Dow Jones 2021 Target, Might Outperform the S&P 500

While most brokerages have targets for the S&P 500, not many provide their targets for the Dow Jones Index. Can the Dow outperform in 2021?

Dec. 17 2020, Published 9:01 a.m. ET

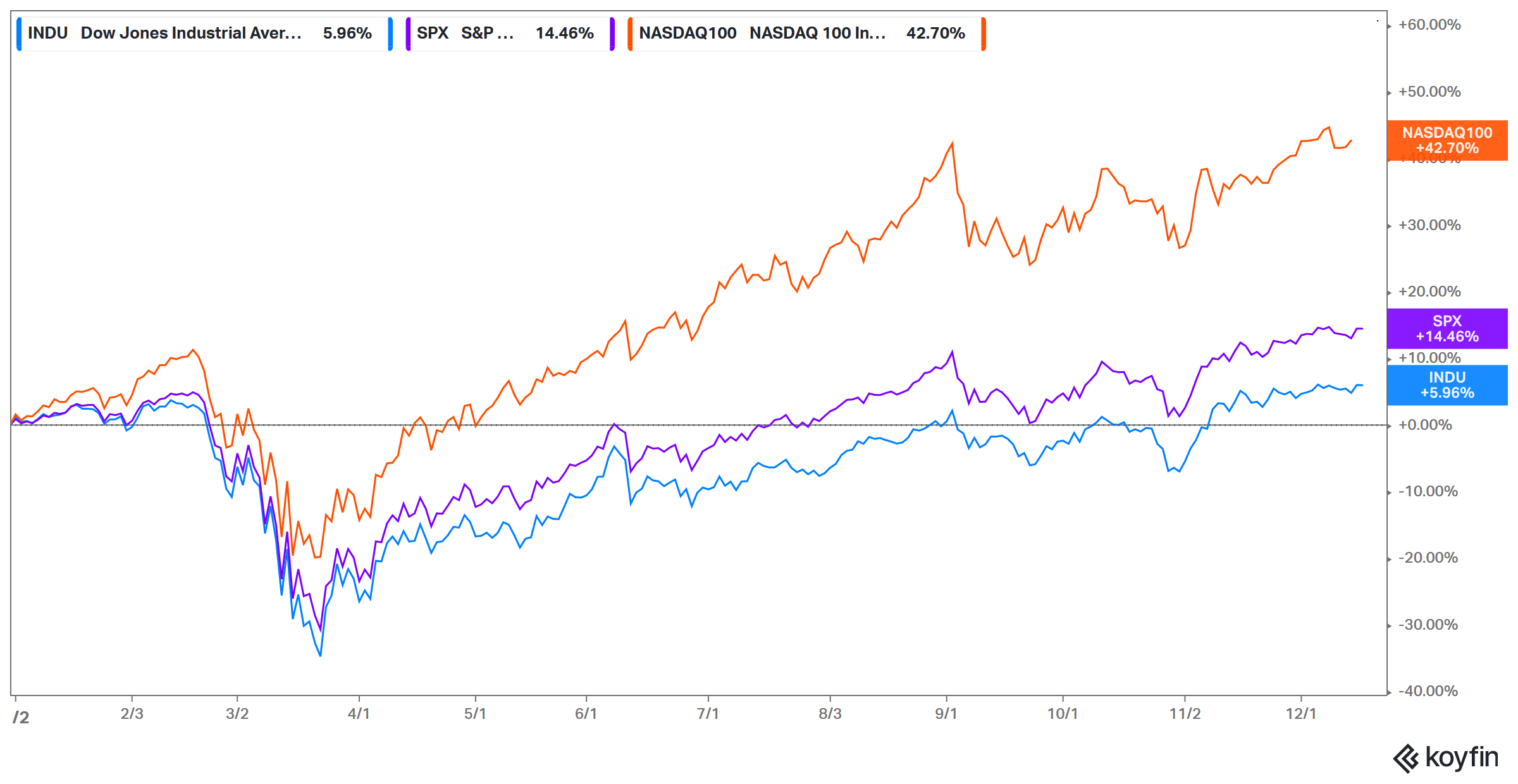

The Dow Jones Industrial Average Index made a record high in 2020 and recovered smartly from its March 2020 lows. However, the index underperformed the S&P 500 and the Nasdaq Index this year. What’s the Dow Jones’ 2021 target and could it outperform the S&P 500?

The Dow Jones is among the oldest stock exchanges globally. However, its popularity has been masked by the S&P 500, which is the world’s most popular stock index. While most brokerages give their yearly targets for the S&P 500, not many of them provide targets for the Dow Jones Index.

Dow Jones faced challenges in 2020

The Dow Jones Index has been on a rollercoaster ride in 2020. At one point, the Dow Jones erased all of the gains that it had made under Trump’s presidency. However, thanks to the massive fiscal and monetary easing, the Dow managed to recoup its 2020 losses. The Dow Jones rose sharply in November. There was a sector rotation from growth and tech stocks to value and cyclical stocks.

What investors can expect from the Dow Jones in 2021

The Dow Jones underperformed the S&P 500 and the Nasdaq 100 Index by a wide margin in 2020. However, it could outperform the S&P 500 in 2021 if the sectoral shift towards cyclicals and industrial stocks continues. Also, since there's a strong bullish undertone in U.S. stock markets, the Dow Jones might continue its good run in 2021 as well.

Certain sectors could help the Dow Jones in 2021

The Dow Jones is a price-weighted index of 30 U.S. companies. Looking at the breakdown by sectors, the information technology sector makes up 22.3 percent of the Dow Jones followed by healthcare and industrials with 17.4 percent and 16.9 percent weightage. Consumer discretionary and financials make up 14 percent and 13.2 percent.

The Dow Jones has a high weightage towards industrials, financials, and consumer discretionary compared to the S&P 500. These sectors underperformed in 2020 but could bounce back in 2021 amid the COVID-19 vaccine rollout. The expected strong returns from these sectors could help the Dow Jones in 2021. Analysts expect the highest returns from the consumer discretionary sector in 2021.

Dow Jones might reach 40,000 in 2021

Patrick Spencer, the vice-chair of equities at investment bank Baird expects the Dow Jones to rise to 40,000 next year. “We talk about maybe 40,000 level on the Dow there next year because of the make-up of that index which is more value than growth,” Spencer said in November 2020 speaking with CNBC.

Consensus estimates suggest that analysts expect the S&P 500 to rise to 4,000 next year. J.P. Morgan is among the most bullish with a bull case forecast of 4,600. The bull case scenario is an upside of almost 25 percent for the S&P 500. The Dow Jones would need to rise more than 30 percent in 2021 to hit the 40,000 level.

Biden administration will impact the Dow Jones

President Trump’s trade war took a toll on industrial stocks. While President-elect Joe Biden has indicated that he won't immediately repeal the tariffs on China, the Biden administration is expected to take a lenient view about the tariffs on friendly countries. If the Biden administration pursues a more conciliatory approach towards China, it would support the Dow Jones.

However, Biden's policies on hiking corporate tax and capital gains tax would hurt the U.S. stock markets at least in the short term. The country would need to mobilize resources to cover up for the massive fiscal stimulus in 2020 that has lifted the U.S. debt-to-GDP ratio beyond 100 percent.