What Happened to Livongo Stock After the Teladoc Merger?

Since Teladoc acquired Livongo, the shares fall under a new umbrella. What happened to Livongo stock after the merger?

Dec. 2 2020, Updated 11:28 a.m. ET

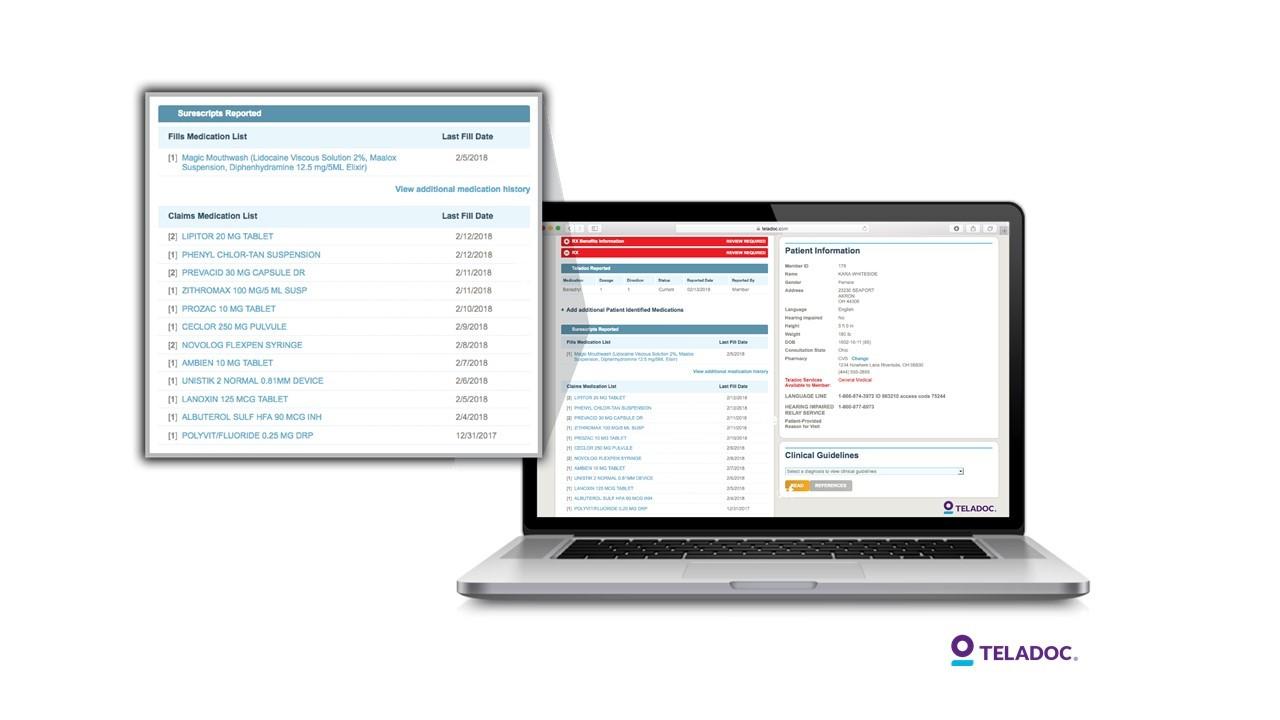

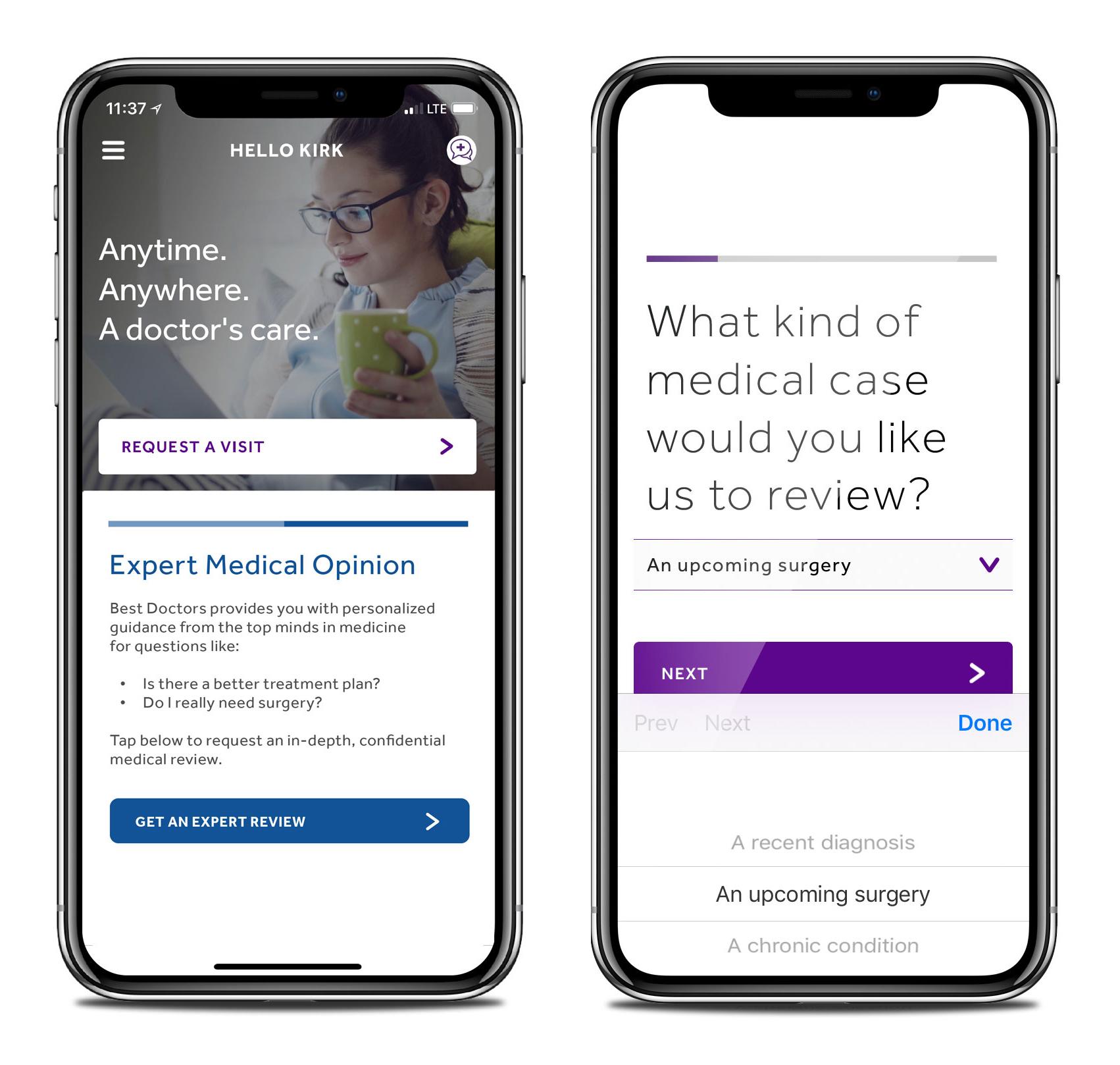

Since the beginning of the coronavirus pandemic, health insurance companies have approved virtual visits as a viable way for people to have access to healthcare. As a result, companies that support the tech behind virtual visits are doing well. Teladoc Health is one of these companies.

Teladoc merged with Livongo on Oct. 30 and broadened its reach in the market.

Highlights of the Livongo and Teladoc merger

Teladoc leads the virtual healthcare market. In the fourth quarter, the company purchased Livongo Health for $18.5 billion. At the time, existing shareholders for both Teladoc and Livongo overwhelmingly supported the acquisition in a voting round.

While Teladoc is a telemedicine company, Livongo offers a chronic illness management platform. Now, Teladoc patients will be able to stay engaged in the healthcare process and track their illness between virtual visits.

Before the merger, Teladoc and Livongo customers overlapped by 25 percent. The two companies actually started the deal in August. It took a few months to come to fruition. In October, they partnered with a company called Guidewell to service Florida Blue members.

Jason Gorevis is CEO of Teladoc Health. In a press release, he said, "Together, our team will achieve the full promise of whole-person virtual care, leveraging our combined applied analytics, expert guidance and connected technology to deliver, enable and empower better health outcomes."

What happened to Livongo stock after the merger?

After the merger, Livongo stock moved in with Teladoc. Now, shareholders for both companies can find the stocks under Teladoc.

As a whole, Teladoc's initial shareholders own 58 percent of the merged company, while Livongo's initial shareholders own the remaining 42 percent.

After the deal, one Livongo share became 0.59 Teladoc shares. At the time of the deal, this equated to $11.33 in cash per Livongo share and a dividend worth $7.09 for each share. Shareholders were given the option to reinvest their liquidity into Teladoc.

Livongo's previous executive team took the merger as their chance to exit. Former leaders include CEO Zane Burke and CFO Lee Shapiro. There was also company president Jennifer Schneider and chairman Glen Tullman. Both Schneider and Tullman are pivoting to create a blank-check company or SPAC. Their goal is to raise half a billion dollars to take a different health tech company toward its IPO.

Teladoc stock today

On Dec. 1, Teladoc stock (which goes by the ticker symbol "TDOC" on the NYSE) opened at $198.33 per share. The amount is a 1.35 percent dip from the previous close, but a 6.36 percent increase from the day's low the previous week.

The stock market crash that started in February 2020 had a negative impact on most industries. In contrast, Teladoc stock had the opposite reaction. The stock has grown more than 138 percent YTD.

During the week of Feb. 20–27, Teladoc shares grew 62.32 percent. The shares actually decreased 12.23 percent from Oct. 30 (when the company announced the merger) until Nov. 10, but it has mostly evened out since then.