Shorting Dogecoin: How to Get Started and Whether You Should

Want to bet on Dogecoin's value decreasing? You'll have to short the cryptocurrency. Keep reading to learn how to get started.

May 6 2021, Published 1:59 p.m. ET

Unsuspecting altcoin Dogecoin has swelled 12,000 percent since the beginning of the year—much higher than flagship cryptocurrencies Bitcoin and Ether. Despite that, short-term volatility is still part of Dogecoin's chart, which is evident by the 5 percent drop on May 6. For this reason, shorting Dogecoin might interest some contrarian investors.

How do you short Dogecoin if you think the value of the asset will crash?

How shorting relates to cryptocurrency

Just like you can short stocks in the marketplace to profit off their downfall, you can also short cryptocurrencies like Dogecoin. Cryptocurrency is largely considered to be one of the most volatile markets, so many people find it to be a prime opportunity for shorting.

First, get a cryptocurrency trading account that allows shorting.

Platforms like Binance, Kraken, and Bitfinex allow margin trading, which means you can short cryptocurrency. There's also the option to use Coinbase Pro on margin, although not everyone will reach the deposit threshold.

Next, purchase futures to short Dogecoin.

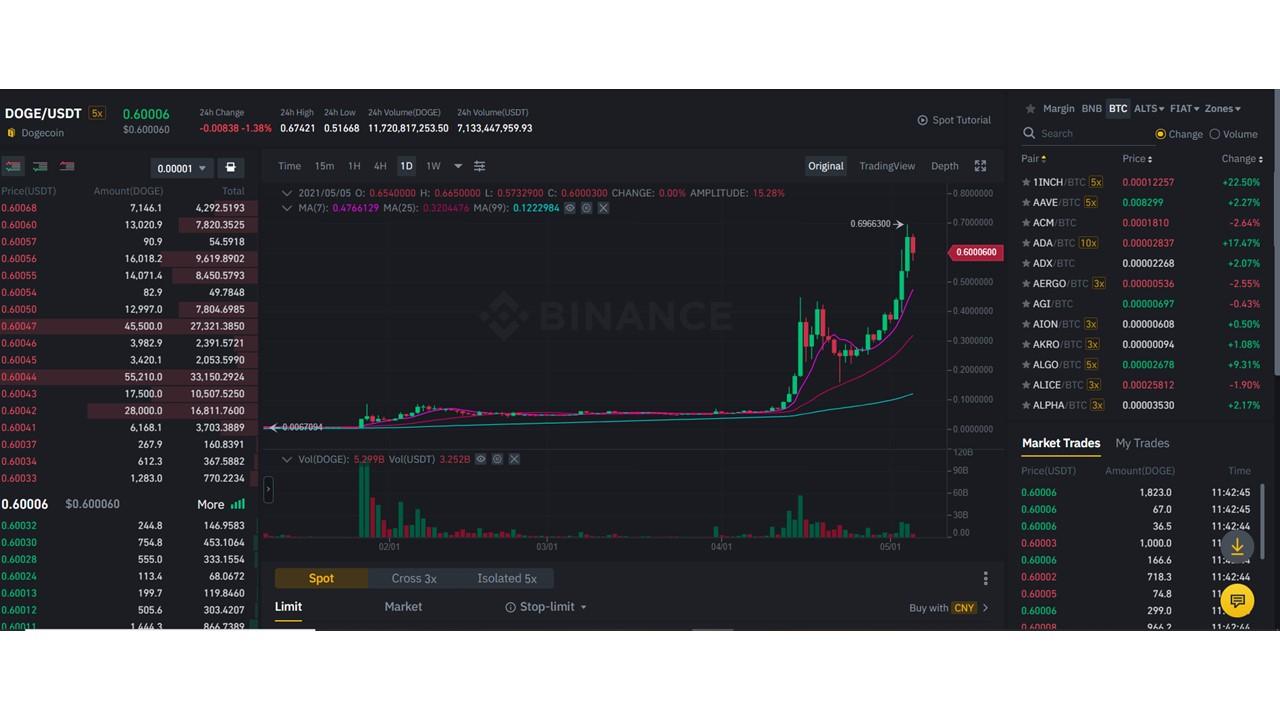

To bet on the price of the Dogecoin asset decreasing, you'll need to purchase USD Tether coins (USDT) to use for your futures contract. This is what the DOGE/USDT page looks like on Binance:

In the search bar, type "DOGE" and find the DOGE/USDT Perpetual option. This is what you'll short.

Convert your USD in your account to USDT. You can also sell other assets like Bitcoin to get USDT if you don't have money in your account.

Then, transfer your USDT funds into a futures wallet (USDS-M Futures wallet on Binance), which will likely be a separate wallet on your cryptocurrency platform.

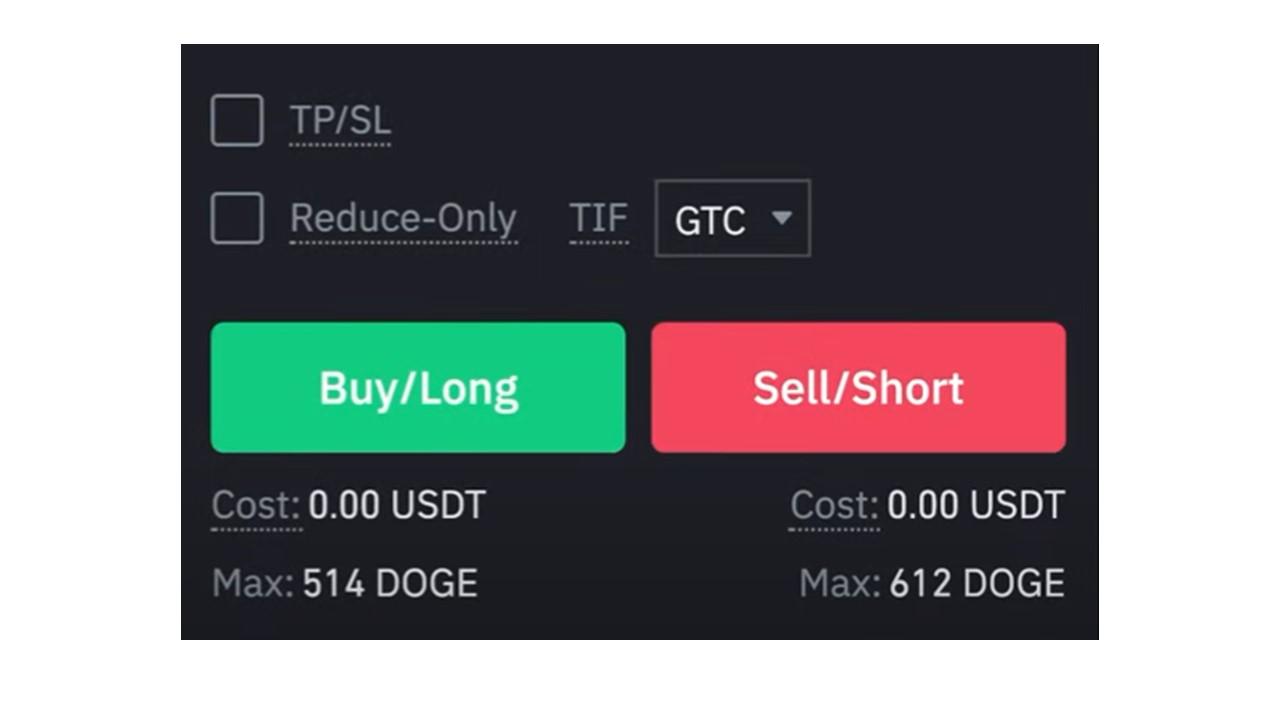

Once you have USDT, you can go back to the DOGE/USDT page and click the button for Sell/Short. It will look something like this:

If you're predicting that Dogecoin will go down, you'll use this short button.

Beware of using too much leverage when shorting Dogecoin.

For Dogecoin, you can leverage your bet up to 50 times your principal. Basically, if you have $100 to invest, you have the option to invest on margin for up to $5,000 in the hopes that you'll make that much back.

More leverage equals more risk. Investing on margin requires you to risk getting liquidated, losing all your money, and going into debt.

Whether or not you're a novice in the world of shorting cryptocurrency, you should question whether or not using marginal funds is right for you.

Choose an isolated position rather than a cross position.

If you short Dogecoin and the value of the asset ends up going up (which is against your favor), a cross position means you lose all of your money in your futures wallet. This is pretty risky. However, an isolated position means that you'll just lose what you paid for that particular futures contract. Check this option before confirming your short position so you don't end up emptying your wallet.

You don't need much to short Dogecoin.

You can short Dogecoin with as little as $10, although you can go much higher if you want to maximize your potential outcome.