Are Natural Gas Stocks a Good Investment in 2021?

Investors are seeking out the best natural gas stocks to buy now as global economic activity picks up again after the COVID-19 pandemic.

March 12 2021, Published 3:10 p.m. ET

As the coronavirus outbreak slowed down global economic activities, the demand for natural gas declined. As a result, investors sought to reduce their exposure to natural gas stocks. Economic activities are picking up again as vaccines are rolled out. Natural gas demand and prices are starting to rebound.

For investors keen on playing the global economic recovery, this might be the right time to start looking for the best natural gas stocks to buy. The decision by OPEC members to curb production makes investing in natural gas stocks exciting. Curbing output should allow gas prices to rebound quickly, which could result in more profits for gas companies.

Is natural gas clean energy?

If you’ve been following the climate change talks, you know that the world has decided to move away from fossil fuels to clean energy sources. As a result, those investing for the long-term want to know whether natural gas energy is clean and if the commodity has a future.

Natural gas is a type of fossil fuel. However, burning natural gas produces the least amount of carbon dioxide compared to burning other fossil fuels like petroleum products or coal. Therefore, burning natural gas gives relatively clean energy. Natural gas can be used to produce hydrogen, which is regarded as clean energy source.

5 best natural gas stocks to buy now

Some of the best natural gas stocks to invest in right now are:

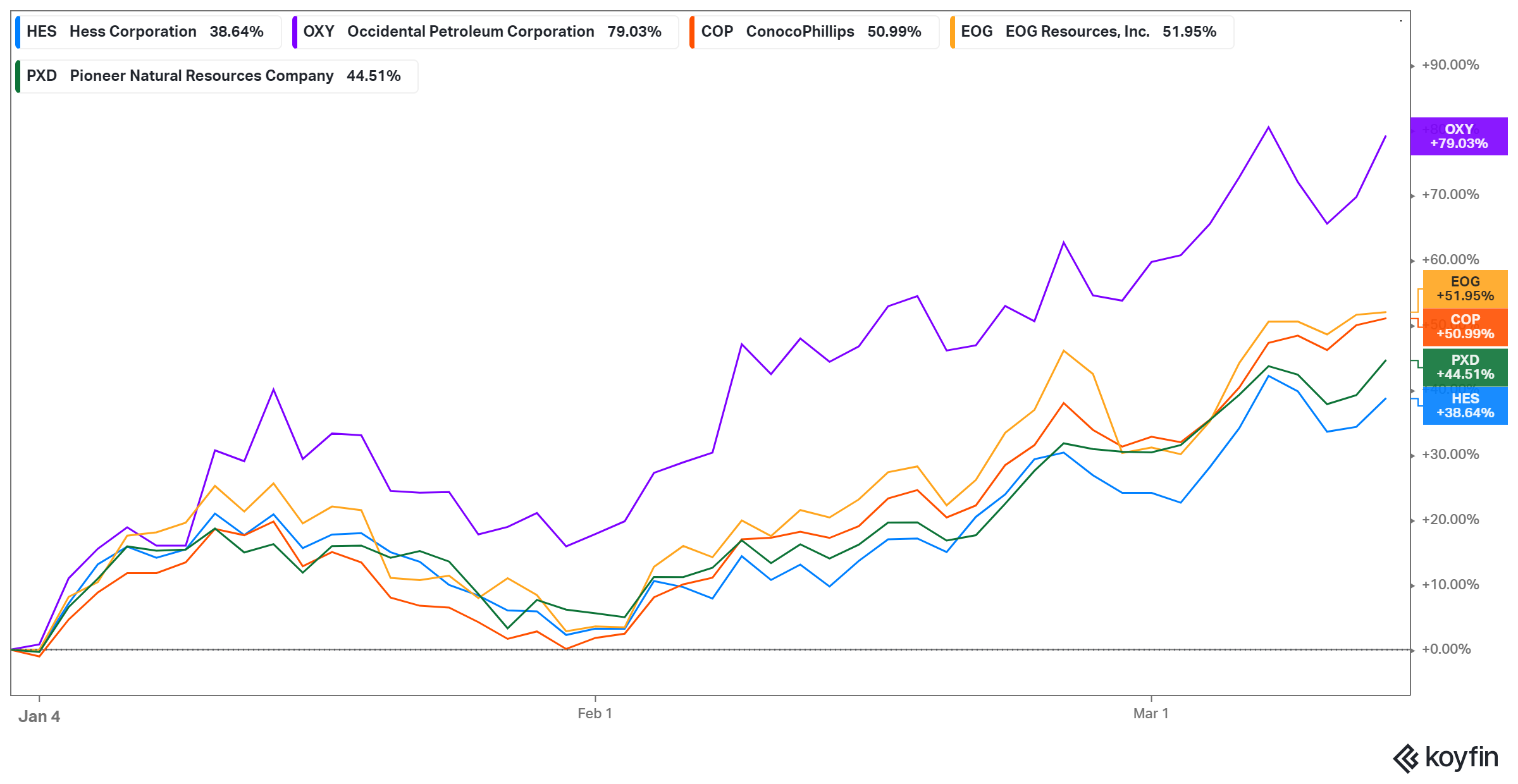

- Hess Corporation (HES)

- Occidental Petroleum (OXY)

- ConocoPhilips (COP)

- EOG Resources (EOG)

- Pioneer Natural Resources (PXD)

The best natural gas stocks to buy now

Hess Corporation stock has gained about 40 percent YTD. The stock has more room to run. Wall Street bulls see 25 percent upside potential in the stock to $87. HES stock offers a dividend yield of about 1.4 percent.

Occidental Petroleum stock has gained nearly 80 percent YTD. However, it still trades at more than a 4 percent discount to its recent high. Wall Street bulls forecast 25 percent upside for the stock to $38. OXY stock offers a dividend yield of 0.13 percent.

ConocoPhilips stock is up 50 percent YTD. It has the potential to rise 20 percent more as natural gas demand and prices continue to rebound. COP stock offers a dividend yield of about 2.9 percent.

EOG Resources stock has risen more than 50 percent YTD. EOG stock, which currently offers a dividend yield of about 2.2 percent, has the potential to rise 35 percent more from the current level.

Pioneer Natural Resources stock has gained 45 percent YTD but still sports upside potential of as much as 33 percent. The natural gas producer is profitable and pays a dividend. Currently, PXD stock offers a dividend yield of nearly 1.4 percent.

Is natural gas a good investment?

The growing global population is only going to increase the demand for fuel. There's plenty of natural gas and it's cheap. The world is focused on reducing the use of fossil fuels as part of the efforts to combat climate change. But the relatively clean natural gas should continue to see growing demand.

Gas regulations should remain lighter than other fossil fuels to ensure that it can still continue to power global economies in areas that might take a long time to shift to renewable energy. The natural gas market is forecast to grow at the rate of 7.7 percent annually in the next few years to exceed $1 trillion by 2022.

The best natural gas stocks under $5 to buy now

Many natural gas stocks have soared as investors bet on the global economic recovery, particularly in Asia, which accounts for the bulk of the gas demand. However, there are still some good natural gas stocks you could buy under $5.

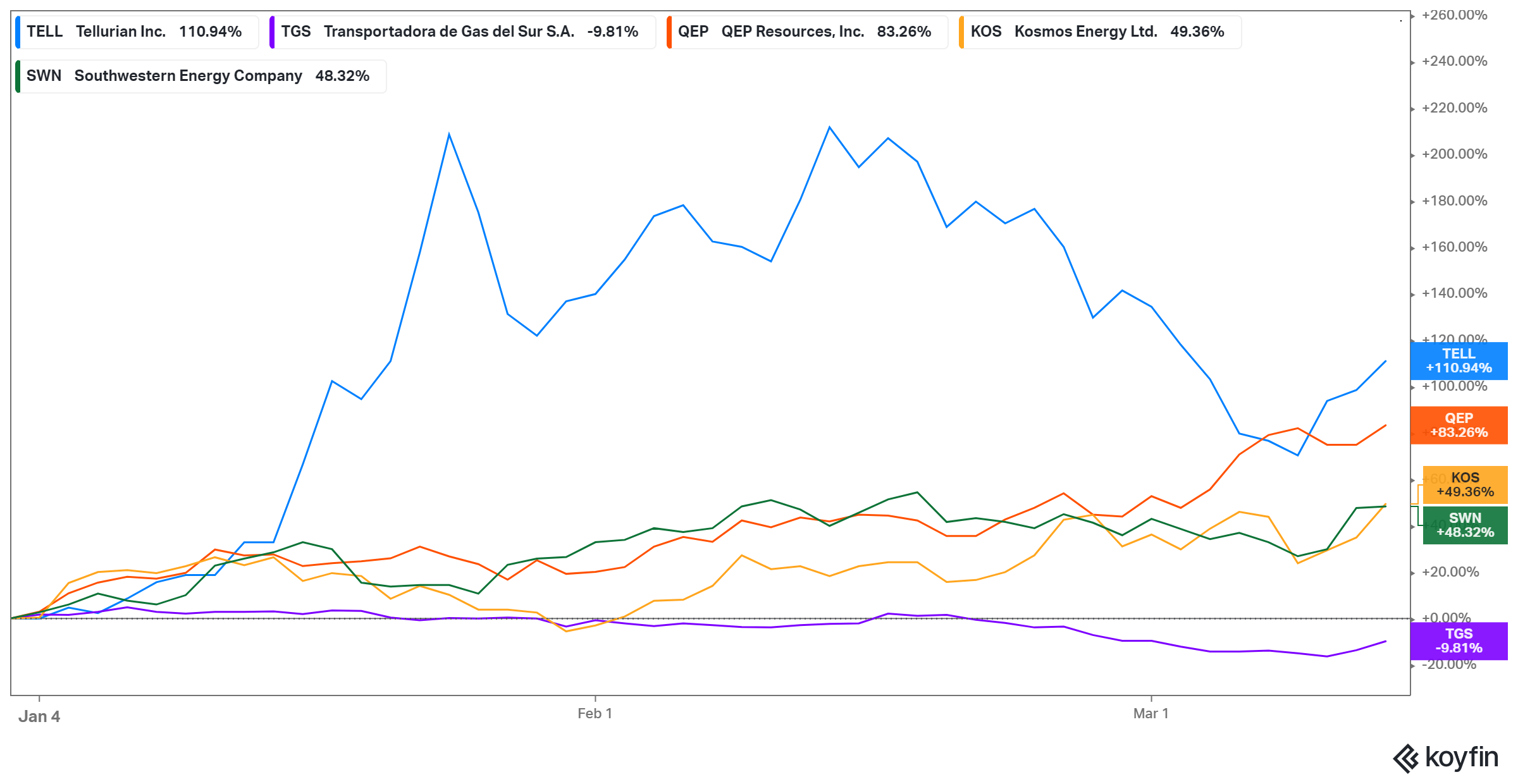

- Tellurian (TELL)

- Transportadora de Gas (TGS)

- QEP Resources (QEP)

- Kosmos Energy (KOS)

- Southwestern Energy (SWN)

Tellurian stock trades at $2.70 per share. It has gained 110 percent YTD but still trades nearly 40 percent below its recent high. Wall Street bulls forecast up to 85 percent upside for TELL stock from current level to $5.

Transportadora supplies the Latin American natural gas market, which continues to grow. At about $4.70 per share, TGS stock trades at a 30 percent discount to its recent peak. The stock has more room to run as Wall Street's target price of $7 implies nearly a 50 percent upside potential.

QEP Resources (QEP) stock costs only $4.38 per share now. The stock has gained more than 80 percent YTD. Diamondback Energy (FANG), another natural gas company, wanted to acquire QEP Resources. However, QEP Resources shareholders have rejected it. They think that the company is better off alone.

Kosmos Energy shares cost only $3.50. The shares are up about 50 percent YTD but still trade at a 5 percent discount to their recent peak. KOS stock still has the potential to rise as much as 30 percent from the current level.

Southwestern Energy cost costs about $4.40. It has gained nearly 50 percent YTD but still offers 6 percent discount to its recent high. SWN still shows upside potential of as much as 50 percent.

The best natural gas stocks ETF

Some investors might not have the time or skill to analyze individual stocks to identify the best picks. For them, natural gas stock ETFs are ideal. These funds identify the gas companies that fit with their investment style and purchase shares in them. Here are some of the best natural gas stock funds for both experienced and beginner investors.

- the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) – expense ratio is 0.35 percent

- the VanEck Vectors Unconventional Oil & Gas ETF (FRAK) – expense ratio is 0.54 percent

- the First Trust Natural Gas ETF (FCG) – expense ratio is 0.60 percent