Berkshire Hathaway 13F: Stocks Warren Buffett Is Buying in 2021

Berkshire Hathaway is expected to release its first-quarter 13F this weekend. What stocks is Warren Buffett buying and selling in 2021?

May 13 2021, Published 8:23 a.m. ET

Berkshire Hathaway, which is led by legendary value investor Warren Buffett, will release its first-quarter 13F soon. The filing will tell us what stocks the Oracle of Omaha has bought in 2021. What should investors expect in the filing? What stocks could Buffett be buying in the first quarter of 2021?

Earlier in May, Berkshire Hathaway held its annual shareholder meeting virtually and also released its first-quarter earnings. While the company didn't spell out what stocks Buffett bought in the first quarter, the earnings showed that he sold more stocks than he bought.

Warren Buffett is selling stocks.

Berkshire Hathaway was a net seller of stocks in the first quarter of 2021. While the company continues to spend generously on share repurchases, its cash pile increased to $145.4 billion. In the absence of compelling buying opportunities and the elusive “elephant-sized acquisition,” Buffett has scaled up share repurchases. In 2020, Berkshire Hathaway repurchased a record $24.7 billion worth of its shares.

Which stocks is Warren Buffett buying?

In the fourth quarter of 2020, Berkshire Hathaway made several new investments. Buffett revealed a nearly $9 billion stake in Verizon. He also invested almost $4 billion in energy company Chevron.

Berkshire Hathaway invested in insurance broker Marsh & McLennan and the stake was valued at just under $500 million at the end of 2020. Berkshire Hathaway also invested in media company EW Scripps and the stake was valued at around $364 million.

Berkshire Hathaway increased stakes in Merck, AbbVie, Kroger, RH, T-Mobile, and Bristol Myers-Squibb in the fourth quarter of 2020. The conglomerate had bought pharma stocks in the third quarter of 2020 and in the typical Buffett way, it scaled up the purchases in the subsequent quarter.

What stocks Buffett might be buying in 2021

Before Berkshire Hathaway releases its 13F for the first quarter of 2021, we really don’t know what stocks the company bought or sold in the quarter. However, looking at the way Buffett has been making investments, he could have increased stakes in the companies where he recently took a stake.

So, I would expect more purchases of Merck, AbbVie, RH, Marsh & McLennan, and EW Scripps in the first quarter of 2021 when Berkshire Hathaway releases its 13F. The filing could happen over the weekend. Fund managers are required to file the 13F within 45 days of a quarter’s end.

What stocks is Buffett selling in 2021?

Buffett has been gradually selling Apple shares and has sold $11 billion worth of them over the last two years. However, during this year's shareholder meeting, Buffett admitted to making a mistake in selling Apple stock. The stock has risen nearly 3x from the lows in the fourth quarter of 2018.

Meanwhile, Buffett was a net seller of stocks in 2020. In the last five quarters, he was a net buyer of stocks only in the third quarter of 2020 when he surprisingly took stakes in several pharma companies. He didn't hold Pfizer for long and sold it in the fourth quarter of 2020.

Buffett has also been selling a lot of bank stocks. In the first quarter of 2021, I would expect Buffett to sell most of his stake in Wells Fargo. At one point, Berkshire Hathaway held almost a 10 percent stake in the bank. Over the last year, the company has been gradually trimming the stake.

Why Buffett isn't able to identify buying opportunities

Blame the abundant supply of cheap money for hampering Buffett’s deal-making abilities. If the deal-hungry private equity giants weren't enough, we now have a flurry of SPACs. With a plethora of SPACs hunting for targets, Buffett is getting tough competition in making private market deals.

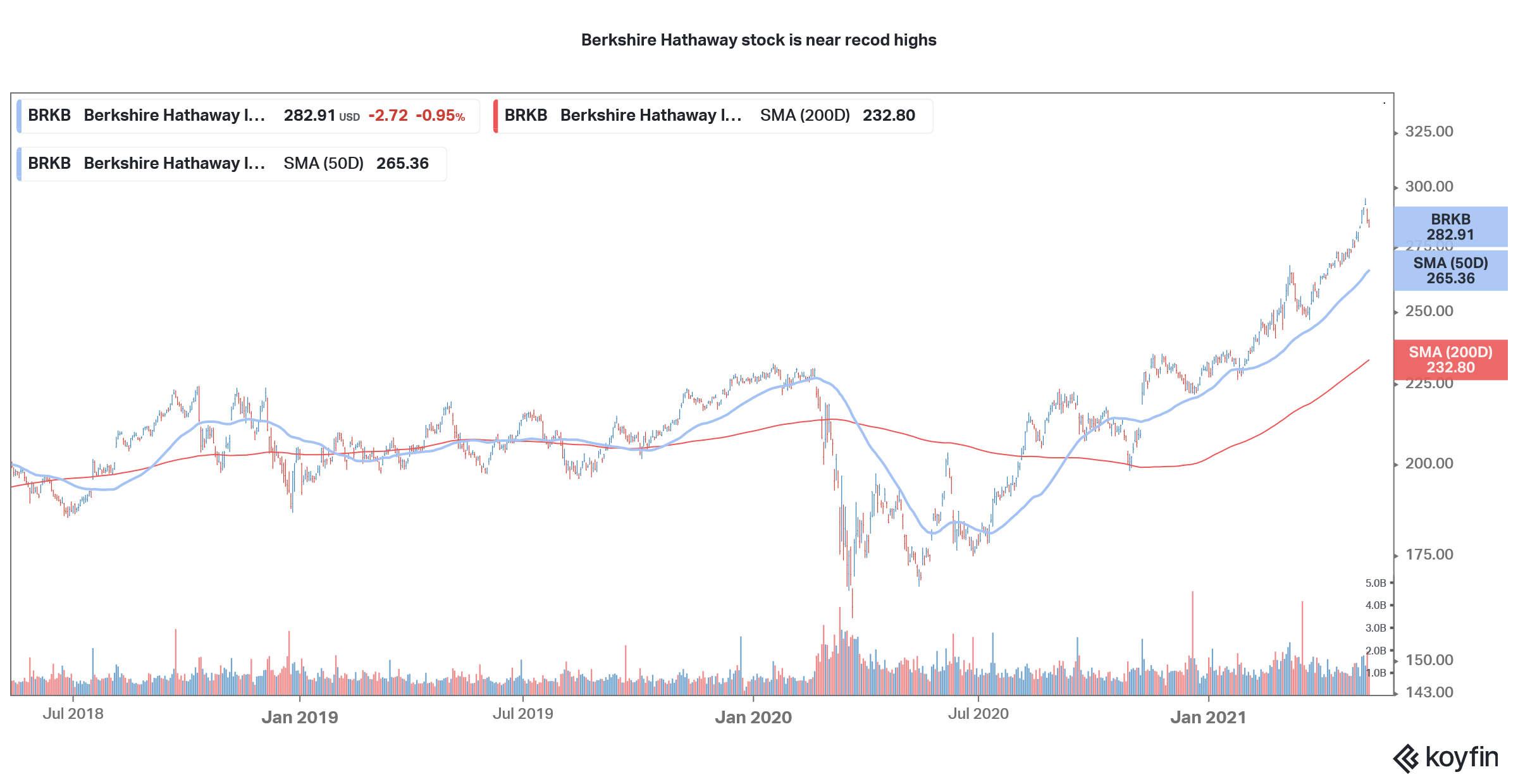

Also, with stock market valuations running high and the still uncertain economic environment, Buffett hasn't been able to identify good buying opportunities in publicly traded companies. Berkshire Hathaway stock has been the only solace for Buffett. If not for these repurchases, the company’s cash pile would have bloated even more.

Sooner rather than later, the Oracle of Omaha might have to scale down the repurchases after the sharp rise in 2021. Even Berkshire Hathaway stock doesn't look too cheap either, which could be the “nightmare” scenario that Buffett talked about in 2019.