Newegg Stock Is Faring Well After the Company’s Back-Door Merger

Newegg Commerce Inc. went public in May by way of a reverse merger. How has the stock been holding up since?

July 1 2021, Published 1:34 p.m. ET

Like an Amazon for computer parts, Newegg Commerce Inc. (NASDAQ:NEGG) has a solid hold in its niche. The company has slowly built a cult-like following since its 2001 inception, primarily among DIY computer enthusiasts.

Since going public via a back-door merger in May, Newegg now has the opportunity to prove whether it has as strong a hold on the public market as it does its consumers.

Details of the Newegg merger

Calif.-based Newegg merged on May 19 with a Chinese company formerly called Lianluo Smart Limited. Lianluo previously held the ticker symbol LLIT, and Newegg was formerly a privately held company.

By joining forces in a reverse merger with an existing public company, Newegg was able to land on the public market without having to go through the lengthy, expensive, and often complicated process of a traditional IPO.

Following the finalization of the merger, Newegg's existing shareholders (institutional and corporate) retained 98.68 percent of the combined entity. Existing Lianluo shareholders received a minimal 1.32 percent. Prior to the shift, Lianluo offered a dual-class structure, but that has been changed to a single common stock tier.

How has Newegg stock performed since going public?

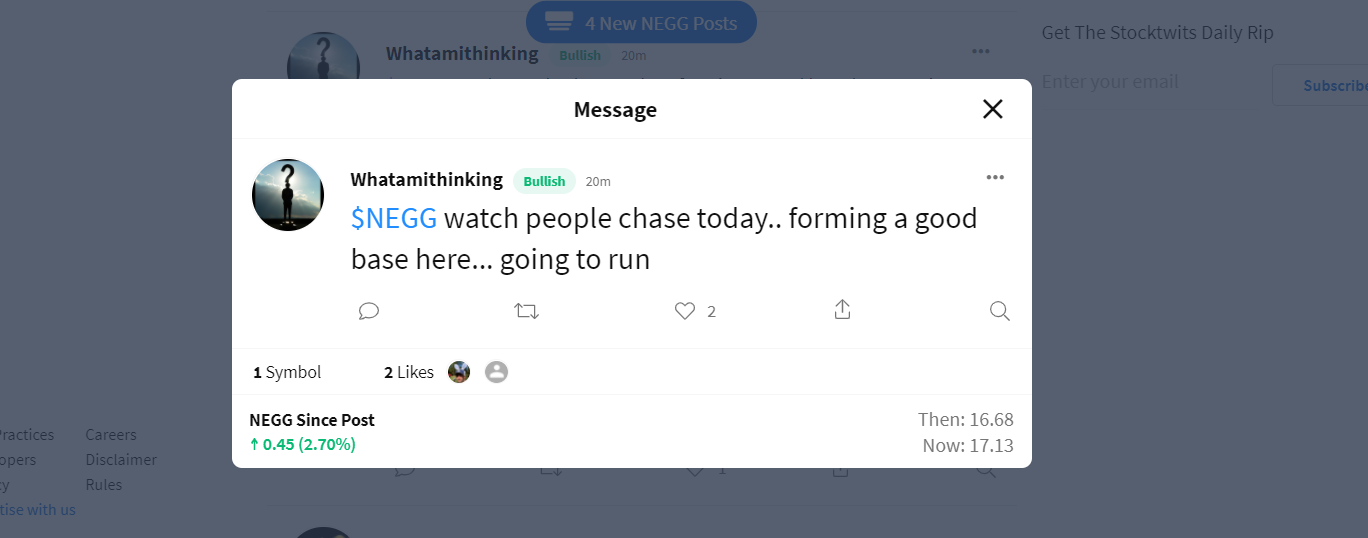

Trading under the ticker symbol "NEGG" on the Nasdaq, the e-commerce company has seen its stock rise 79.61 percent since May 19. It jumped another 78.29 percent between Jun. 28 and 29 before correcting by about 14 percent.

Why did NEGG stock jump so high?

The most recent upward fluctuation for NEGG stock can't be attributed to any news, as the company has been quiet since its May merger. It's possible investors are banking on the future launch of Newegg Capital, a joint venture between Newegg Commerce and Payability. The resulting entity would provide "tech-enabled working capital solutions for marketplace sellers," according to Own Snap.

Alternatively, NEGG could be a target of short interest hunters looking for the next squeeze. NEGG's short interest is locked, but with 60.5 percent of shares held by insiders, it's a possibility.

What investors are saying about Newegg

Traders are enthusiastic about Newegg stock, with many recognizing the bullish opportunity. However, they may wait for a flush after the sudden and strong price increase. That flush isn't guaranteed, though, considering trading volume has settled and people are holding at a higher rate than they're selling (for the time being, at least).

Others point out that NEGG stock is in a lockup period following the recent merger, which is why many people are targeting the stock now. Insider selloffs are typically imminent at the end of a lockup period.

NEGG stock's forecast now that the merger is behind us

Newegg stockholders can expect volatility as NEGG exits its lockup period in the coming months. However, the next 12 months could be good for the fresh Newegg entity, with some analysts predicting a median growth rate of 157.31 percent over the year.