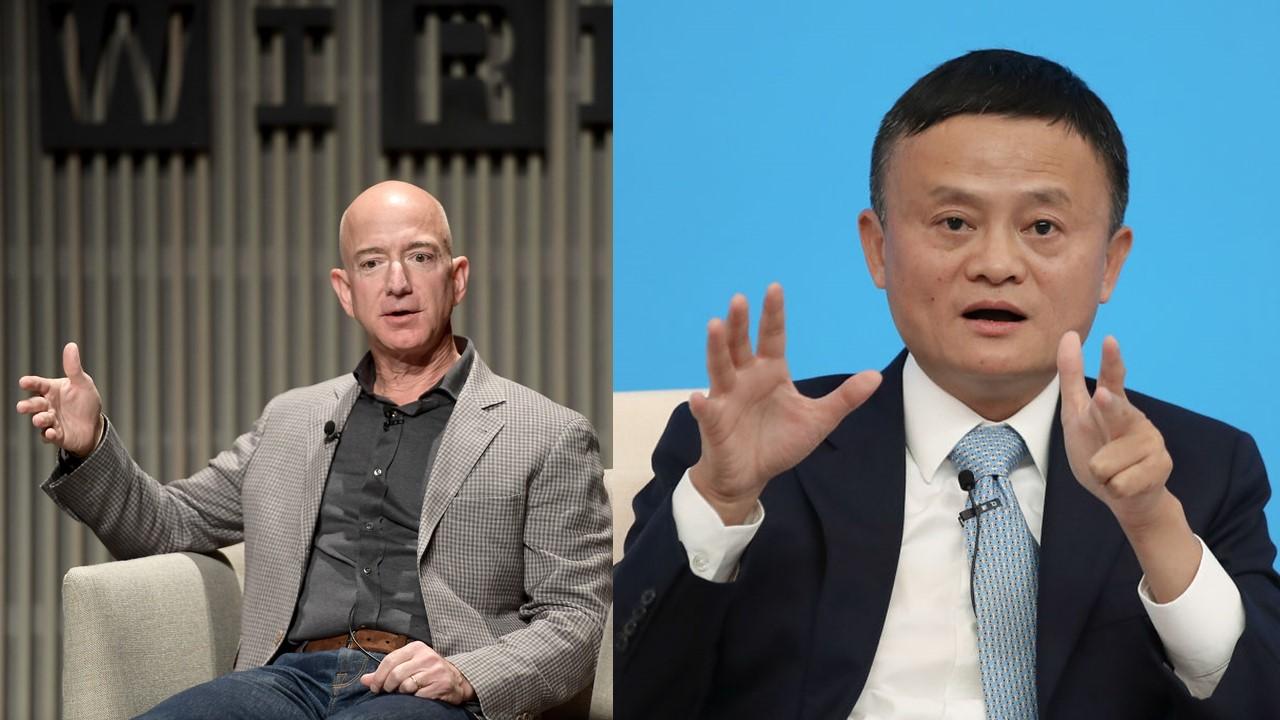

Is Alibaba Becoming Bigger Than Amazon?

Amazon.com and Alibaba have both reaped the benefits of the COVID-19 pandemic. Which company could come out on top when the dust settles?

Sept. 15 2020, Updated 2:26 p.m. ET

The COVID-19 pandemic hasn't had a good or bad impact on the world of finance. So far, the COVID-19 pandemic has been transformative for finance. Many possibilities have opened up that weren't there before, specifically when it comes to the internet. Consumers were forced to quarantine at the beginning of the coronavirus outbreak.

There has been a huge increase in the use of cloud services and online orders. Amazon.com and Alibaba, the two top e-commerce cloud providers in the world, have reaped the benefits of the massive shift. Which of the two companies has benefited more? Which company could be the victor of 2020’s e-commerce renaissance?

Comparing valuations — Alibaba and Amazon

A cursory look at the basic numbers will tell you that while Amazon's price-to-earnings ratio looks high, the stock doesn't appear as expensive based on other metrics. Amazon’s price-to-cash-flow ratio and price-to-sales numbers aren't as appealing as the price-to-earnings ratio. In contrast, Alibaba seems to be solid across all of the value measures.

Since Alibaba is a Chinese company, it's usually priced lower than Amazon due to the perceived risk attributed to any investment in China. There's greater potential for regulatory measures to be put in place by the Chinese government. The measures could be enacted without warning.

Since Alibaba’s lower valuation indicates a higher risk, many investors will favor Amazon. However, Amazon is hardly a “sure thing.” Some analysts think that Amazon is undervalued. The presumption is based on the fast growth and high-profit margins of Amazon Web Services.

Is Alibaba or Amazon growing faster?

Even though Alibaba and Amazon have been around for more than 20 years, they are still experiencing massive growth spurts relative to their size. The COVID-19 pandemic is partially responsible, but both companies have different models of operation.

Since Alibaba is a marketplace, it doesn't own the inventory of the merchandise that it sells. Alibaba facilitates a connection between buyers and sellers. Amazon is a reseller that owns the inventory and supply chain for all of its merchandise.

Alibaba’s business operates with much less overhead. Judging by the companies’ profit margins, Amazon is lower at 4.1 percent compared to Alibaba’s 23.3 percent. Amazon’s expanded offering of digital products and additional services makes for a better investment overall.

How Alibaba and Amazon treat employees

Jeff Bezos isn't known for his altruism as an employer. Many people think that he's one of the world’s worst bosses in terms of his lack of humanism. The accusations have increased during the COVID-19 pandemic. Many Amazon workers were underpaid and overworked in order to meet the high demand amid increased online orders.

One of Bezos's former employees, who is now a chief technical officer at HP, called Amazon, “The most toxic work environment I have ever seen.” Even taken out of context, the statement is particularly telling.

According to Jack Ma, who runs Alibaba, he holds his employees as number two in the three-part hierarchy of his company stakeholders. The first tier is the customer, while the third tier is the shareholders. Ma said that he doesn't undervalue shareholders. He just understands the importance of building and nurturing talented employees within an organization. As far as Jack Ma is concerned, you can challenge your employees and yell at them if needed, but you shouldn't treat them as a means to production.

Is Alibaba or Amazon a better buy?

Amazon stock started rising before the COVID-19 pandemic hit. Although Amazon is a good and solid stock, Alibaba has grown as well. Right now, Alibaba is growing faster than Amazon.

If you exclude the individual risk that comes from investing in a Chinese company and look at the overall growth, Alibaba is the better buy. However, no one knows what the market will look like in the future or during a holiday season mired by a global pandemic.