Proteomics Might Be an Unsung Sector in the Stock Market

Proteomics, the study of proteins, might be worth investing targeted capital in through the stock market. What can investors expect from this sector?

March 30 2021, Updated 1:32 p.m. ET

With all the hubbub about genomics and CRISPR, the market isn't a stranger to niche scientific sectors. Perhaps proteomics, the study of proteins, deserves some credit, too.

Proteomics contributes to the development of society in interesting ways. Certain companies are taking charge of the industry in the stock market.

What is proteomics?

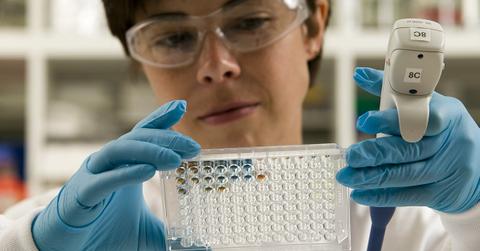

Eisbach Bio scientist targeting protein for COVID-19 research

The large-scale study of proteins has been gaining traction in the last few years, including in the venture capital realm. Discovery and clinical proteomics help to unearth the intricacies of various pharmaceuticals and diseases. Proteomic technologies can identify how effective or toxic a drug is, which can ultimately lead to improvements.

How proteomics ties in with COVID-19

COVID-19 viruses heavily target spike protein in the body to latch onto. Eisbach Bio is targeting proteins in COVID-19 research to help identify new treatment drugs for the virus.

Eisbach isn't public. In fact, the German startup was founded in 2019 and maintains just a dozen or so employees. They have conducted two grant rounds and a seed funding round through venture capital. The company has a new product in beta testing. Regardless of their standing in the market, it just goes to show how relevant proteomics is and will continue to be.

Proteomics companies to invest in

First, SomaLogic is a proteomics company that has just landed a $1.2 billion reverse merger with the blank-check company CM Life Sciences II. Eli Casdin of Casdin Capital is now proceeding with his second SPAC via a scientific company that holds immense potential.

Investors can expect SLGC to hit the market sometime in the third quarter of 2021, although CM Life Sciences (NASDAQ:CMIIU) is already there.

Second, Seer Inc. (NASDAQ:SEER) is another proteomics biotech company. On March 29, Seer had its earnings call for the previous fourth quarter and the full year that ended December 31, 2020. For a newly public company that's heavily invested in clinical research, the earnings call went pretty well—especially since the company is only a quarter out from its $314.4 million IPO. Since the call, Seer shares have increased marginally by about 3 percent.

Investors can expect SLGC to hit the market sometime in Q3 2021, though CM Life Sciences (NASDAQ:CMIIU) is already there.

Finally, Nautilus Inc. (NYSE:NLS) calls itself a "next-gen proteomics company" that maintains a focus on speed and efficacy of research. The company went public in 2016 and has had a bumpy ride since. In the past year alone, the shares have burgeoned 1,041 percent. A recent 50 percent dip makes it a good time to invest if you have a flexible time horizon.

The caveat of proteomics stocks: Clinical phases

Clinical research can be a cherry and a bone for public companies. In the proteomics sector, there's a lot of waiting, but as long as they have a strong foundation of funding and ethics, there's a chance it'll pay off. You can improve your chances of returns by diversifying your proteomics investments, despite the fact that you're already dealing with a pretty targeted market.