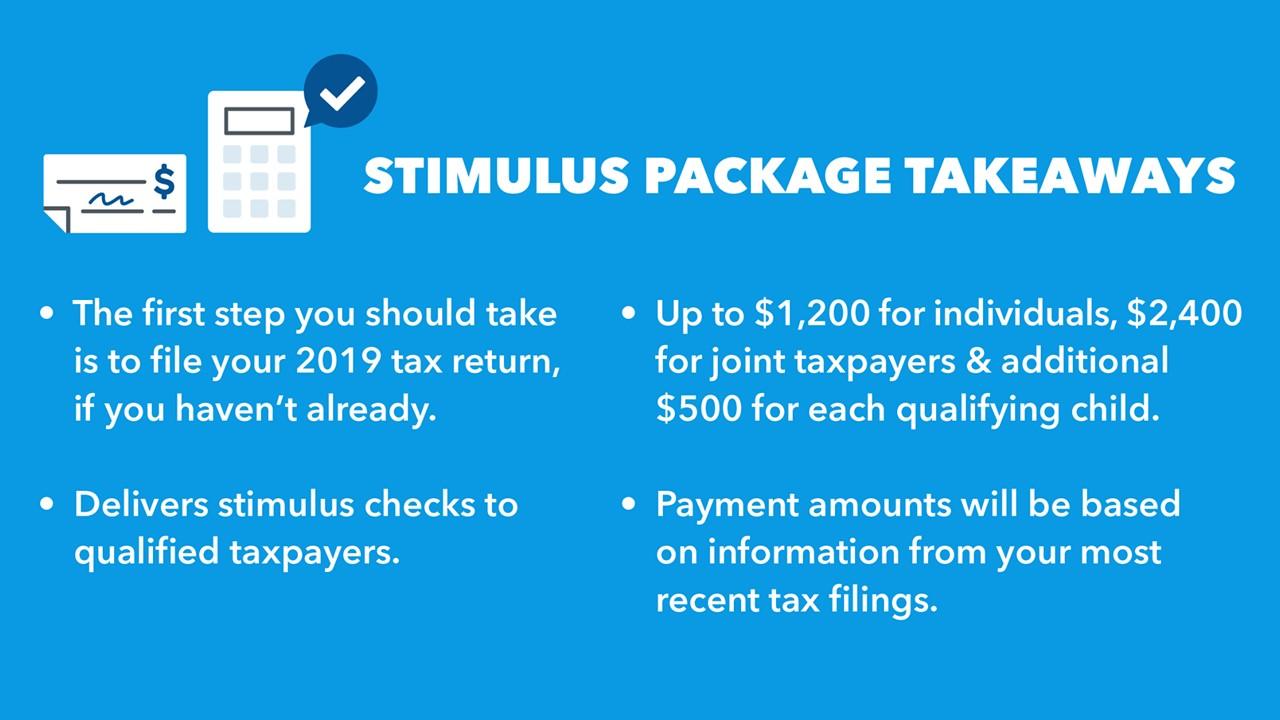

Stimulus checks were sent to millions of Americans after the first round of economic relief passed in the spring of 2020 and once after the second stimulus bill passed at the end of the year. However, some eligible people didn't receive checks or didn’t get the full amount.

In order to determine your eligibility for a Recovery Rebate Credit, TurboTax needs to know whether or not you received the full amount of the stimulus payments that you were eligible to receive. Your Recovery Rebate Credit will be zero if you already received stimulus checks in full.

If you received both rounds of stimulus checks in the correct amounts, simply note that in your answers. However, if you are still missing stimulus funds, TurboTax can ensure that you receive the money through the tax credit.

What is the Recovery Rebate Credit?

The Recovery Rebate Credit is available to anyone who was eligible to receive Economic Impact Payments (stimulus checks) but didn't receive them, whether in the first round, second round, or both. Anyone who received a partial stimulus check is also eligible for a Recovery Rebate Credit.

Both sets of stimulus checks were considered an advance on the Recovery Rebate Credit. Stimulus payment eligibility was based on 2018 or 2019 tax return information, while rebate credit eligibility is based on 2020 tax return information. It's possible to qualify for stimulus payments but not the credit or qualify for the credit but not stimulus money.

Did TurboTax help distribute payments to clients?

TurboTax, which is owned by Intuit, partnered with the IRS to help distribute stimulus payments. Intuit noted that as many as 10 million Americans weren't required to file taxes, which puts a lot of people at risk of not receiving a stimulus check.

Since the IRS used previous-year tax returns to determine eligibility for stimulus checks and to facilitate sending checks, not filing taxes was a problem. TurboTax created the free TurboTax Stimulus Registration product to help Americans file a minimal tax return in order to receive stimulus funds if eligible.

The simple product enabled many Americans easily receive stimulus payments via direct deposit without having to file a complete tax return. For anyone not required to file taxes or anyone who doesn't receive Social Security payments, the service helped get funds to those who needed them.