Intapp’s (INTA) IPO Is Here, and Its Stock Looks Promising

Intapp (INTA) has priced its IPO and is expected to list on Jun. 30. Is its valuation reasonable, and should you buy the stock?

June 30 2021, Published 11:44 a.m. ET

Intapp (INTA) has priced its IPO and is expected to list on Jun. 30. The company plans to raise around $278 million in the offering. Is Intapp’s IPO stock a good buy for investors? What can investors expect afterward?

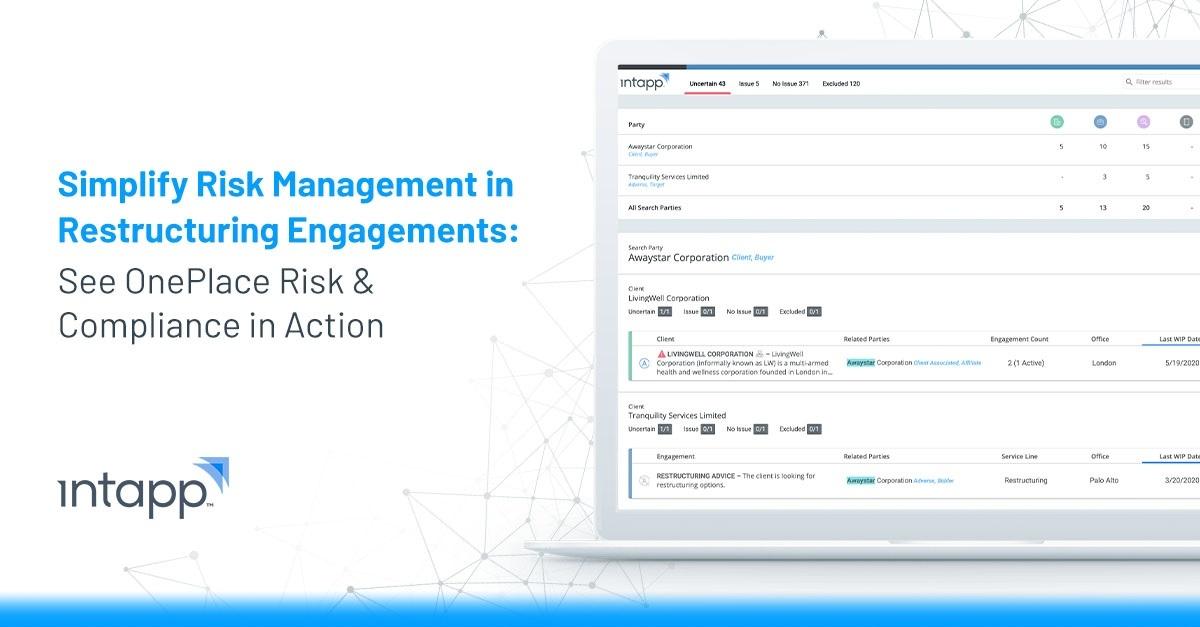

Founded in 2000, Intapp is a cloud-based software provider for professional and financial service companies. The company is backed by Temasek Holdings and Great Hill Partners.

Intapp’s IPO date and stock price

Intapp is expected to start trading on Jun. 30. The company is offering 10.5 million shares in the IPO, at $26 each. Previously, the company was planning to offer shares for $25–$28. Insiders plan to buy $60 million in shares during the IPO (22 percent of the offering). The offering is expected to close on Jul. 2.

The net proceeds from the offering will be used to repay outstanding debt and for general corporate purposes. JPMorgan Chase, BofA Securities, and Credit Suisse Securities are the offering's lead book-running managers. Intapp has granted the underwriters a 30-day option to buy an additional 1.6 million shares at the IPO price.

Intapp’s stock symbol

Intapp stock will trade under the ticker symbol “INTA”. The stock will be listed on the Nasdaq.

Intapp isn't profitable

Intapp has incurred net losses over the last several years, and it might not be able to achieve or maintain profitability as its expenses rise. Intapp reported a net loss of $45.9 million in fiscal 2020 (ended Jun. 30, 2020), compared with $17.1 million in fiscal 2019. As of Mar. 31, 2021, the company had $419.4 million in total liabilities and $71.3 million in cash and cash equivalents.

Intapp’s valuation

Intapp’s revenue grew 30.5 percent YoY (year-over-year) to $186.9 million in fiscal 2020. The IPO will value Intapp at $1.9 billion, and its terms put the company’s fiscal 2020 price-to-sales multiple at 10.2x. Considering that peers Microsoft and Adobe are trading at next-12-month EV-to-sales multiples of 11.1x and 16.9x, respectively, Intapp stock looks undervalued.

Intapp’s stock forecast

Intapp stock’s outlook looks promising. The company believes that its serviceable addressable market is worth $9.6 billion, of which more than $6.5 billion would be attributable to large companies with more than 500 employees.

Intapp IPO is a good long-term investment

Intapp IPO is a good buy based on its attractive valuation and growth potential. The company provides software solutions for professional and financial service companies worldwide. Intapp’s ARR (annual recurring revenue) grew by 22 percent YoY to $201 million as of Mar. 31, 2021.

Intapp has a software-as-a-service (SaaS) subscription revenue model, and as of Mar. 31, it had more than 1,600 customers, with around 20 having ARR of $1 million or more. Its customers include 96 Am Law 100 firms, seven of the top eight accounting firms, and more than 900 investment banking and private capital companies. Intapp’s net retention rate was 110 percent in fiscal 2020. The COVID-19 pandemic-related surge in remote work has highlighted the need for having easy access to data and software.

How to buy Intapp IPO stock

Once Intapp stock begins trading, you can buy it through a stockbroker, like Robinhood.