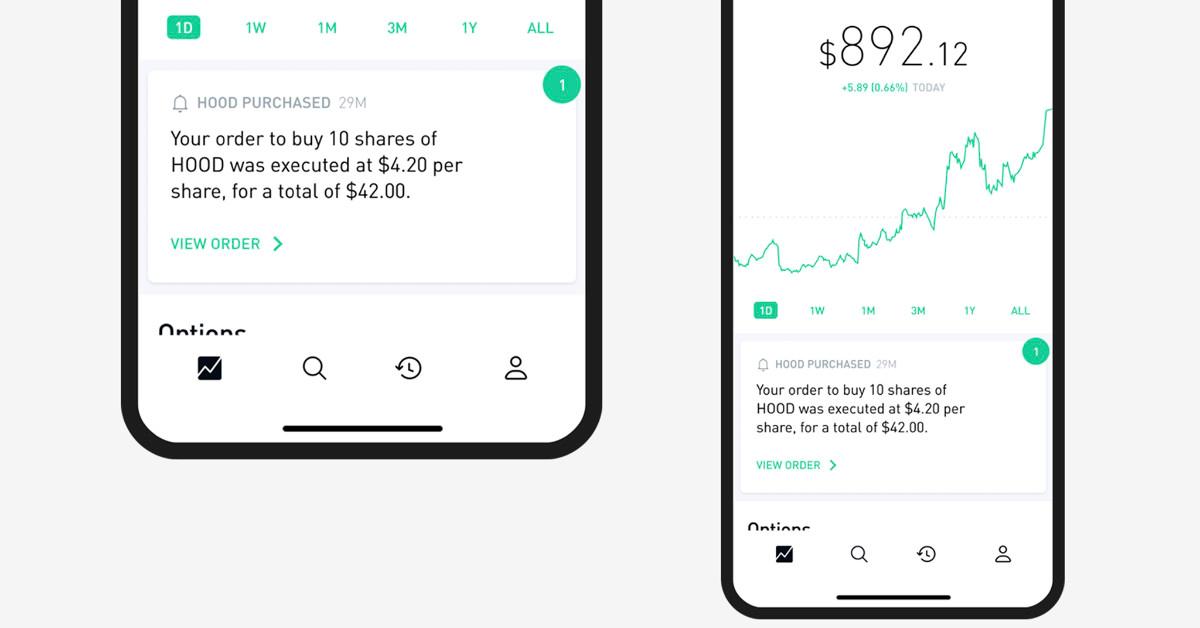

Your Robinhood Brokerage Cash Isn't the Same as Your Buying Power

What is brokerage cash on Robinhood? The app makes a point of differentiating users’ brokerage cash from their buying power. Here’s the breakdown.

March 2 2023, Updated 11:19 a.m. ET

Seems like Robinhood users have a lot of question about the “brokerage cash” they see in their accounts, and why they aren't always able to withdraw it or use it for trading.

“@RobinhoodApp, why do I have $0.00 available and money in my Brokerage Cash?” one user tweeted recently.

Another wrote, “I’m unable to withdraw brokerage cash! What kind of scam is this? First you restrict trading, now you won’t let me pull money out of your terrible app?!,” though that tweet has since been deleted.

If you're another who has stumbled across this issue, keep reading find out what brokerage cash is on Robinhood and how you can access it.

What is the brokerage cash balance on Robinhood?

Simply put, brokerage cash on Robinhood is the value of the cash in your brokerage account — as opposed to stocks or crypto — but it isn't necessarily the same as your “buying power” because brokerage cash can include money that hasn't settled yet.

In one example posted to Reddit, a user had $2,283.99 in brokerage cash but $1,250.00 in options collateral. Thus, that user’s buying power was the difference: $1033.99.

What’s options collateral? “Depending on the options strategy you use, we may hold stocks or cash as collateral to make sure you can cover the position in the case of assignment,” Robinhood explains on its website.

Speaking of buying power, another Robinhood support article states that Robinhood Instant or Robinhood Gold account holders have instant access to funds from bank deposits and proceeds from stock transactions, meaning they don’t have to wait two trading days to access those funds.

Robinhood Instant account holders can access $1,000 of instant deposits, while Robinhood Gold users can access instant deposits corresponding to their account balance. Users with portfolio values over $50,000 have a $50,000 instant deposit limit, those with portfolio values over $25,000 have a $25,000 instant deposit limit, those with portfolio values over $10,000 have a $10,000 instant deposit limit, and all other Gold users have a $5,000 instant deposit limit.

It’s a bit different for Robinhood Crypto: “Funds from stock, ETF, and options sales become available for buying crypto within 3 business days, Robinhood specifies. “However, limited cash deposits and all proceeds from crypto sales are available to instant accounts immediately.”

Can I withdraw brokerage cash on Robinhood?

Assuming your account doesn’t have a restriction, you can withdraw the brokerage cash in your Robinhood account when it settles and is added to your “buying power,” Robinhood says.

The settlement period is T+2, or the trade date plus two trading days. “On the third day, those funds will go into your buying power and will appear as withdrawable cash,” the company explains.

There are caveats, though: If you withdraw funds to a bank account different from the bank account from which you deposited the funds within the past 60 days, Robinhood may ask you to verify additional information, which may include bank statements and/or photos of your photo ID.

Additionally, Robinhood requires the cash value from referral stocks to remain in your account for 30 calendar days, and the company also requires Robinhood Gold users to maintain a brokerage account value of $2,000.

Why is my brokerage cash negative on Robinhood?

Another issue some Robinhood account holders have run into is having a negative balance in their brokerage account. Your balance can drop below $0 if you “used more buying power than you had available,” according to the Robinhood website. An account deficit might also be a reflection of ACH reversals after using the Instant Deposits feature or had fees withdrawn.