What Are the New Fannie Mae Loan Limits in 2022?

Fannie Mae, along with Freddie Mac, provides financing for mortgage lenders. It follows federal regulations and limits for loans determined by average home prices.

Dec. 28 2021, Published 11:54 a.m. ET

For Americans ready to search the housing market in the new year, it’s important to know about certain lending limits from mortgage providers. Fannie Mae is one of the companies you might hear about when considering taking out a home loan. Fannie Mae is one of the top sources of financing for mortgage lenders.

Along with Freddie Mac, Fannie Mae helps drive the mortgage market by purchasing mortgages from banks, which enables banks and other lenders to finance more housing loans. Fannie Mae and Freddie Mac are both subject to FHFA (Federal Housing Finance Agency) regulations, which set the limits for new loans each year.

How did Fannie Mae get started?

Fannie Mae is the more common label for the Federal National Mortgage Association, which was chartered by Congress in 1938. Fannie Mae isn't a mortgage lender but a source of financing for mortgage lenders. It helps offer liquidity in the market for low to moderate-income mortgage borrowers and renters.

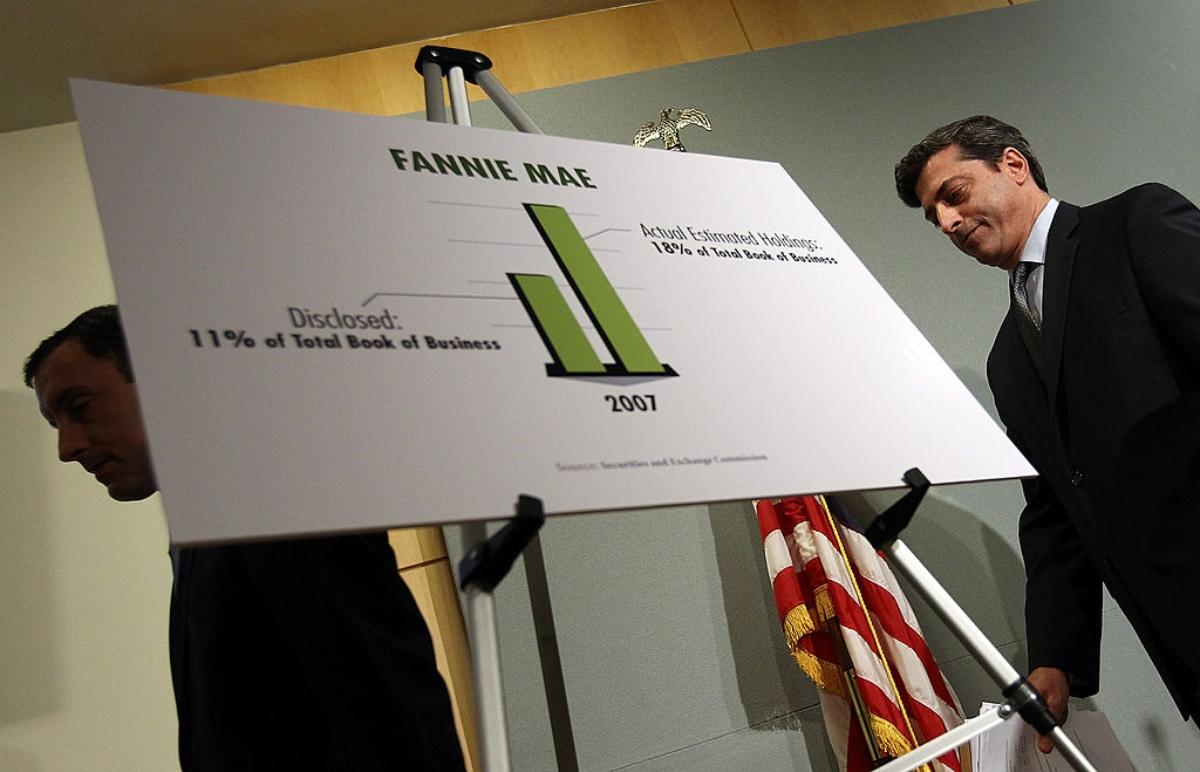

Fannie Mae and Freddie Mac executives were charged with securities fraud in 2011.

Fannie Mae and Freddie Mac loans are different from FHA loans and VA loans, so their mortgage limits will be different.

Fannie Mae has new loan limits in 2022.

On Nov. 30, the FHFA announced its conforming loan limits for 2022. The CLLs (conforming loan limits) for Fannie Mae and Freddie Mac will be capped at $647,200 for most of the U.S. That goes for one-unit properties, and there are some exceptions to the limit.

For 2021, the CLL was $548,250. The CLL is increasing by $98,950 for both mortgage enterprises in 2022.

For multi-unit properties in low-cost areas, the Fannie Mae loan limits are higher than for single units.

2 units: $828,700

3 units: $1,001,650

4 units: $1,244,850

In high-cost areas, a 4-unit property has a limit of $1,867,275.

What are Fannie Mae’s loan limits in high-cost areas?

Certain areas of the country are subject to adjusted CLLs due to higher housing costs in those areas. If 115 percent of local median home values exceed the baseline CLL, HERA establishes different limits with a ceiling of 150 percent of the baseline limit.

In 2022, 150 percent of $647,200 is $970,800, which is the new ceiling loan limit for one-unit properties. In high-cost areas, a 4-unit property has a limit of $1,867,275.

Alaska, Hawaii, Guam, and the U.S. Virgin Islands are subject to special statutory provisions, which means that their baseline loan limit will be $970,800 for one-unit properties.

How are home loan limits determined?

Fannie Mae and Freddie Mac are given a baseline conforming loan limit that reflects changes in the average price of a home each year. The limit is thanks to the Housing and Economic Recovery Act (HERA)—a piece of financial reform legislation passed in 2008 after the subprime mortgage crisis.

One of the effects of the HERA was that both Freddie Mac and Fannie Mae were placed under the conservatorship of the FHFA to improve the resilience of the federal housing system.

When the FHFA published its latest 2021 FHFA House Price Index® report, it showed that home prices went up 18.05 percent on average between the third quarter of 2020 and the third quarter of 2021. The baseline CLL in 2022 increases by the same percentage.