Microvast Stock (MVST): What to Expect With This New WallStreetBets Favorite

MVST is seeing major investor interest following IPO merger, thanks largely to WallStreetBets users. What's to come for Microvast stock?

Aug. 6 2021, Published 11:52 a.m. ET

Li-ion battery chemistry innovator Microvast (NASDAQ:MVST) recently made its way onto the public market through a merger with Tucson Holding Corp., which formerly traded under the ticker THCB. The Texas-headquartered company and its Chinese subsidiary are already taking the WallStreetBets world by storm.

What's to come for Microvast stock? The recent merger may not be the only reason the reddit apes are intrigued by the battery maker. Let's sort through the short rumors and where analysts predict the stock is headed.

Microvast finalized its merger and IPO on Jul. 26

It has been less than two weeks since Microvast took over the Tucson ticker. In the time since the debut, shares are up 40.45 percent, making the stock's market value $12.37 as of Friday, Aug. 6.

Despite this quick and sudden growth, it's still a lot lower than where Tucson was trading prior to the merger. The holding company was trading for as much as $24.50 per share in early 2021.

MVST is trending on WallStreetBets alongside AMC and AMD.

The three trending stocks on WallStreetBets for Aug. 6 are MVST, AMC, and AMD. How did MVST join popular meme stock entertainment company AMC and semiconductor chip maker AMD to gain such notoriety?

Traders are mostly interested in the rumors that suggest Microvast's short interest ratio is really high. The stock has been on the market for a short period of time, so it's too soon to say the facts about the stock's shorted float. However, rumors are often enough to get the gears going for meme-happy traders.

Plus, there's an overall belief in the potential of what Microvast is doing. The company designs, develops, and manufactures battery systems for commercial EVs. It also produces innovative energy storage solutions with ultra-fast charging capabilities (combined with an impressive lifespan and safety). Microvast believes its charging capabilities make charging EVs as convenient as fueling gas-powered vehicles. With President Biden coming off of a speech about how he wants half of all cars in the U.S. to be electric by 2030, Microvast's market debut couldn't have come at a better time.

A prediction for MVST stock

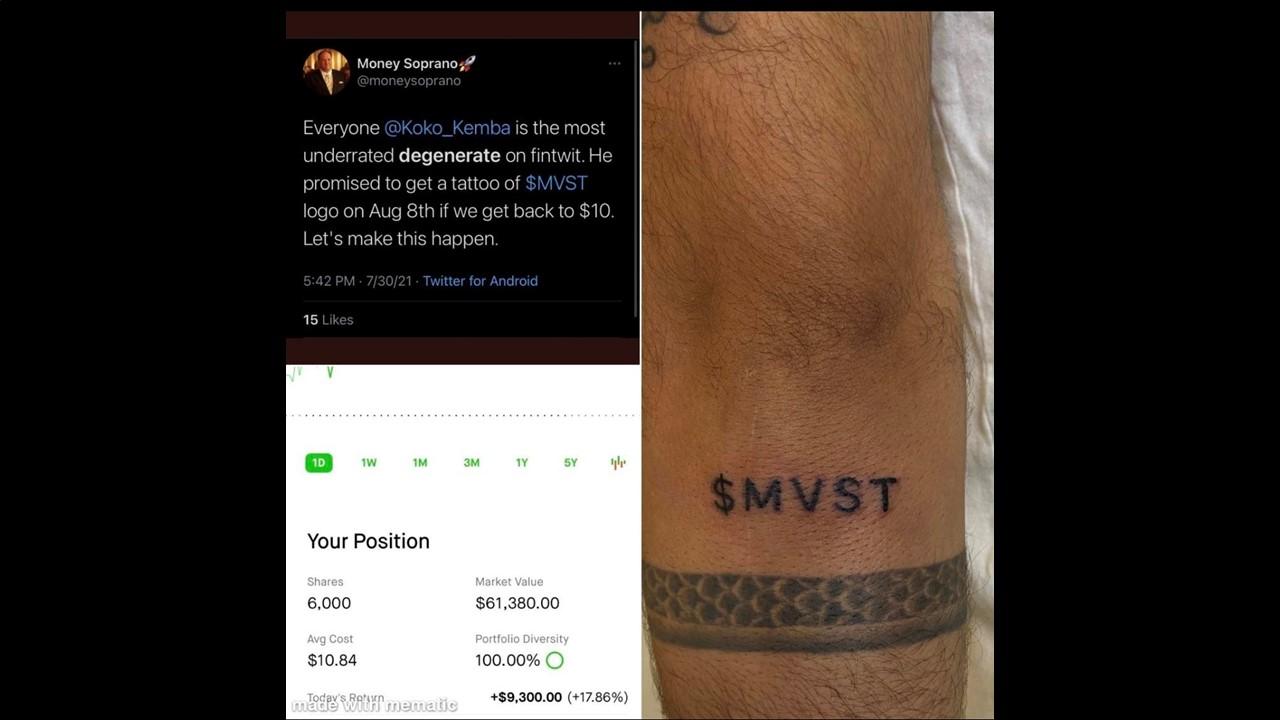

Whether or not you decide to get a Microvast tattoo like one fintwit influencer, you have the chance to bet on MVST stock or options. Some analysts predict as much as a 50 percent downside for the stock by this time next year. Currently, analysts are rating it as a sell.

Ultimately, it's your choice as to whether you take on the position. However, this meme stock is one that's bound to follow the volatile pattern that has plagued others in the sector.

The risk of carrying a Chinese subsidiary in your position

Right now, Chinese regulators are going off on big tech corporations, especially those which are listed on U.S. exchanges. MVST calls the Nasdaq home, and that could put investors at risk given the fact the company contains a Chinese subsidiary equivalent. Microvast Power Systems of Huzhou, China, may or may not be a regulatory target, but it's undoubtedly a risky place to be in given the unpredictable nature of the Chinese government.