Rakesh Jhunjhunwala: How the 'Warren Buffett of India' Made Billions

Rakesh Jhunjhunwala is among the richest people in India. What’s his net worth and what do we know about his portfolio and investments?

Dec. 13 2021, Published 9:11 a.m. ET

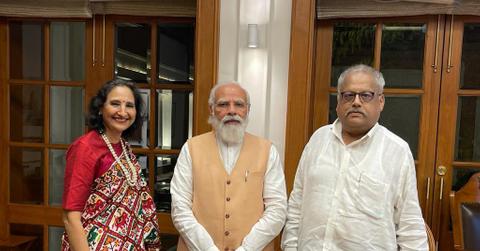

Rakesh Jhunjhunwala is among the richest people in India. He made his wealth through investing and is also known as the “Warren Buffett of India." What’s his net worth and what do we know about his portfolio and investments?

Rakesh Jhunjhunwala

Investor

Net worth: $5.9 billion

Rakesh Jhunjhunwala is among the richest people in India with a net worth of $5.9 billion. He made his wealth through investing and is also known as the "Warren Buffett of India." His portfolio includes a mix of public and private companies. He has also launched an airline company that's expected to commence operations in 2022.

Jhunjhunwala is also known as the “big bull” since he's among the perma bulls. He recently mocked those who believed that the rally in Indian stock markets is being led by excess liquidity. While Indian stock markets have come down from their 2021 highs, they're still up sharply for the year.

Rakesh Jhunjhunwala’s net worth is estimated at $5.9 billion.

Jhunjhunwala’s net worth is estimated at $5.9 billion. He made his money through investing and most of his money is parked in stocks. He's bullish on Indian stock markets as well as the economy and expects the country to surpass China in the next 25 years. Currently, China is the world’s second-largest economy but the country’s economic growth has slowed down considerably.

Rakesh Jhunjhunwala invests in public as well as private companies.

Jhunjhunwala invests in public as well as private companies. He owns the stockbroking company Rare Enterprises and the firm derives the name from the initials of his and his wife Rekha’s names. He's also the co-founder of Alchemy Capital, which is a portfolio management company.

What are Rakesh Jhunjhunwala’s private investments?

Jhunjhunwala has invested in several private companies. His investments include the health insurance company Star Insurance, which was recently listed in a dismal IPO. Metro Brands is another private company backed by Jhunjhunwala that's listing in December. In 2021, Jhunjhunwala backed Nazara Technologies. The IPO was a big success and delivered good listing gains.

Rakesh Jhunjhunwala has also started an airline company.

Jhunjhunwala has also launched Akasa Airline, which is majority-owned by him. The company is expected to receive the required clearances sometime next year. However, how the airline performs remains to be seen as the Indian aviation industry hasn’t been in the best of health. Some companies had to wind down operations amid the perennial cash burn.

Rakesh Jhunjhunwala has famous investments.

Meanwhile, Jhunjhunwala has a significant portfolio of publicly traded companies. Titan is his biggest holding by a big margin and he has been owning the stock for quite some time now. Tata Motors, the Indian automotive company that acquired Jaguar and Land Rover, is the second-largest holding in his portfolio.

Escorts, CRISIL, and Fortis Healthcare are his other three top holdings in that order. Jhunjhunwala also holds shares of SAIL (Steel Authority of India), which is an Indian steelmaker run by the government. While Jhunjhunwala is known as "the Indian Warren Buffett," some of the stocks like SAIL might never find their way into Buffett’s portfolio. The Oracle of Omaha has generally stayed away from metal and mining companies.

Jhunjhunwala also owns Rallis India stock. While the stock has underperformed in 2021, analysts see the stock bouncing back.

Rakesh Jhunjhunwala has invested in Indian banks.

Jhunjhunwala holds three banks in his portfolio—Canara Bank, Federal Bank, and Karur Vyasa Bank. Canara Bank is an Indian public sector bank and it's among Jhunjhunwala's newest investments.

Indian public sector banks have destroyed a lot of investors’ capital despite the current bull market, and many investors don't expect them to turn around anytime soon. However, Jhunjhunwala has a contrarian view of at least one of them. Will the "big bull" be right? We'll have to wait and see.