After Its Crash, Robinhood Markets (HOOD) Stock Still Isn’t a Firm ‘Buy’

Analysts are optimistic about Robinhood's prospects in banking and beyond. What’s HOOD’s price prediction, and is the stock a good buy?

Aug. 24 2021, Published 6:59 a.m. ET

On Aug. 23, Robinhood Markets (HOOD) stock rose more than 6 percent after Wall Street analysts initiated coverage and lauded the investment platform’s potential despite last week’s disappointing second-quarter earnings report. What’s HOOD’s price prediction, and is the stock a good buy now?

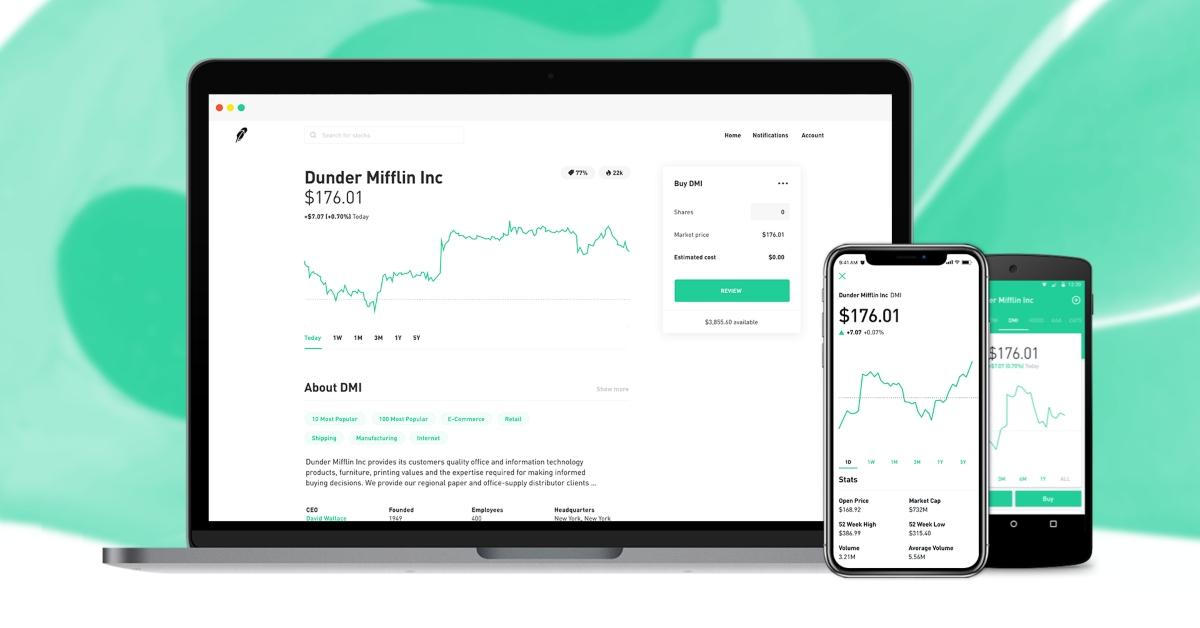

On Jul. 29, Robinhood went public at $38. After more than doubling within the first week of its IPO, the stock has given up much of its gains on signs that the company’s fundamentals don’t support the rally. Robinhood, which revolutionized stock trading with its easy-to-use, commission-free platform during the COVID-19 pandemic, closed Aug. 23 at $45.29, losing nearly half of its value from its peak of $85 on Aug. 4.

Robinhood's stock price prediction

On Aug. 23, at least ten analysts initiated coverage on Robinhood stock. Half of them rated it as "buy" or equivalent. Most analysts expressed concerns about the sustainability of the frantic retail trading that powered the company’s second-quarter growth. However, they were largely optimistic about Robinhood's long-term growth potential.

Citigroup analyst Jason Bazinet estimates that Robinhood’s account base could increase to 32.5 million by 2023 from 22.5 million on Jun. 30, 2021. The analyst believes that Robinhood will evolve beyond crypto and stock trading into a broader-based money app. He also thinks that Robinhood will expand its business internationally, boosting its account growth. Citigroup has a “buy” rating on Robinhood, with a price target of $63.

Meanwhile, Goldman Sachs analyst Will Nance has given HOOD a “neutral” rating and price target of $56. Nance sees significant growth ahead, with Robinhood reaching 53 million accounts by 2025.

At Piper Sandler, analyst Richard Repetto initiated coverage of Robinhood with a “neutral” rating and price target of $47. Repetto expects Robinhood to continue to benefit from its effective, incentive-driven customer acquisition model creating strong brand awareness among Millennials.

Mizuho analyst Dan Dolev has given HOOD a “buy” rating and price target of $68. Dolev said, “We view Robinhood not as a meme stock phenomenon, but as a singularity that captures Generation Z's zeitgeist.” He added that Robinhood could double its average revenue per user by adding new products and services.

JPMorgan Chase was the lone bearish voice, rating the stock as "underweight." It cited Robinhood's regulation of payment for order flow, price, and market saturation.

Analysts' average target price for HOOD stock

According to MarketBeat, analysts' average target price for HOOD is $52.33, which is 16 percent above its current price. Among the 13 analysts tracking HOOD, seven recommend “buy,” five recommend “hold,” and one recommends “sell.” Their highest target price of $68 is 50 percent above the stock's current price, while their lowest target of $35 is 23 percent below.

Is HOOD stock a good buy now?

While analysts have a bright outlook for HOOD stock, I would be cautious about buying it at this time. In the short term, the stock may see selling pressure. Given Robinhood's present valuation, it may make sense to sell the stock at its current price and book profits.

In the second quarter, Robinhood’s revenue rose 131 percent year-over-year to $565 million. The gains were fueled by the company's cryptocurrency-related transaction revenue rising to $233 million from $5 million a year prior. Unfortunately, management has cautioned that Robinhood’s third-quarter earnings results are unlikely to be as impressive.