NTIC Stock Might Be a Worthwhile Bet Amid Environmental Push

With the earnings report for the third quarter of 2020 on the horizon, NTIC's losses might be high but that isn't the be-all-end-all.

Jan. 6 2021, Published 1:27 p.m. ET

With growing enthusiasm around environmentally friendly innovation, Northern Technologies International Corp. (NTIC) has managed to find its place in it all.

The company plans to release its earnings for the third quarter of 2020 on Jan. 8. Analysts expect losses, but it doesn't mean that NTIC won't grow.

NTIC has been publicly traded for decades

NTIC trades on the Nasdaq Exchange and the chart goes all the way back to March 27, 1992, when the shares traded at $1.44 per share. On Jan. 6, the shares are trading at $11.03 per share.

Over the course of NTIC's market history, it has seen consistent growth. In recent years, the growth has been bigger and quicker, which inevitably means it has farther to fall. Historically, long-term NTIC investors are the likeliest to see marked returns.

NTIC products are eco-friendly

NTIC develops products that are rooted in "environmentally beneficial materials science." They have a few key brands under their belt, including:

- Zerust/Excor products include kraft packaging paper, industrial rust removers, packaging films, and firearm storage protection.

- Zerust Oil & Gas products include pipeline casing protection, offshore rigs, equipment preservation tools, spare parts protection, underground storage tanks for retail gas stations, and aboveground storage tanks.

- Natur-Tec products include biobased performance compounds like resin, garment packaging, and compostable plastics.

NTIC stock could benefit amid eco-friendly shift

It's only a matter of time before environmental regulations catch up with the corporate norm as we know it. Things like environmental credits will help new companies embark on the fast-track to profit. We are already seeing this with companies like Tradewater and Sierra Energy.

While the company didn't start out that way, NTIC has been on the eco-bandwagon for years. With NTIC's oil and gas protection products, it even caters to the other side of the climate debate, which could help the company succeed in a changing market that's increasingly favoring sustainable solutions.

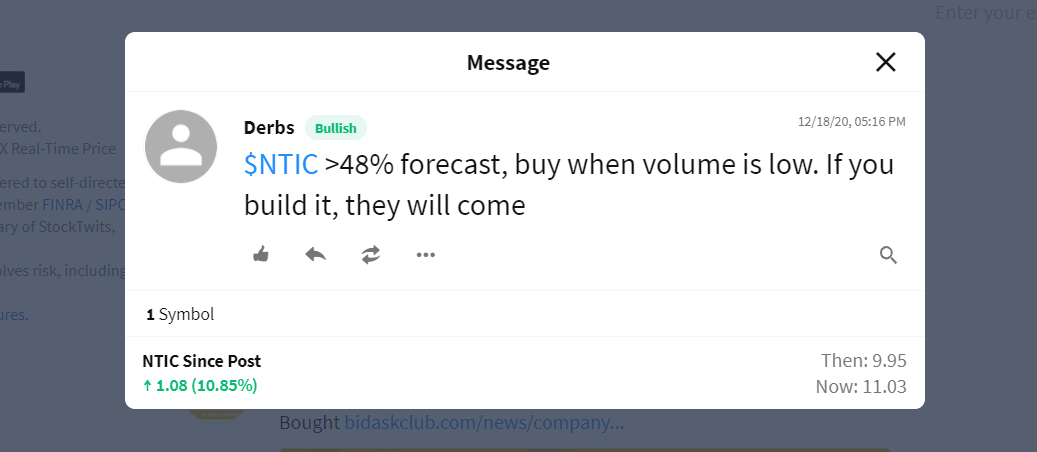

NTIC is trending on Stocktwits

NTIC dips are getting bigger with its gains, which could be good for investors who manage to get in on the downturns. Clearly, Stocktwits frequenters feel the same.

NTIC is a dividend stock, but it may not stay that way

As of Jan. 6, NTIC has a 2.39 percent dividend yield, which puts the annual dividend at $0.26 per share. The next dividend release will likely occur after the upcoming earnings report.

While NTIC missed the dividend mark from 2002–2017, it has switched back to a dividend payout system. It isn't known if the company plans to maintain dividends in the long term.

A quick forecast for NTIC stock

Wall Street experts are looking ahead at NTIC and they see a projected year-over-year decline. If NTIC manages to pull ahead of the expectations, the stock could rally in the short term.

Is NTIC stock a buy?

Growth investors may find NTIC worth the trade. The company isn't doing its best and the COVID-19 pandemic has definitely impacted NTIC's earnings. However, buying on the dip with historical growth in mind could lead to long-term returns that aren't all that risky.