Why CFV Stock Looks Like a Good Investment Now

Amid this year's SPAC mania, investors want to know whether they should buy CFV stock before the SPAC's merger with Satellogic.

July 8 2021, Published 8:39 a.m. ET

Satellogic's IPO process has begun. The satellite imagery company plans to go public through a SPAC merger with CF Acquisition Corp V (CFV). Should you buy CFV stock before the Satellogic merger?

CFV stock jumped following the announcement of the Satellogic IPO deal. Although stocks that debut through SPAC mergers have had a mixed track record, SPAC stocks can sometimes offer retail investors early exposure to promising businesses.

What is Satellogic, and could it be a good investment?

Satellogic, officially called Nettar Group, is a satellite imagery company that serves commercial and government customers. Started in 2010, it currently operates 17 satellites and aims to have more than 300. The company believes its high-resolution Earth imaging can provide information to help combat global challenges.

The company makes all of the main components that go into building its satellites, which offers tremendous cost advantages—Satellogic says its builds and launches satellites for less than one-tenth the costs of its competitors. The company’s technology is backed by a patented camera design.

A key arrangement for the company is its deal with Elon Musk-led SpaceX to launch satellites into space. The deal is expected to help the company reach its target of 300 satellites.

Who’s the CFV SPAC's sponsor?

CF Acquisition was formed by financial service company Cantor Fitzgerald. The SPAC raised $250 million in its IPO and arranged a $100 million PIPE investment that involved a SoftBank affiliate.

The Satellogic–CFV SPAC merger date

The parties announced their deal on Jul. 6. They aim to close the transaction early in the fourth quarter of 2021. After the deal's closure, CFV stock will automatically convert to a new ticker, “SATL”.

Satellogic's valuation

The CFV SPAC deal values Satellogic at $850 million. Since its founding, the startup has raised about $124 million through several investors, including Tencent and Pitanga Fund. As part of its IPO deal, Satellogic is set to have more than $270 million in cash to invest in growing its business.

Should you buy CFV stock before the Satellogic merger?

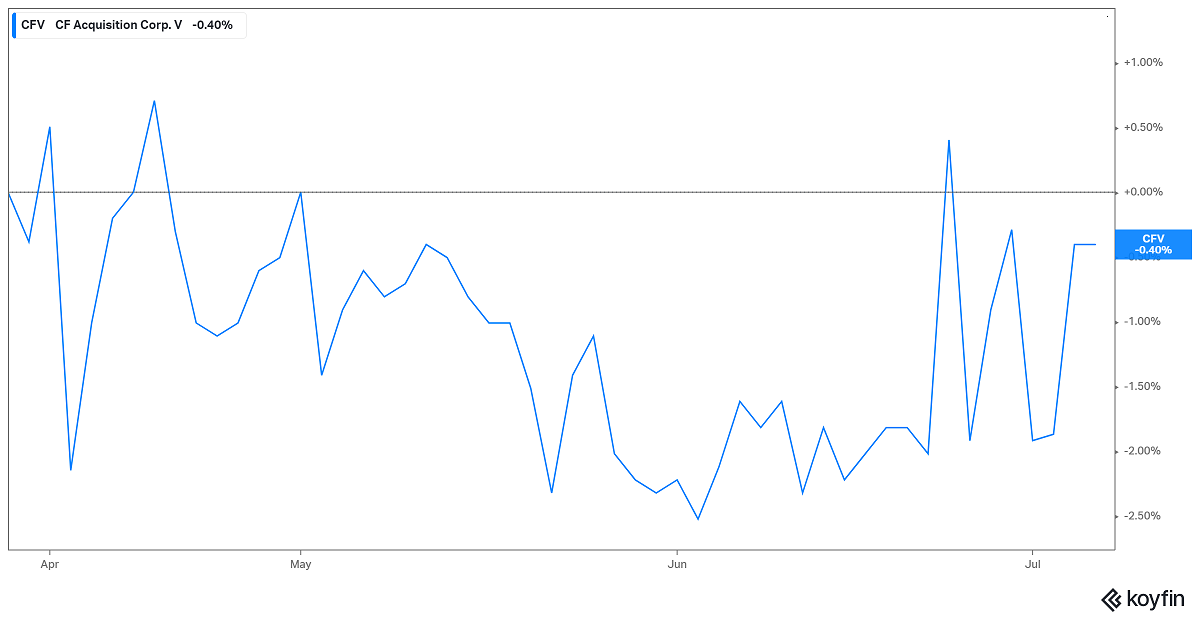

CFV stock deserves a look following the Satellogic merger. As the stock has dropped below its IPO price of $10, an arbitrage opportunity has opened up for bargain seekers.

Furthermore, whereas Satellogic aims to have more than 300 satellites in orbit by 2025, even with its 17 satellites, it has more capacity than its four top competitors combined. The company estimates its revenue will reach $800 million by 2025, and has room to grow—its addressable market is worth $140 billion.

In addition to delivering high-resolution Earth imagery that refreshes daily, Satellogic aims to offer affordable prices. This strategy could help grow its business as well as defend its market share.

Finally, CFV stock could be a smart climate play, as Satellogic's high-quality data could prove critical in tackling some of the world’s most pressing challenges, including climate change.