Vicarious Surgical (RBOT) Has Promising Outlook After DEH Merger

D8 Holdings and Vicarious Surgical’s merger will get completed on Sept. 17 and the new entity will start trading on Sept. 20. What is RBOT;s forecast after the DEH merger?

Sept. 17 2021, Published 9:43 a.m. ET

On Sept. 15, D8 Holdings shareholders approved its merger with Vicarious Surgical, which is a next-generation robotics company. Through this deal, Vicarious will receive nearly $220 million in gross cash proceeds, which is lower compared to the initially agreed value as nearly 77.5 percent of SPAC’s public shares were redeemed.

The minimum cash condition for the deal to go through was $125 million and the PIPE was upsized on Sept. 9 to $142 million so that the deal gets closed even with maximum possible redemptions. As Vicarious gets closer to its debut on the NYSE, investors want to know about DEH’s stock forecast after the merger.

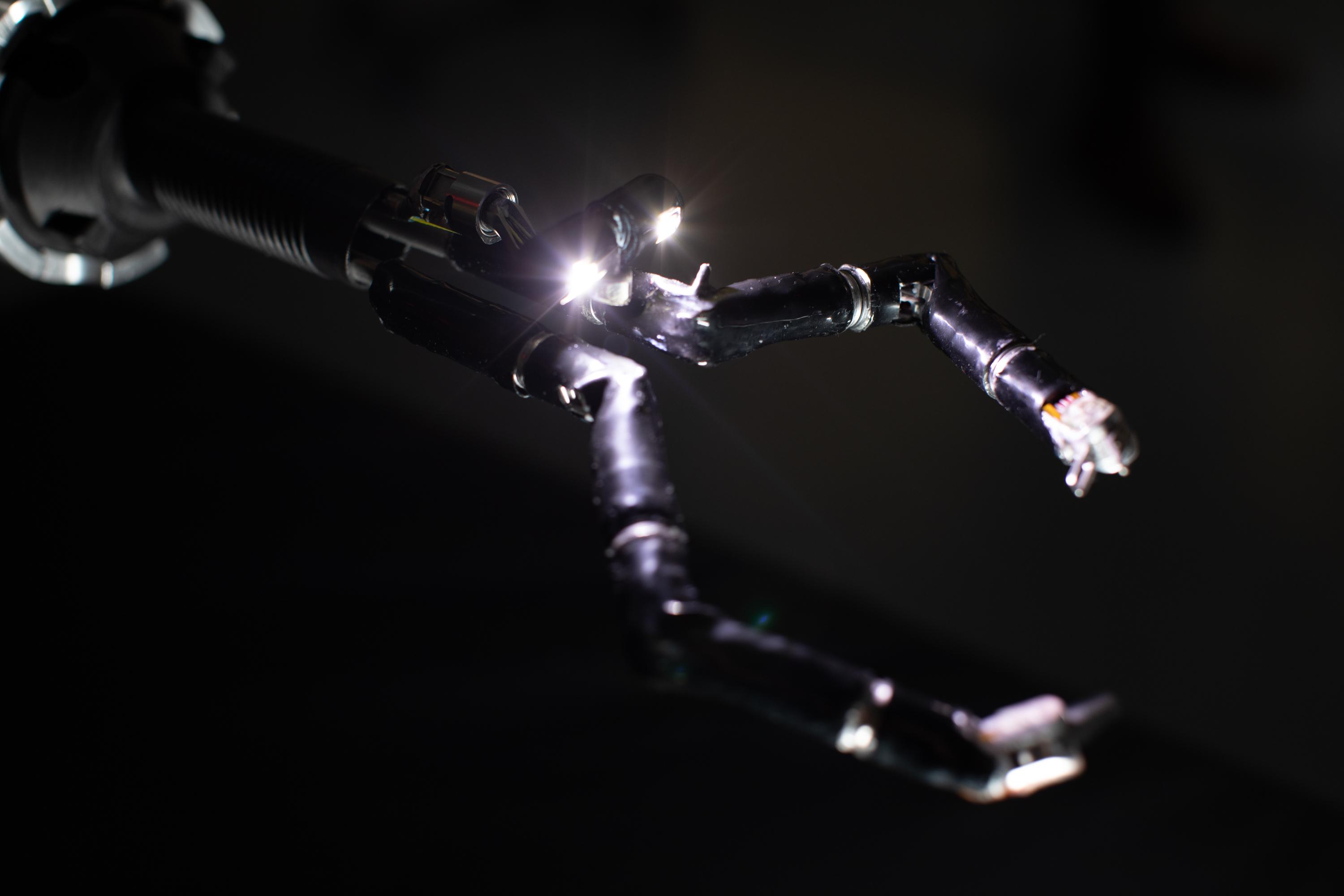

Vicarious Surgical, founded in 2014, is a disruptive next-generation robotics technology company, which is seeking to increase the efficiency of surgical procedures and improve patient outcomes. Its surgical approach uses a combination of proprietary human-like surgical robots and virtual reality to transport surgeons inside the patient to perform minimally invasive surgery.

The idea for the company’s miniature surgical robots came from Adam Sachs’s (one of the company’s founders) fascination with the 1966 sci-fi movie Fantastic Voyage.

What is the DEH merger date?

The Vicarious Surgical and DEH business combination will close on Sept. 17. The combined entity is expected to start trading on Sept. 20. The combined company will trade on the NYSE under the ticker symbol "RBOT."

Will Vicarious Surgical (RBOT) stock go up after merger?

Vicarious Surgical has a lot of potential. Its technology was the first and only surgical robot to receive breakthrough device designations from the FDA. According to Sachs, the company’s surgical robots are capable of completing surgeries in half the time compared to its competitors. More importantly, the efficiency doesn’t lead to higher price tags.

According to Forbes, the robots cost about $1.2 million and are almost half the cost of existing robots. It helps that the company is backed by luminaries like Bill Gates, Vinod Khosla, and Eric Schmidt.

DEH’s stock price jumped by nearly 17 percent on Sept. 16. However, the stock price still isn't too far away from DEH’s listing price. There are high chances that the stock could get a good start post-merger.

Vicarious Surgical's stock forecast

Vicarious Surgical's stock forecast will also depend on how fast and far its target market expands. According to Markets and Markets research, the global robotics surgical market is expected to grow from $6.4 billion in 2021 to $14.4 billion by 2026 at a CAGR of 17.6 percent. The growth is driven by technological advancements in surgical robots, the increasing adoption of surgical robots, and the increase in funding for medical robot research.

Interestingly, while the TAM (total addressable market) is huge, it's only close to 3 percent penetrated currently. This represents a massive potential opportunity for Vicarious and its peers like Intuitive Surgical. Vicarious Surgical estimates revenues of $1 billion by 2027 with under 1 percent adoption. Its revenue CAGR from 2023–2025 is estimated to be 300 percent, which is much higher than Intuitive’s 12 percent.

However, this nascent niche isn't without competition. In fact, Intuitive Surgical is present has been in the market for a long time and is currently dominating the space. Johnson & Johnson has also entered the market. The company unveiled its surgical assistant robot, Ottava, last year. There are other small as well as big startups that have made a splash in this segment.

Should you buy DEH before merger?

Based on its forecasted 2025 revenues, Vicarious is trading at EV-to-2025 sales of 3.1x, which is much lower than Intuitive’s 11.1x. While Intuitive is also a good bet to play this space, Vicarious is just getting started and could offer more growth at a lower multiple, which should be attractive for growth-oriented investors.