How Do You Pay Taxes on Robinhood Stocks?

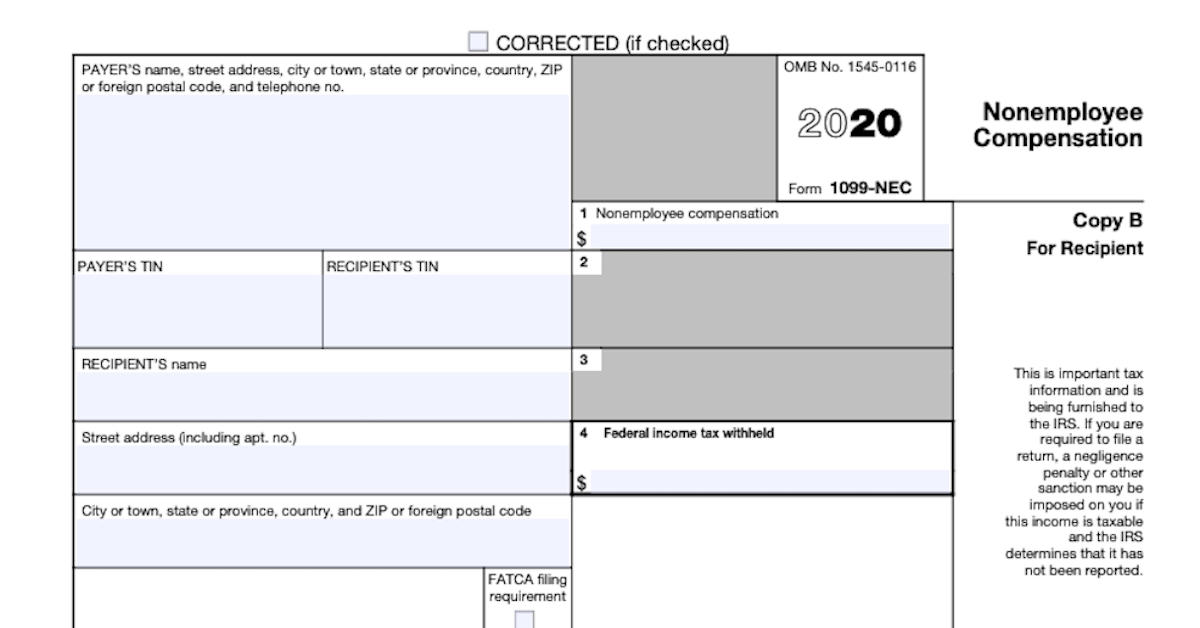

To pay taxes on Robinhood stocks, you will receive a consolidated 1099 tax form that outlines all of your transactions for the year.

July 27 2020, Updated 8:44 a.m. ET

The Robinhood platform lets you invest in stocks, ETFs, and cryptocurrencies without having to pay brokerage fees. Notably, Robinhood pioneered commission-free trading that other brokerage firms have adopted, which lowers the cost of securities investing. Millions of Americans have embraced Robinhood’s investing service, which is available through a smartphone app and the company’s website. If you're new to the app, you may have questions about how Robinhood handles taxes on stocks.

Robinhood stocks and taxes

Investing in stocks and other securities through the Robinhood platform is free. However, Robinhood investors, like all individuals on an investing platform, must report earnings with the IRS.

So, how do you pay the taxes on Robinhood stocks? First, not all Robinhood stock investors have to pay taxes every tax season. For tax filing purposes, Robinhood will send you a consolidated 1099 tax form that summarizes all of your transactions for the whole year.

The Robinhood tax document is made available in February of the tax year. As a result, investors have enough time to prepare and file their tax returns before the typical April 15 tax filing deadline.

Will you owe taxes on Robinhood stocks?

You may owe Robinhood stocks taxes if you made a profit from buying and selling stocks on the Robinhood platform. Also, you may owe taxes if you received dividend income on your Robinhood stocks or ETF investments.

If you didn’t make more than $10 in dividends or sell any stocks for a whole year, you won’t have to pay taxes on your Robinhood stocks. So, the company won’t send you the 1099 tax form.

If you completed taxable transactions on your Robinhood stocks account, then the company will send you the 1099 tax document. You can access the tax form under “Tax Documents” in the “Account” section on the Robinhood app or website. You can download and print the form or import it to the TurboTax app for filing taxes. Notably, you can receive up to a $20 credit for filing Robinhood stocks taxes using TurboTax.

Does Robinhood withhold tax?

Withholding tax is sometimes called “retention tax.” Your employer and some trading platforms can withhold a portion of your income or proceeds and release it to the government on your behalf. Robinhood’s investing platform doesn’t withhold taxes when you sell securities or receive dividends on your Robinhood stocks.

Robinhood crypto taxes

Robinhood stocks and cryptocurrency trades might be subject to capital gain tax. The tax will be levied on the profit realized from the sale of a capital asset like stocks or cryptocurrencies.

If you sell a stock or cryptocurrency, like bitcoin, for profit after holding it for more than one year, the profit would be subject to long-term capital gain tax. The long-term capital gain tax rate can be 0 percent, 15 percent, or 20 percent depending on your tax bracket.

Similarly, the profits from selling a stock or crypto asset that you held for less than one year would be subject to short-term capital gain tax. Short-term capital gain tax rates are similar to ordinary income tax rates and can be as high as 37 percent.

Finally, you can deduct losses from Robinhood stock or crypto trades from your tax bill.