Debunking Myths About the Stock Market and War as Russia Invades Ukraine

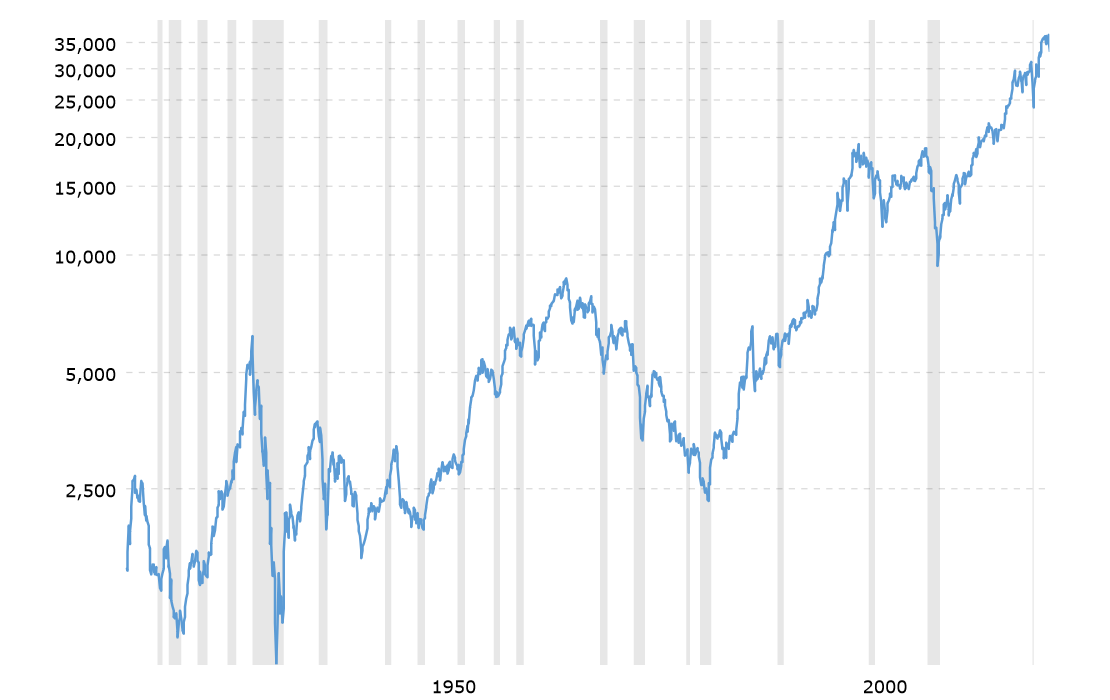

Over the last century, there have been several wars, including World War II. How do stocks historically perform during times of war?

Feb. 25 2022, Published 8:20 a.m. ET

The U.S. stocks rebounded sharply on Feb. 24, shrugging off the Russia-Ukraine crisis. Over the last century, there have been several wars, including World War II. Historically, how does war impact the stock market and is the current crash a buying opportunity?

The market sentiments are currently negative. Apart from the geopolitical tensions, markets face the hanging sword of rate hikes. U.S. inflation, already running at multi-decade highs, might rise even more amid the rise in energy prices. Add slowing global growth and we almost have a perfect storm for investors.

How do wars impact stock markets?

Major wars do impact stock markets. First, it creates uncertainty and dampens market sentiments. Wars can also take a toll on economic activity. For example, the expected rise in crude oil prices after the Russian invasion of Ukraine would lower the U.S. GDP in 2022.

How did U.S. stocks play out during World War II?

U.S. stocks saw some wild swings during World War II. However, from the beginning of the war in 1939 to its eventual end in 1945, the Dow Jones gained almost 50 percent. U.S. stock markets bottomed in April 1942 and then they were in a general uptrend. As the Allied forces continued to build their lead, stock markets reacted positively.

U.S. stock markets were closed on December 7, 1941, the day when Pearl Harbor was attacked. When they opened the next day, the Dow Jones Index fell around 3.5 percent. Given the severity of the attack and the escalation it meant for the war, the 3.5 percent fall doesn't look too high.

U.S. stock markets increased during the Vietnam war.

U.S. stock markets increased by 43 percent between 1965 and 1973, which was the period when U.S. troops were in Vietnam. It turns out to be an annual increase of around 5 percent. While it's below what the Dow Jones has historically delivered, markets nonetheless delivered positive returns during the Vietnam War.

Stocks are less volatile during wars.

While it might sound counterintuitive, analysis by Mark Armbruster, CFA shows that stocks are less volatile during times of war. The Vietnam war is an exception here where the volatility was in line with historical averages. Another counterintuitive fact from the research is that small-cap stocks on average outperformed large-cap stocks during wars.

In fact, during World War II, small-cap stocks delivered almost twice the returns of their large-cap peers. This puts to rest the general belief that investors should look at quality large-cap stocks in times of war.

It’s the economy that matters.

To borrow a phrase from former President Bill Clinton’s strategist James Carville, “It is the economy stupid.” Analysis by LPL Research shows that unless war is accompanied by a recession, stocks tend to take wars in their stride. For example, stocks crashed after the Yom Kippur war. However, more than the war, it had to do with the oil shock during that period.

During the Iraq war, U.S. stock markets soared to record highs. Here again, that was a period of high global growth as the U.S. and the global markets saw an unpreceded boom before the crash in 2008.

How will stocks react to the Russia invading Ukraine?

If the Russian invasion of Ukraine doesn't lead to a global recession or unmanageable energy prices, stocks should eventually recover. The western countries have been careful when imposing sanctions on Russia to minimize the impact on the global markets.

However, more than the Russia-Ukraine crisis, investors should be worried about soaring U.S. debt, multi-decade high inflation, and slowing corporate earnings growth. Also, the market valuations are running above their historical averages.