Is Your Property Tax Bill Too High? How to Protest Property Taxes

If your property taxes have increased considerably, there are ways to challenge the increase. Here are some tips on how to protest property taxes.

Feb. 23 2022, Published 12:27 p.m. ET

Skyrocketing home prices in the real estate market over the last year will have a definite impact on property taxes. If your property taxes have increased considerably, there are ways to challenge the increase. Here are some tips on how to protest property taxes.

There's a deadline to appeal your property taxes.

Most local governments send out property assessment notices at the beginning of the year. There's usually a period when you can protest or appeal the assessed value. The window for appeals varies depending on where you live. Some jurisdictions will only give you 30 days to appeal, while others could give you up to 90 days.

Check the accuracy of your tax assessment.

Is all the information on your appraisal correct? Ensure that the assessor's office has the description of your house correct, including the number of bedrooms, bathrooms, and overall square footage. You should also check the tax rate, assessment figures, and payment schedule. If you're eligible for any credits, make sure that those credits are reflected on your property tax bill.

Research the value of homes in your neighborhood.

Many factors impact your home's appraised value, which determines your property taxes. One of the most significant factors affecting the value is the appraised value of comparable properties around you.

Research the current and past values of your home and others in your neighborhood. Make sure that you're looking into the values of homes comparable to yours. If you own a three-bedroom, two-bath single-family home on the water, you'll need to compare your home value with other homes on the water that are the same size.

You should go back at least six months to a year when looking at past values. A realtor can help compile a list of home values in your area.

Ask your neighbors if they've seen a similar increase in their home value or if they've made improvements to their home, which could have an impact on your home's market value. If there's a significant discrepancy between your home's assessed value and similar properties in the area, then you have grounds to protest your property tax bill.

Document your home's condition.

When building your case to protest your property tax bill, document the condition of your home. If your home needs major repairs, that will impact its value. Take pictures of areas throughout your home, both those that need repairing and those you have already fixed. For the repairs you have done on your home, make sure that you have receipts, invoices, or estimates for the work.

Look at what's happening in the area where you live.

Different factors where you live can impact whether your home value increases or decreases. For example, if you live in a gentrified neighborhood, the value of your home will most likely increase as more affluent people move into the area. On the flip side, if your community is seeing increased crime, your property values may decrease.

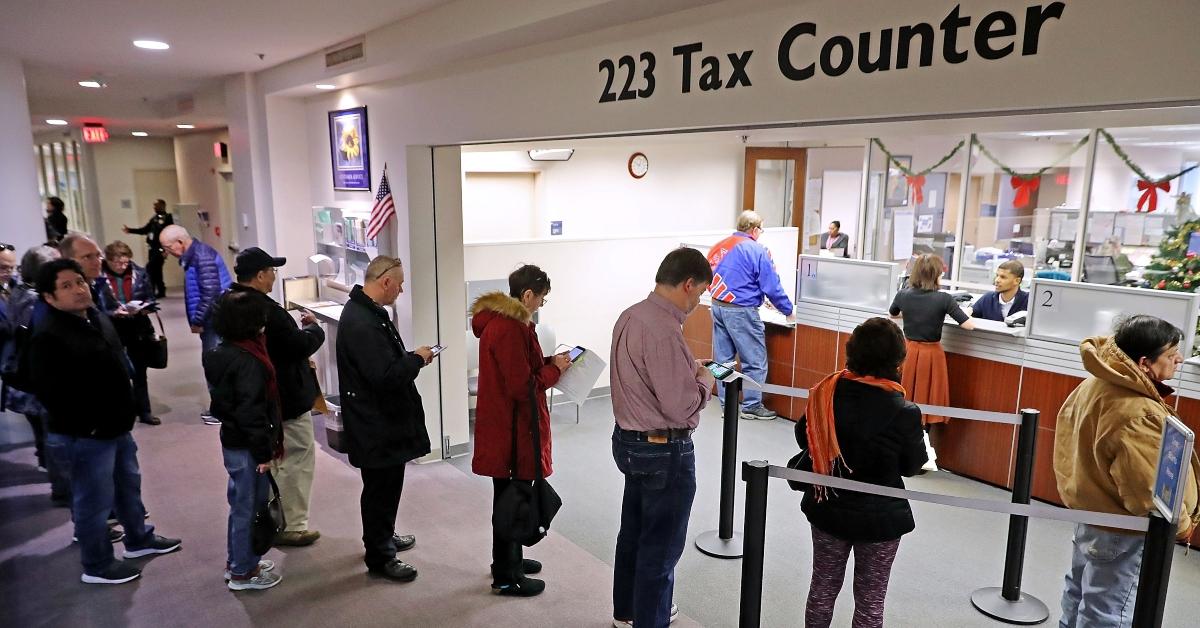

Take your case to the assessor's office.

Once you've done your due diligence and built your case to appeal your property tax assessment, you'll take your case to the county assessor's office. Most assessors have a form or process for filing an appeal, and that differs depending on the jurisdiction where you live. If the county rejects your request, you can appeal the decision to an appraisal review board.

About 20 percent–40 percent of property owners who protest their tax assessment win their case and get their property tax bills lowered.