How to Invest in Rising Gas Prices and Make a Profit

Natural gas prices have been rising amid the rebound in global economies as the world emerges from the COVID-19 pandemic. Can investors profit?

March 19 2021, Published 9:05 a.m. ET

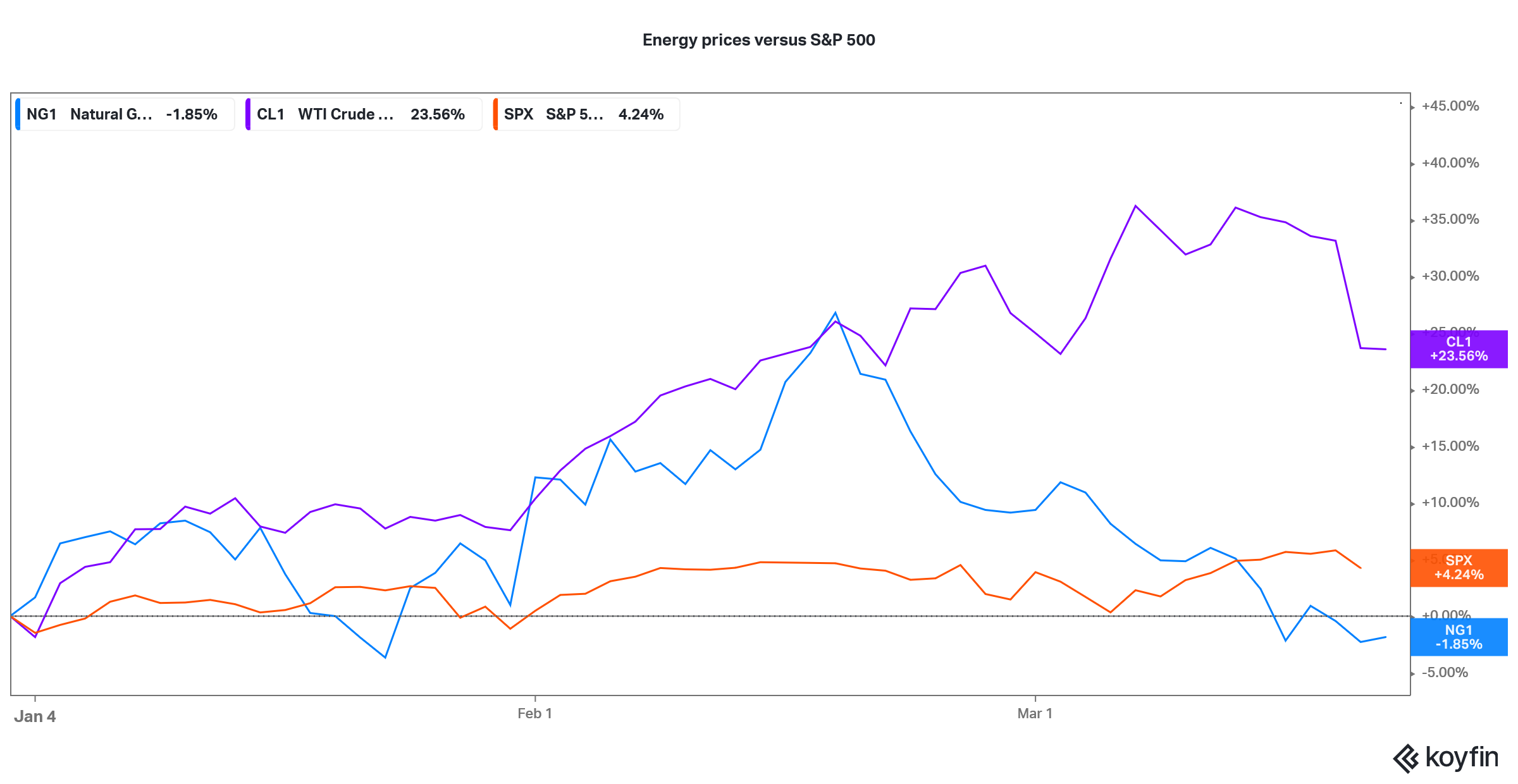

Energy prices tumbled on March 18. While WTI prices crashed 7 percent, natural gas prices closed down 1.85 percent. Natural gas prices have now turned negative for the year, while WTI prices are still up over 23 percent. However, natural gas prices are up 35 percent over the last year. Gasoline prices are also at the highest level since 2019. How can you invest in rising gas prices and profit?

Energy prices fell to historic lows in 2020 as the COVID-19 pandemic ravaged markets. WTI prices turned negative for the first time in history and natural gas prices also tumbled. However, as the world economy rebounded, so did energy prices.

Is natural gas a good investment?

Natural gas was once seen as a good alternative to dirty coal, which is among the most polluting sources of energy. However, as the costs for renewable energy generation have come down drastically, they have emerged as good alternatives. Also, while natural gas is a cleaner source of energy compared to coal, it's still a fossil fuel.

Energy prices versus S&P 500

Globally, countries are shifting to cleaner sources of energy and focusing on green energy. The global transition towards green energy is a bearish driver for natural gas prices even though it might benefit from a shift from coal towards natural gas.

Warren Buffett invested in natural gas.

Under Trump’s presidency, the U.S. focused on oil and gas exports to bridge its massive trade deficit. However, given Biden’s focus on green energy, it remains to be seen whether energy exports will be a priority.

Berkshire Hathaway chairman Warren Buffett seems bullish on natural gas. In 2020, he bought Dominion Energy's natural gas assets. Overall, the near-term outlook for natural gas prices looks decent if not overtly bullish.

Certain stocks go up when gas prices go up.

Meanwhile, gasoline prices have been on an uptrend this year due to the sharp rise in crude oil prices. Gasoline prices are at the highest level since 2019. Higher gasoline prices are usually positive for downstream energy companies that refine oil. So, you would expect stocks like Valero, Occidental Petroleum, and Marathon Petroleum to perform well when gasoline prices rise.

So far, these companies have performed well in 2021. They are among the top gainers in the S&P 500. Based on the closing prices on March 18, Marathon Petroleum and Occidental Petroleum are up 75 percent and 68 percent, respectively. They are among the top 10 gainers in the S&P 500.

Valero is also up 40 percent and is among the top 40 gainers in the S&P 500 Index. In 2020, the energy sector was among the worst-performing sectors as energy prices nosedived. However, the stocks have bounced back in 2021.

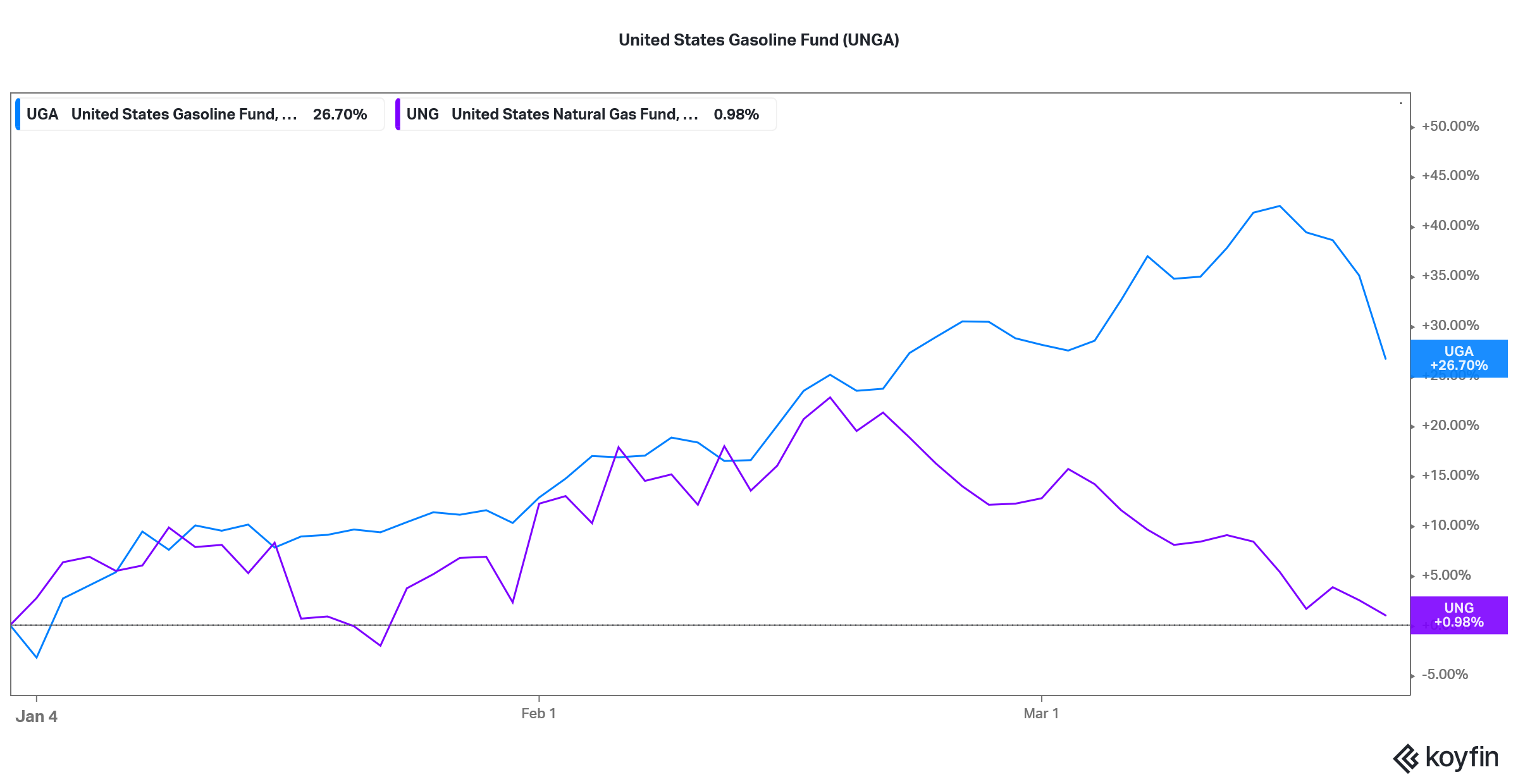

Is there an ETF that invests in gasoline?

The United States Gasoline Fund (UGA) is an ETF that’s designed to capture the movement in U.S. gasoline prices after accounting for the fees. The ETF is up 147 percent over the last year and 26 percent YTD.

UGA versus UNGA

If you are looking at an ETF that invests in natural gas, you could consider the United States Natural Gas Fund (UNG). The ETF is trading flat for the year.