AmerisourceBergen and Walgreens Sign 'Deal of a Lifetime'

AmerisourceBergen is acquiring a hefty portion of Walgreens. Is the stock a buy or sell for investors in 2021? How will the deal with Walgreens help the company?

Jan. 7 2021, Published 11:56 a.m. ET

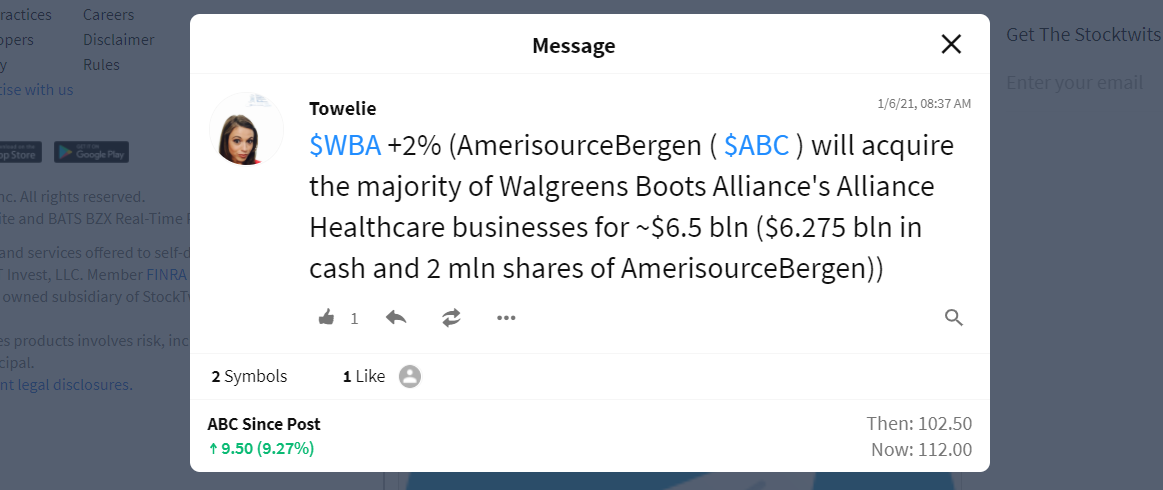

On Jan. 6, Walgreens Boots Alliance made the deal of a lifetime. For $6.5 billion, Walgreens sold the drug wholesale leg of its brand to AmerisourceBergen.

The deal went through in cash and stock. Now, AmerisourceBergen will reap the earnings of Walgreens' pharmaceutical middleman operation. Walgreens will focus on rehabilitating the retail side, which has been impacted by the COVID-19 pandemic.

AmerisourceBergen is one of the most reliable dividend stocks out there

Trading on the NYSE under the ticker symbol "ABC," AmerisourceBergen stock has remained in line with market growth over the last half a decade. The stock's growth leading up to 2015 was particularly fast-paced.

Although AmerisourceBergen's dividend yield is only 1.66 percent as of Jan. 7, the company has been committed to quarterly payouts for years. The conservatively low payout ratio leaves plenty of room for error. For a company that's been in business since 1985, AmerisourceBergen has seen its fair share of market crashes.

AmerisourceBergen likely maintains a minimal dividend yield so it can continue to promise payouts in future quarters, while simultaneously reinvesting earnings into the company.

AmerisourceBergen on Stocktwits

After reaching a swift peak at 1:30 p.m. ET on Jan. 6, AmerisourceBergen stock started to dip. Investors can catch this dip if they are on the ball, but they need to be quick.

Interest in both AmerisourceBergen and Walgreens stock remains high as news of the deal ripples through the retail and pharmaceutical worlds.

AmerisourceBergen stock forecast

AmerisourceBergen saw major growth for decades. Since 2015, the company has hit a more even-keeled growth rate and will likely stay within that range. The Walgreens deal might boost AmerisourceBergen's earnings enough to surpass the market rate, but it won't be a miracle. However, with Walgreens' earnings for the first quarter of 2021 hitting about seven percent above expectations, it seems that AmerisourceBergen's ties to the company are a good thing.

AmerisourceBergen is a good stock thanks to its dividends

Although the dividends keep many investors tied to AmerisourceBergen, they aren't the only perk. AmerisourceBergen is a smart company that manages to maintain good graces with shareholders. Also, various business deals keep it lucrative in a shifting market. However, with undeniable volatility on AmerisourceBergen's chart over the course of the past 1–5 years, the regular quarterly payouts definitely help keep capital coming.

What happens to Walgreens stock after the deal?

As part of the deal, Walgreens got another two million common stock shares of AmerisourceBergen. The amount is in addition to the 30 percent stake that Walgreens already has in the company. While the two stocks (Walgreens trades under "WBA" on the Nasdaq Exchange) will remain separate, they will influence each other. They might work well as investments that play off one another.

Despite the fact that Walgreens beat the earnings expectations, the net income is still about 30 percent lower than it was in the fourth quarter of 2020. With the AmerisourceBergen-Walgreens deal signed and sealed, the company could very well see a shift by the second quarter.