Intuitive Surgical (ISRG) Stock Looks Like a Solid Long-Term Bet

Intuitive Surgical stock has gained 20 percent on a YTD basis. What's the ISRG stock forecast for 2025?

Oct. 12 2021, Published 11:55 a.m. ET

Intuitive Surgical stock has gained 20 percent on a YTD basis. ISRG shares reached an all-time high on Sept. 8 of $360.85. However, after hitting this peak, the shares have fallen almost 9 percent due to the potential impact of the Delta variant. Despite short-term concerns and weaknesses, investors are more focused on its long-term potential. What is Intuitive Surgical’s (ISRG) stock forecast for 2025?

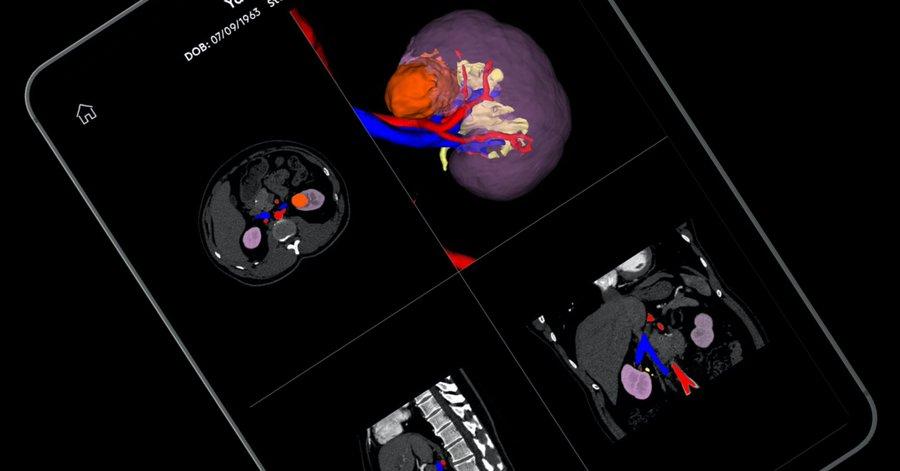

Intuitive Surgical is a robot-assisted surgery pioneer that develops, manufactures, and markets robotic products. Its da Vinci surgical systems assist physicians in performing a wide range of complex medical procedures through minimum invasion. The surgical systems increase the efficiency of surgical procedures and improve patient outcomes.

Could Intuitive’s near-term earnings underwhelm?

Intuitive CFO Marshall Mohr spoke at the Wells Fargo Healthcare Conference in September. He mentioned that its second-quarter profitability was an anomaly. Its revenues returned, while costs remained low due to lockdowns. Investors shouldn't expect the same level of profitability in the third quarter. The company also mentioned that it might have underestimated the impact of the Delta variant.

Why are analysts sitting on the sidelines for Intuitive Surgical?

Most of the analysts are currently sitting on the sidelines as far as the forecast for Intuitive Surgical stock is concerned. Among the 16 analysts covering the stock, 10 analysts have a hold rating, while six analysts have a buy rating on the stock. Analysts' average target price is $327.9, which implies almost flat rate growth for the stock.

On Oct. 1, ISRG was downgraded to neutral from buy at Citigroup. Given management's commentary on the impact of the Delta variant and disruption to the supply chain, the Citi analyst is refraining from recommending the stock.

Other analysts like Stifel also see a negative impact on the third-quarter revenues after management's commentary around the Delta variant. Therefore, most of the analysts are probably waiting for these short-term concerns to subside before getting more positive on the stock.

Intuitive Surgical 2025 forecast

According to Markets and Markets research, the global robotics surgical market is expected to grow at a CAGR of 17.6 percent from $6.4 billion in 2021 to $14.4 billion by 2026. The growth is driven by technological advancements in surgical robots and the increasing adoption of surgical robots. Being a pioneer in robotic surgery, Intuitive is expected to keep riding this secular wave for years to come.

Intuitive estimates that nearly 6 million surgical procedures are performed annually for which its robotic systems could be used. In contrast, only about 1.2 million procedures were performed with Intuitive's systems last year. The company's growth is expected to remain buoyant. Intuitive plans to win more regulatory clearances, which should continue to enhance its growth potential.

Is Intuitive Surgical a good long-term buy?

Intuitive Surgical's NTM PE ratio is 65x compared to Boston Scientific’s multiple at just 25x. ISRG’s valuation seems like a steep one. However, if you consider how it has been a market leader and is expected to remain so in years to come, part of the valuation premium starts to make sense. Intuitive's recurring revenue streams and software subscriptions make its business model attractive. The company's large installed base compared to its peers ensures higher revenues and higher growth.

Intuitive’s revenues have grown at a CAGR of 11.9 percent from 2010 to 2020, which is impressive for a well-established company. Its profitability is also high and running into the 30s (in percentage terms). Even amid the negative impact of the COVID-19 pandemic, which was much more severe for its competitors, Intuitive has managed to remain profitable.

Given the company’s leading position, moat, high-growth, and favorable industry background, ISRG looks like a good long-term investment.