When Was Nvidia’s Most Recent Stock Split? 4-for-1 Split, Explained

Nvidia, a chip maker for electronics, executed a 4-for-1 stock split in July to increase its accessibility to more investors. Here's what investors need to know.

Aug. 2 2021, Published 1:57 p.m. ET

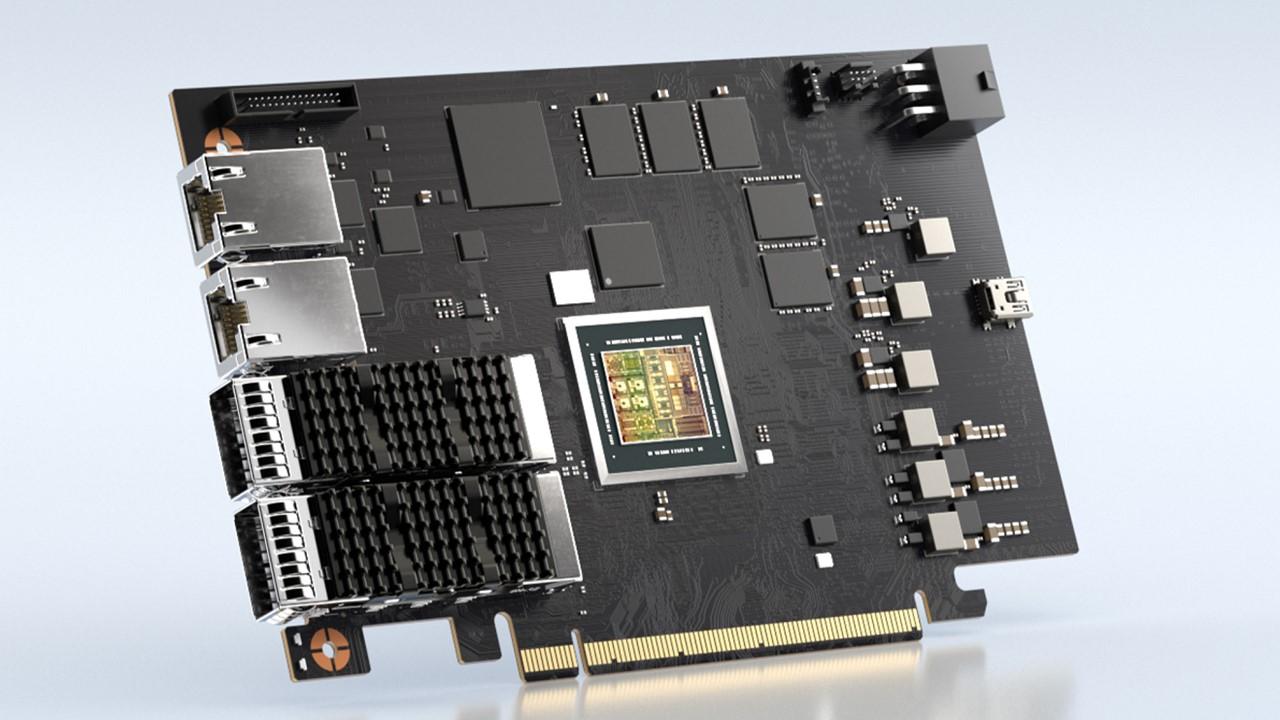

Nvidia, the inventor of the GPU (graphics processing unit), has been in existence since 1993 making chips for electronic devices. It has executed multiple stock splits since it became publicly traded.

Nvidia makes most of its revenue from its GPUs, which it sells for both professional and entertainment purposes. Two of its competitors are Intel and Advanced Micro Devices (AMD). Nvidia trades on the Nasdaq under the ticker symbol "NVDA." What was the most recent stock split for Nvidia?

Nvidia stock split 2021

On July 20, 2021, Nvidia completed a 4-for-1 stock split. In a stock split, a company decides to increase the number of its outstanding shares on the market according to a precise ratio. In other words, every share of the stock “splits” into a certain number of pieces.

After a stock split, existing shareholders still own the stock, but their number of shares is multiplied. For example, in a 2-for-1 stock split, every share pre-split would become two shares post-split. The value of the said shares wouldn't increase because the price divides according to the ratio of the split.

Other stock splits in Nvidia’s history

Nvidia has had four previous stock splits. In 2000, 2001, and 2006, the company underwent stock splits and each of them was a 2-for-1 ratio. A 2-for-1 split doubled the number of shares and cut the share price in half. In 2007, the company elected to execute a 1.5-for-1 split, which gave each investor 1.5 shares for each individual share.

Reasons for stock splits

Companies might elect to undergo a stock split for several reasons. The main benefit of splitting stock is that the company’s shares become more affordable to everyday investors. When a stock is priced out of reach for retail investors, the company's executives might determine that a stock split would increase liquidity by lowering the price per share.

Not all companies are interested in making shares more accessible to average investors. For example, Berkshire Hathaway’s stock price is astronomical in part due to Warren Buffett’s aversion to stock splits.

In Nvidia's case, the company said that the 4-for-1 stock split makes “NVIDIA stock ownership more accessible to all.” Since the prices of its common stock shares increased in recent years, the split was intended to help increase liquidity and improve equity for employees.

Is NVDA stock more valuable after the split?

A stock’s inherent value doesn’t increase or decrease due to a stock split. The value of the entire stake you own in a company essentially remains the same if you own shares both before and after a stock split.

However, the way your investment is calculated does change. Since Nvidia performed a 4-for-1 stock split, if you owned 100 shares of Nvidia before July 20, you would now own 400 shares at the lower price.

The decision to implement a stock split can be a good sign for the overall health of a company. Usually, the company's share price rises before a split. Motley Fool noted that the rise of NVDA stock prices prior to the split was “likely primarily a result of the business's strong underlying momentum.”