Is Driven Brands (DRVN) a Good Stock to Buy? A Look at the Year Ahead

Driven Brands is one of J.P. Morgan’s top stock picks for May. How’s the company’s outlook? Is DRVN a good stock to buy?

May 5 2021, Published 1:40 p.m. ET

On May 5, Driven Brands (DRVN) stock is up over 1 percent after J.P. Morgan revealed its top stock picks for May. How’s the company’s outlook? Is DRVN a good stock to buy?

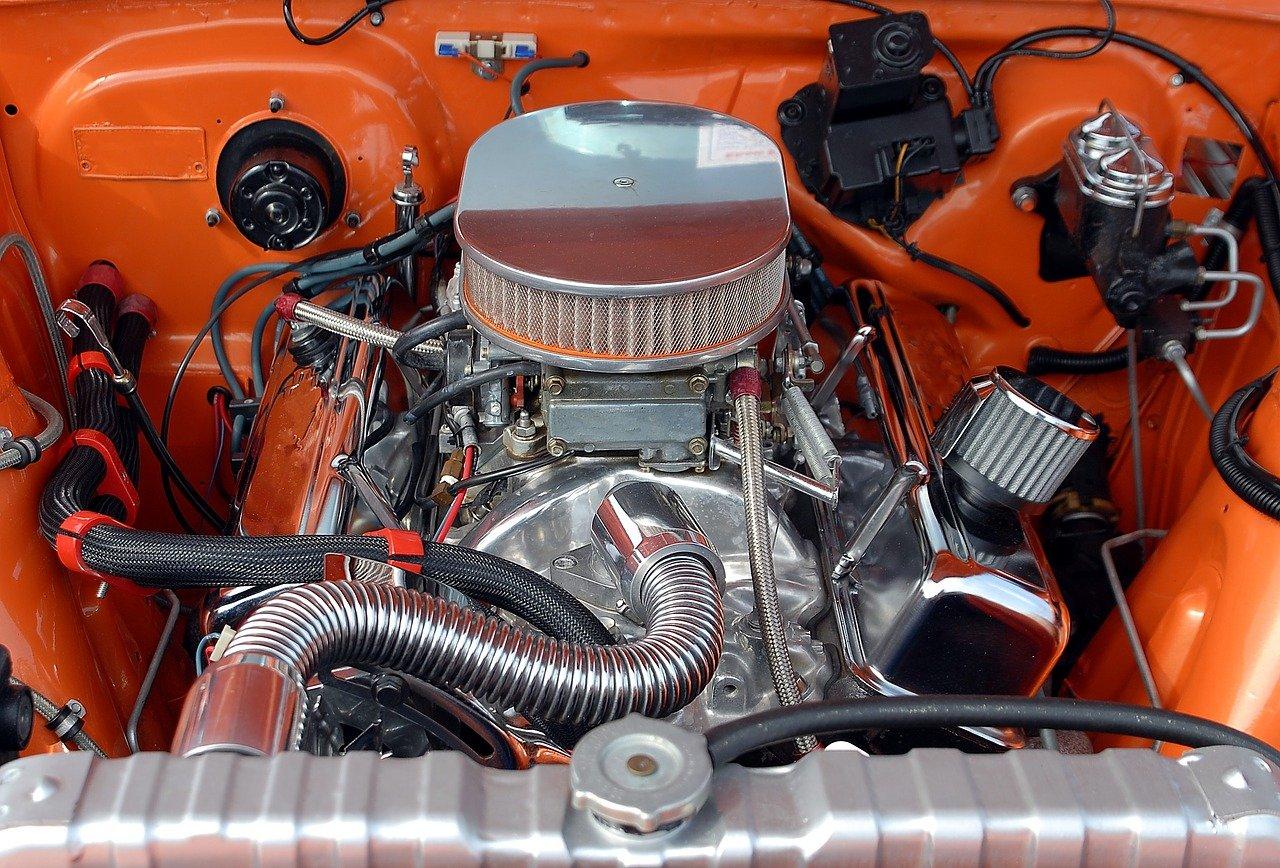

Driven Brands is the leading automotive aftermarket service company in the U.S. with over 4,100 locations across North America and 14 International countries. The company provides repair and maintenance, collision, paint, and oil change services. Driven Brands went public on January 15 through the traditional IPO process.

Driven Brands is J.P. Morgan’s top auto services pick

Each month, J.P. Morgan issues a focus list of the top stock picks in its coverage. The investment firm has an overweight rating on all of the stocks on the list and can be categorized as near-term, value, or growth plays. Driven Brands was one of the smallest companies on J.P. Morgan’s list of the top stock picks for May, with a market capitalization of $4.9 billion. J.P. Morgan has an “overweight” rating on Driven Brands with a target price of $42.

J.P. Morgan’s analyst referred to Driven Brands as a “quadruple threat that was still a bit of an undiscovered gem” despite the stock’s modest decline since its IPO. The investment bank’s other stock picks for May are Dell Technologies, Amazon, Allstate, Caterpillar, Ulta Beauty, and McDonald’s. J.P. Morgan removed tech giant Alphabet from the list.

Driven Brands’ stock valuation

Driven Brands was valued at $3.74 billion when its IPO was priced at $22. At its current stock price, the company’s market capitalization has ballooned to $4.9 billion.

DRVN Stock Price

Driven Brands stock valuation

Driven Brands trades at an NTM EV-to-sales multiple of 5.2x, which looks undervalued compared to other automotive aftermarket stocks. XPEL is trading at an NTM EV-to-sales multiple of 8.7x.

Driven Brands’ stock forecast

According to Market Beat, analysts' average target price is $35.75 for DRVN stock, which is 25 percent above its current price. Among the nine analysts tracking DRVN, six recommend a buy and three recommend a hold. None of the analysts recommend a sell. Their highest target price of $42 is 46 percent above the stock's current price, while their lowest target of $32 is 12 percent above.

On May 5, Morgan Stanley raised its target price on DRVN stock to $32 from $30 and maintained an equal weight rating on the stock. Baird analyst Peter Benedict said that he remains bullish on DRVN stock following the company’s beat-and-raise first quarter.

Driven Brands stock is a good investment.

In the first quarter of 2021, Driven Brands generated total revenue of $329.4 million, which represents an 83 percent rise from the first quarter of 2020. This was mainly due to the acquisition of International Car Wash Group in the third quarter of 2020 and positive same-store sales growth. The company’s operating income rose 216 percent YoY in the first quarter of 2021. The analysts polled by TIKR expect the company’s revenue to increase by 45 percent and 9 percent, respectively, in 2021 and 2022.

Driven Brands stock looks like a good investment based on its growth outlook. The global automotive aftermarket size is expected to reach $529 billion in 2028 compared to $390 billion in 2020.