Take-Two Interactive Missed Out on Codemasters, Investors Should Be Patient

Take-Two Interactive stock (TTWO) is up almost 55 percent YTD. Is the stock a buy even though it missed out on Codemasters?

Dec. 14 2020, Published 9:19 a.m. ET

Take-Two Interactive Software (TTWO) missed out on buying game developer Codemasters. The company was outbid by rival Electronic Arts (EA). However, Take-Two Interactive stock is up almost 55 percent YTD amid the surge in stay-at-home stocks. Is Take-Two Interactive stock a buy even though it missed out on Codemasters?

In November, Take-Two Interactive agreed to acquire Codemasters for $971 million. However, Electronic Arts shelled out $1.2 billion for the U.K.-based racing game developer. There has been a consolidation in the video game market as small players are bought by big names.

Take-Two Interactive on Stocktwits

Username tflo82 on Stocktwits is bearish in Take-Two Interactive stock and sees its removal from the Nasdaq 100 Index as a bearish driver. The user also points to the sell-off in gaming and tech stocks after the positive news about COVID-19 vaccine candidates.

U.S. tech shares have come off their 2020 highs amid the sector shift from growth to value stocks. Stay-at-home stocks have seen a correction as markets brace for a return to normalcy after the COVID-19 vaccine is administered to more people next year.

Take-Two Interactive stock price

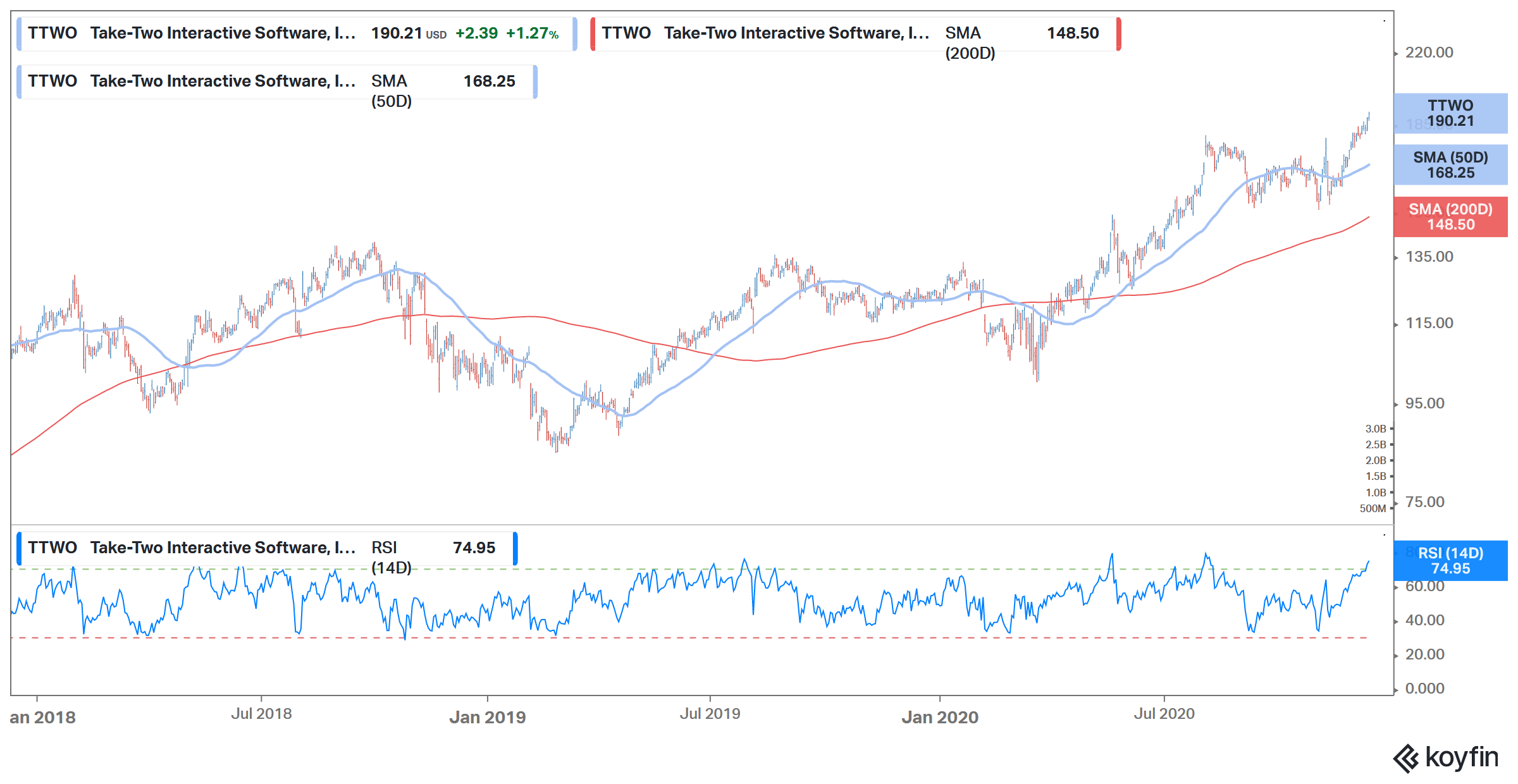

Despite the news of Electronic Arts outbidding Take-Two Interactive for buying Codemasters, TTWO stock was trading 1.4 percent higher in pre-market trading on Dec. 14. The stock made a 52-week high of $190.21 on Dec. 11. Take-Two Interactive stock looks set to make a new 52-week high on Dec. 14.

TTWO's stock forecast

According to the estimates compiled by CNN, Take-Two Interactive stock has a median target price of $200, which is a 5.1 percent premium over the current prices. Among the 25 analysts covering the stock, 19 have a buy or higher rating, four have a hold rating, and two have a sell or equivalent rating.

Should you buy TTWO stock?

Take-Two Interactive stock is trading at an NTM PE multiple of 46.6x, which is higher than its historical multiples. It's among the highest multiples for the stock barring 2007 when its NTM PE multiple spiked above 200x. The stock looks richly valued and the NTM PEG (PE-to-growth) multiple of 3.7x doesn't look cheap either.

Looking at the technical indicators, Take-Two Interactive stock is trading above its 50-day SMA (simple moving average) and 200-day SMA, which signals a short-term uptrend. However, its 14-day RSI of 74.9 suggests that it's overbought in the short run.

Take-Two Interactive stock looks richly valued even after accounting for strong growth. However, investors should use any fall in the stock as a buying opportunity. Looking at the elevated valuations both in TTWO stock as well as the broader markets, it might be prudent to wait for better prices before buying Take-Two Interactive stock.