Nano Dimension Has a Strong Start in 2021, Could Face Stock Dilution

In the last three months, Nano Dimension stock has risen 155 percent. Is NNDM stock a good buy at this price? How's the company's outlook and what can investors expect?

Jan. 14 2021, Published 11:21 a.m. ET

On Jan. 13, Nano Dimension stock rose by 21.6 percent, while the S&P 500 rose by 0.2 percent. The stock was up $2.03 from its previous closing price of $9.40 on a volume of 59,695,205 shares. In the last three months, the S&P 500 has risen by 9.2 percent, while Nano Dimension stock has gained 155.1 percent. The 3D printing stock has surged significantly despite substantial new share offerings. Is Nano Dimension or NNDM stock a buy or sell at this price?

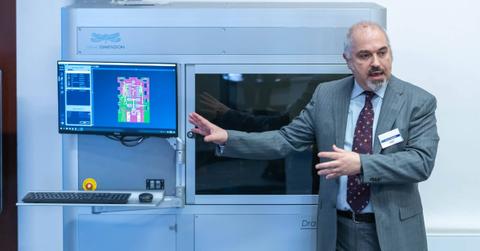

On Jan. 13, Nano Dimension stock surged significantly because of a patent grant for its printing technology. According to the U.S. patent filing, Nano Dimension was granted a patent titled “Rigid-flexible printed circuit board fabrication using inkjet printing.”

Nano Dimension’s direct public offering

On Jan. 13, Nano Dimension said that it has entered into agreements with investors for the sale of 35 million ADS at a price of $9.50 apiece in accordance with a registered direct offering. The expected gross proceeds from the offering will be $332.5 million. The net proceeds generated will be used for working capital and other general corporate purposes. The offering will likely close on Jan. 19.

Nano Dimension or NNDM on Stocktwits

Nano Dimension stock has become a major talking point on social media platforms. An investor named Professorr on Stocktwits said that the company issued five offerings in the last seven weeks and all at higher prices than the last. The investor added that the stock rose higher each time. The investor also congratulated the ones who bought the dip since something big is planned.

Nano Dimension doesn’t pay dividends

Currently, Nano Dimension doesn’t pay dividends.

Nano Dimension’s stock forecast

Nano Dimension stock has risen by 1.7 percent in the last five days and by 15.8 percent in the last year. The stock is trading 0.2 percent below its 52-week high of $11.45 and 2,141.2 percent above its 52-week low of $0.51.

Currently, Nano Dimension stock is being tracked by just one Wall Street analyst. The analyst has a buy recommendation. The 12-month average target price for Nano Dimension stock is $10.

Nano Dimension stock is a risky bet for investors

Nano Dimension stock is a risky bet because the company has been offering new shares. The existing investors should keep in mind the stock dilution effects as the company issues new shares. The company’s market capitalization has increased from $10.6 million in 2019 to $1.3 billion to date. New share offerings often increase the company’s valuation more than gains in its stock price.