Life Time Group (LTH) IPO Downsized Before Listing Date

Life Time Group (LTH) has priced its IPO, and is expected to list on Oct. 7. What’s LTH’s stock forecast, and is it a buy for investors?

Oct. 7 2021, Published 9:47 a.m. ET

Life Time Group (LTH) has priced its IPO and is expected to go public on Oct. 7, 2021. The company downsized its IPO just before the listing. Life Time plans to list its shares on the NYSE under the ticker symbol “LTH”. What’s LTH’s forecast, and should you buy the stock?

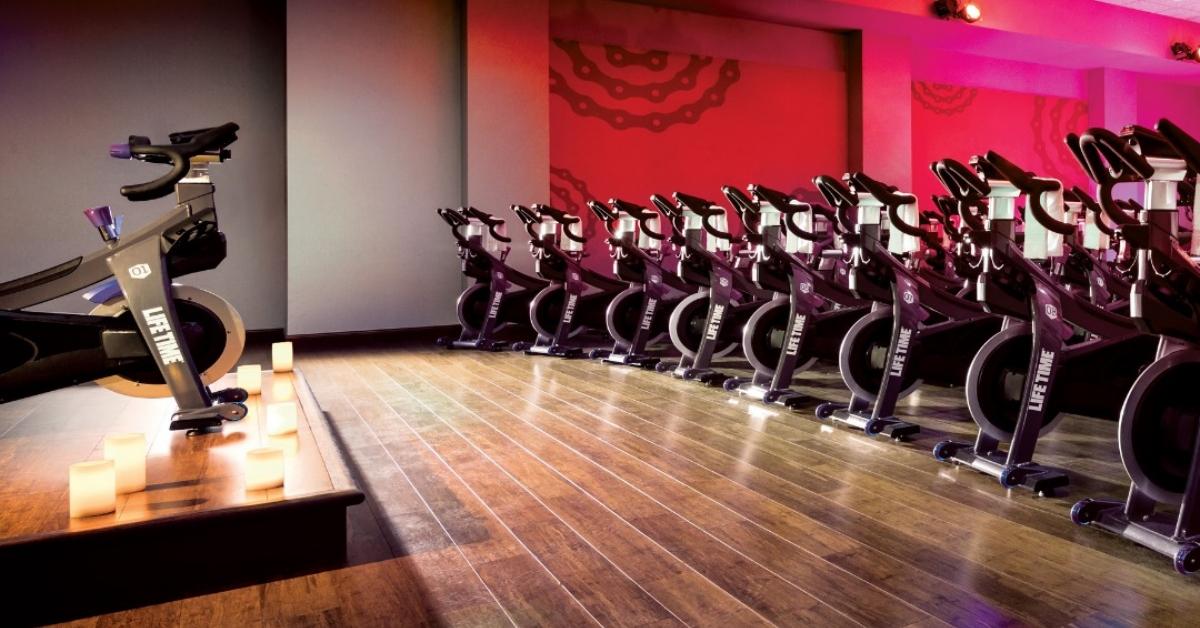

Founded in 1992, Life Time operates a network of premium health and fitness centers in the U.S. and Canada. The company operates over 150 centers across 29 U.S. states and one Canadian province.

Life Time Group priced its IPO at the low end

Life Time raised $702 million by offering 39 million shares in the IPO at $18 each. Previously, the company planned to offer 46.2 million shares for $18–$21. The net proceeds from the offering will be used for repaying debt, working capital requirements, and general corporate purposes. Goldman Sachs, Morgan Stanley, and BofA Securities are the IPO's joint lead book-running managers. The underwriters have the option to purchase an additional 5.9 million shares at the IPO price.

Life Time Group’s investors

In 2015, Life Time was acquired by private equity investment companies Leonard Green & Partners and TPG at a valuation of $4 billion. LNK Partners and Life Time founder and CEO Bahram Akradi have also invested in Life Time.

Life Time Group’s stock forecast

As of July 31, 2021, Life Time served a community of about 1.4 million individual members, who together comprised over 767,000 memberships. The company’s financials were hit hard from the COVID-19 pandemic, as it was forced to temporarily shut all of its centers in March 2020. In response to the pandemic, Life Time shifted its focus to its digital offerings by providing live-streamed classes about nutrition counseling, meditation, and exercise.

The global health and fitness club market, valued at an estimated $81 billion in 2020, is expected to grow 7.2 percent compounded annually between 2021 and 2026, according to Mordor Intelligence.

Life Time Group IPO stock doesn’t look like a good buy yet

In 2020, Life Time reported a net loss of $360.2 million, compared with a net income of $30 million in 2019. The significant drop in profitability is mainly because the company didn’t collect any fees from its members while its centers were shuttered. Its revenue fell 50.1 percent YoY (year-over-year) to $948.4 million in 2020 but rose 17.1 percent YoY to $572.5 million in the first six months of 2021.

Life Time is seeking a valuation of about $4 billion in its IPO. Based on its pro forma market cap, the company’s 2020 price-to-sales multiple is 4.2x. While Life Time is working on virtualizing its offerings, it will take time to ramp up those offerings to generate substantial results. Overall, investors should stay on the sidelines for now given the uncertainties about Life Time even reaching its pre-pandemic results in the short term.

How to buy Life Time Group IPO stock

You can buy Life Time stock after it starts trading on Oct. 7. The stock will be available through all major brokerages, including Robinhood. All you need to do is select the ticker "LTH" and enter the amount you would like to invest.