New Home Builders Should Expect to Pay More for Wood

Wood is a valuable asset now more than ever. Here's what's pushing the price of lumber through the roof. Will prices keep rising?

March 23 2021, Published 1:25 p.m. ET

During the early days of the COVID-19 pandemic, a series of industries were impacted in one way or another. Rather than struggling, some industries soared—including the lumber industry. By August 2020, wood prices had risen in response to a spike in demand and a subsequent supply shortage.

Now, we're seeing the price of lumber increase even more. The continued price increase proves that some long-term effects of the COVID-19 pandemic might be here to stay.

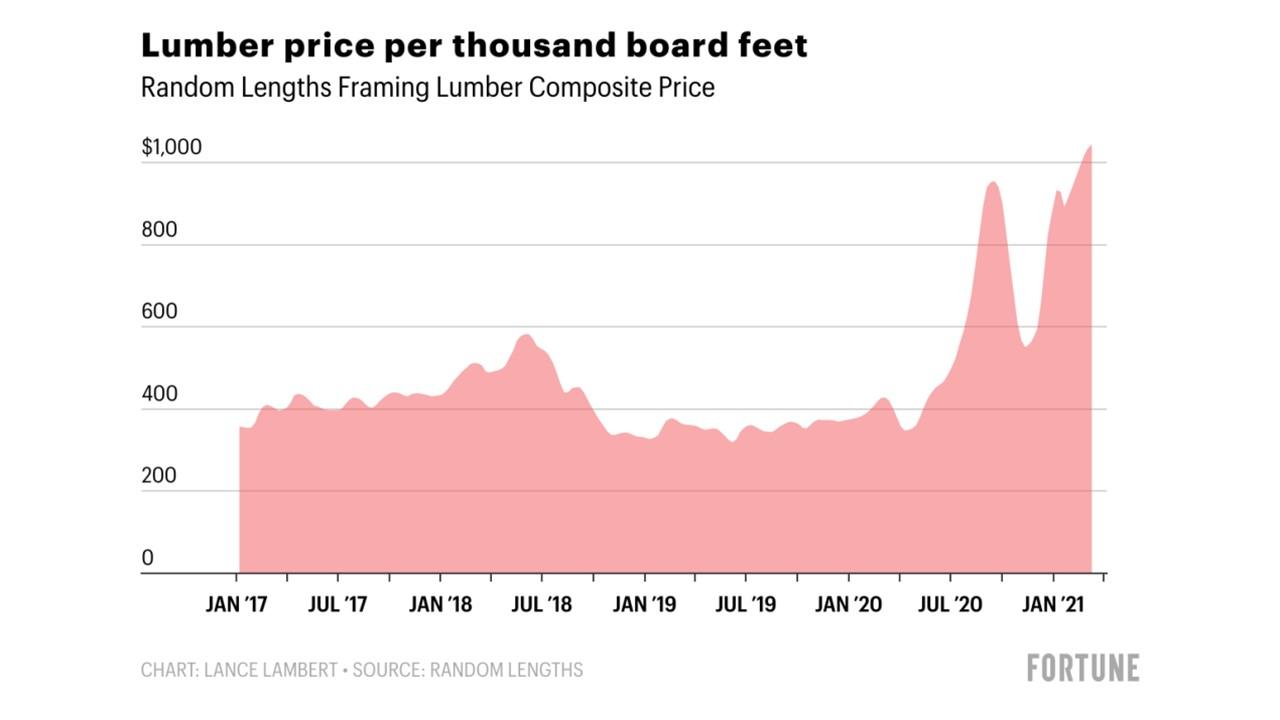

Wood prices are up 188 percent in just over one year.

Five months after U.S. lockdowns, wood prices were up 134 percent, according to Fortune. By the end of February 2021, the number rose to 180 percent. Now, as we progress into spring, we're seeing the measurement rise to 188 percent.

This commodity demand shock has pushed wood prices up to $1,044 per thousand board feet. For the new construction of single-family homes, buyers can expect to pay as much as $24,000 more based on higher lumber costs alone.

What's causing this spike in demand?

Experts attribute this price shock to a surge in interest in new home construction. Considering the price increase started right in line with the COVID-19 pandemic, it makes sense. The "urban exodus" from metropolitan regions within the U.S. has been a major headline over the course of the last year.

There are numerous reasons why people want to move out of big cities. First, cities are crowded, which isn't ideal during a pandemic. Also, a meteoric (and probably, in many cases, permanent) shift to remote work made people interested in moving to a quieter, more suburban, and less accessible area. The elimination of a commute played a big role.

Amid the increased popularity of new home construction, lumber use went through the roof.

Outlook for lumber prices

A lack of available housing on the market might mean that new home construction will continue to surge, which would ultimately make lumber even more exclusive. We might see a wave of home sellers in the next few years, which could even out the lumber demand enough to tame wood prices.

Investing in the wood industry

Companies like Masonite International Corporation (NYSE:DOOR), Floor & Decor Holdings, Inc. (NYSE:FND), and Louisiana-Pacific Corporation (NYSE:LPX) are available for investors to get a hold on the wood industry. Growth could continue, although likely not at such a robust rate.

Meanwhile, ESG investors should consider the environmental and sustainable implications of investing in large wood corporations that contribute to deforestation. For example, Weyerhaeuser Company (NYSE:WY) claims to reforest 100 percent of the stands it harvests within 1–5 years. By this point, wood companies who aren't taking part in sustainable practices are missing out on a large and growing sector of the market.