Trimble's Forecast: What Cathie Wood Sees in TRMB Stock

Cathie Wood's ARKX ETF has bought Trimble stock and it’s the ETF's largest holding. What's the forecast for TRMB stock and is it a good buy?

March 30 2021, Published 8:19 a.m. ET

The ARK Space Exploration & Innovation ETF (ARKX) released its holdings on March 29. It will start trading on March 30. Trimble (TRMB) stock is the ETF's largest holding and accounts for 8.6 percent of the portfolio. Cathie Wood is bullish on the stock. TRMB stock also forms part of her ARK Autonomous Technology & Robotics ETF (ARKQ) where it's the second-largest holding. What’s the forecast for TRMB stock and should you get bullish on it like Wood?

TRMB stock was trading higher in pre-market trading on March 30. Kratos Defense & Security, which is ARKX's third-largest holding, was also higher. Markets see their inclusion in the ETF as a bullish signal.

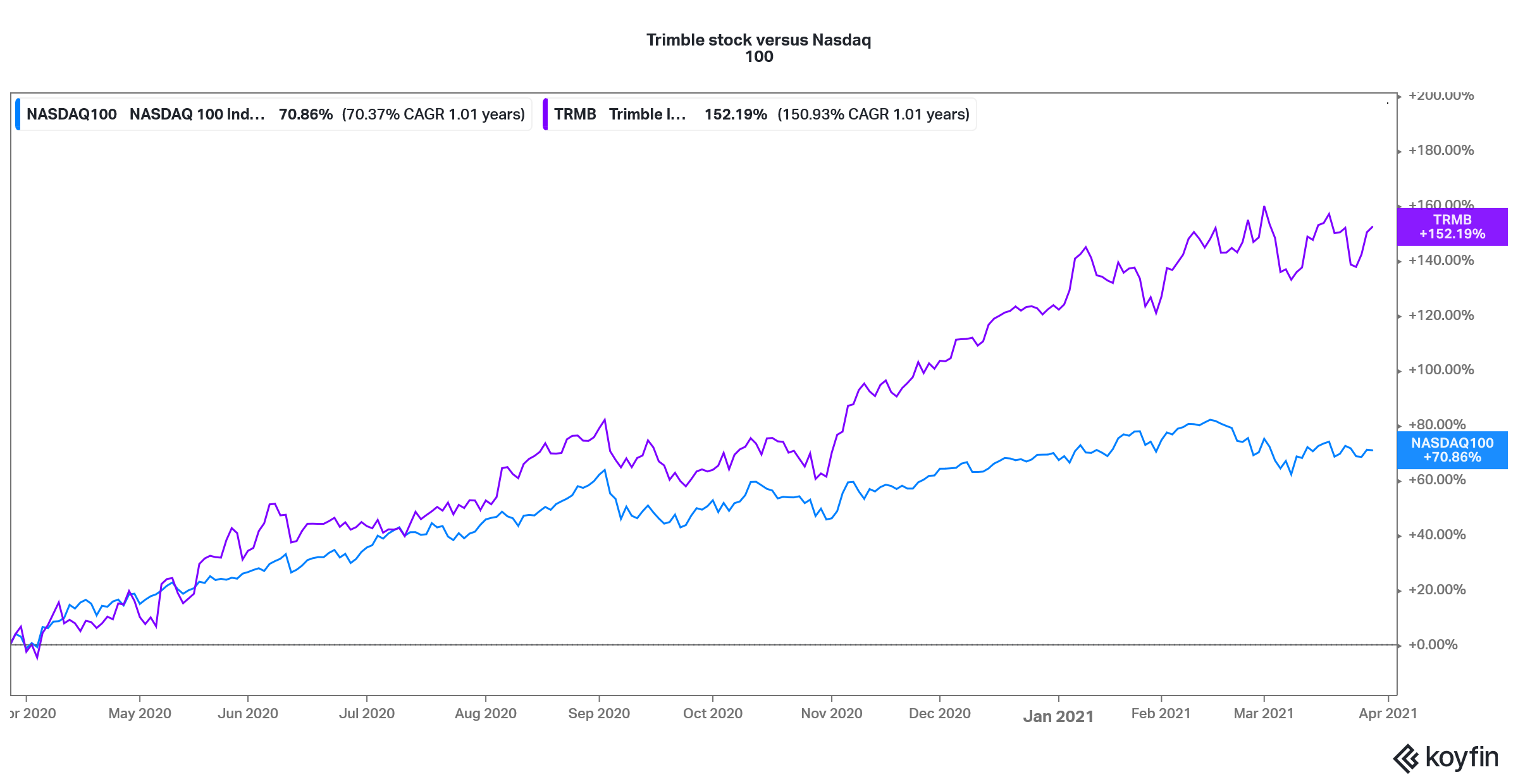

Trimble's stock performance

Trimble stock is up 12.7 percent YTD and has gained 152 percent over the last year. From a price-action perspective, the stock is outperforming the Nasdaq 100 Index in both periods. Despite the sell-off in the tech-heavy Nasdaq Index, TRMBL stock is trading near its 52-week high prices.

TRMB stock versus Nasdaq

Trimble has global operations and it serves many industries like agriculture, construction, and geospatial survey and mapping. Its services are used by consumers in over 150 countries and its employees are spread across 40 countries. The company provides technologies that help connect the physical world to the digital ecosystem.

TRMB's stock forecast

Wall Street is also bullish on TRMB stock. Among the 15 analysts polled by CNN Business, 10 recommend a buy or higher, while the remaining five recommend a hold. None of the analysts recommend a sell.

The stock’s median target price of $80.50 is a premium of 6.9 percent over the current prices. Its lowest target price is $58, while its highest target price is $92. In February, Morgan Stanley and Craig-Hallum raised TRMB’s target price to $76 and $58, respectively.

Is Trimble a good stock to buy?

Looking at the financials, Trimble posted revenues of $3.1 billion in 2020, which were 3.6 percent lower than what it posted in 2019. Analysts expect the company’s revenues to rise 7.3 percent and 7.7 percent, respectively, in 2021 and 2022. The company’s growth isn't what we generally associate with companies that Wood picks for her portfolio.

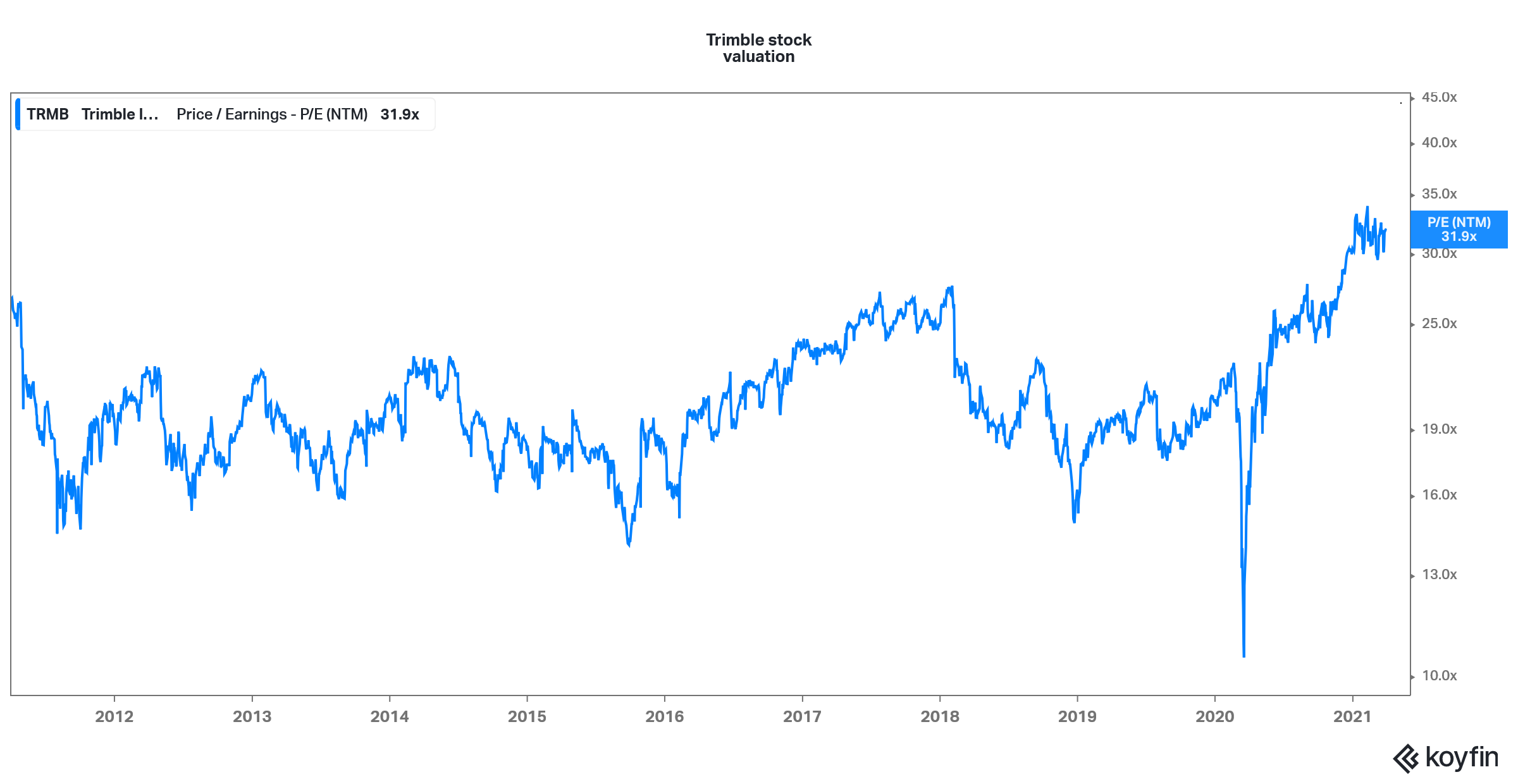

That said, Trimble is a long-term play on the space exploration theme. From a valuation perspective, TRMB stock trades at an NTM PE multiple of 31.9x, which is almost a record for the company since it started trading as a publicly-traded company.

TRMB NTM PE multiple

Cathie Wood and Trimble stock

Trimble stock has seen a valuation rerating over the last year amid the optimism about companies related to space travel and exploration. There has been a flurry of listings in the space with most companies including Virgin Galactic opting for the SPAC route.

The faith that Wood has put in Trimble has also helped buoy sentiments. She is among the most bullish fund managers on Tesla. The stock hasn’t let her down even though it's now off its 2021 highs and hurting ARK ETFs this year.

Meanwhile, the risk for Trimble stock is the ongoing shift from growth to value stocks. Investors have been finding solace in beaten-down cyclical names. That said, the stock looks like a decent buy for the long term and isn't a speculative play like some of the recently listed space exploration companies.