What Happens to Del Taco Stock After the Jack in the Box Takeover?

Del Taco is a publicly traded company, but that's set to change after Jack in the Box acquires the restaurant chain.

Dec. 7 2021, Published 7:56 a.m. ET

Jack in the Box will acquire Del Taco in a $575 million deal to expand the business and unlock economies of scale. Is Del Taco a publicly traded company? What will happen to Del Taco stock after the Jack in the Box takeover?

Del Taco and Jack in the Box are both fast-food restaurant chains based in California. But Jack has been in business much longer, since 1951. It’s also a larger business, operating more than 2,200 restaurants. To compare, Del Taco was founded in 1964 and operates 600 restaurants across more than a dozen states.

Is Del Taco a publicly traded company?

Del Taco went public in 2015 through a SPAC merger valued at $500 million. Levy Acquisition, the SPAC that took Del Taco public, raised $150 million in the IPO. The sponsor contributed $120 million more, and PIPE investors brought in $35 million. Much of the money went into recapitalizing the business.

Before the Levy Acquisition SPAC came on board, Del Taco was controlled by a group of private-equity funds, including Goldman Sachs, Leonard Green Partners, and Charlesbank Capital Partners.

Jack in the Box is acquiring Del Taco to extend its reach and cut costs

The addition of Del Taco will extend Jack’s location presence to more than 2,800 stores across 25 states. Jack hopes to save $15 million in costs by 2023 through cost-saving opportunities such as supply-chain and digital efficiencies.

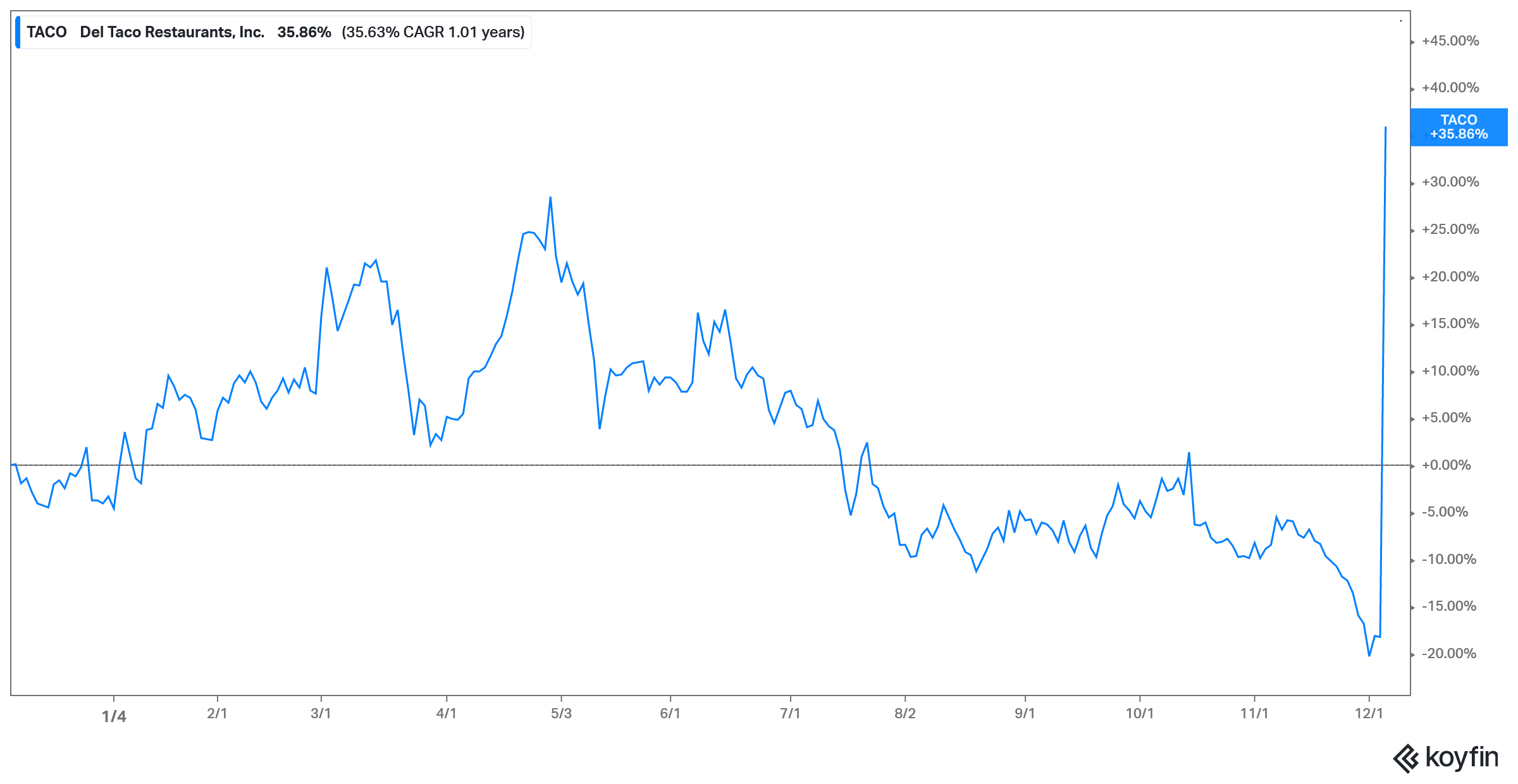

Jack in the Box will finance the acquisition through the issuance of notes in an arrangement with Bank of America, and absorb Del Taco’s debt. Del Taco stock rose 66 percent to $12.51 after the takeover's announcement, driving its market cap to $456 million. Meanwhile, Jack in the Box stock fell more than 4 percent to just over $80, leaving it with a market cap of just under $1.7 billion.

What will happen to Del Taco stock after the Jack takeover?

Del Taco distributed a quarterly cash dividend of $0.04 per share in Nov. 2021. It has also been returning value to investors through share repurchases. At the end of Q3 2021, the company had more than $10 million remaining in its share repurchase program.

You can buy Del Taco stock through your regular broker before the Jack in the Box transaction closes. The company is buying out Del Taco shareholders to fold the business into its portfolio. As a result, Del Taco stock will delist, and existing shareholders will give up their stake in the business. Investors will still be able to get exposure to Del Taco through Jack in the Box stock.

Similar to Del Taco, Jack is profitable, pays dividends, and has a share repurchase program. It plans to distribute a cash dividend of $0.44 per share on Dec. 23 and has added $200 million to its repurchase program.