Russia Invading Ukraine Will Impact U.S. Inflation and Fed Rate Hikes

What does Russia’s invasion of Ukraine mean for U.S. inflation and could it alter the dynamics of the Federal Reserve’s rate hikes?

Feb. 24 2022, Published 9:19 a.m. ET

Russian President Vladimir Putin has invaded Ukraine despite his previous assertions not to do so. As expected, stock markets globally tanked amid the risk-off sentiments. What does Russia’s invasion of Ukraine mean for U.S. inflation and could it alter the dynamics of the Federal Reserve’s rate hikes?

The West has responded with sanctions mainly targeting Russian banks and oligarchs. More severe sanctions are on the table as countries seek to punish Russia for its actions in Ukraine.

U.S. inflation was already running at multi-decade highs.

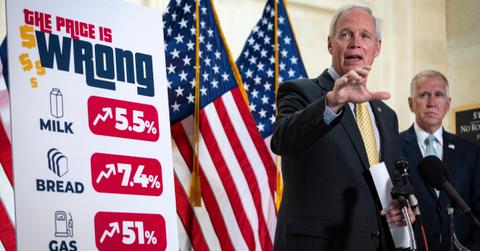

U.S. inflation rose at an annualized pace of 7.5 percent in January, which was the highest since 1982. The inflation is almost four times the 2 percent annual inflation that the U.S. Federal Reserve targets. The Fed announced tapering in 2021 to end its monthly bond-buying program and was widely expected to raise rates in March.

How does Russia’s invasion of Ukraine impact U.S. inflation?

Crude oil prices have surpassed $100 per barrel for the first time since 2014. Higher energy prices have a domino effect on inflation. First, they directly add to inflation as gas prices go up. Second, since energy is a key input for many companies, they face cost pressures amid rising energy prices and pass on the higher costs to consumers. Finally, higher energy costs lead to higher logistics costs, which adds to inflation.

Apart from energy, aluminum prices have also been impacted by the Russia-Ukraine crisis. Since Ukraine is a major exporter of food products to Europe, we could see some impact on global food prices as well.

U.S. inflation at 10 percent is a possibility.

Many people are now fearing that U.S. inflation could rise to as high as 10 percent given the current economic environment. U.S. President Joe Biden called upon the country to bear the costs to defend freedom. However, double-digit inflation could play havoc with Democrats’ chances in the midterm elections.

Are we headed for stagflation?

We're in a situation where economic growth is coming down and rising crude oil prices might further dent the U.S. GDP in 2022. On the other hand, inflation has been steadily going up, which makes conditions ripe for what economists would call "stagflation." One saving grace has been the still strong U.S. job market, which if anything is still grappling with the labor shortage.

What options does the Fed have?

The Fed is widely expected to raise rates at the March meeting even though the quantum of the hike is uncertain. According to the CME FedWatch tool, on Feb. 24, 17.2 percent of traders think that the Fed will raise rates by 50 basis points, which is almost half of the previous day.

The Fed finds itself in a difficult position as it tries to navigate and balance the conflicting objectives of taming inflation while also maintaining the economic momentum. The Fed will also need to keep an eye on the soaring U.S. sovereign debt, which has now surpassed $30 trillion in absolute terms and is 119 percent of the GDP.

The U.S. has already surpassed the grim milestone where its debt has surpassed the GDP. Soon, the annual debt servicing costs will reach $1 trillion, which would be another continued drain on the Federal government’s budget for years to come.

It's isn't surprising that old-timers like Charlie Munger, who has been criticized for what many see as outdated views, have been warning of severe consequences from the fiscal and monetary policy extravaganza of the last two years.

For now, Russia's invasion of Ukraine further complicates the picture for the Federal Reserve, Biden, as well as U.S. consumers who are already battling multi-decade high inflation.