Members of Congress Must Pay Income Taxes Like All Other U.S. Citizens

Do congressmen and congresswomen pay taxes? Yes—it’s a myth that representatives and senators are exempt from income tax.

Sept. 14 2021, Published 12:23 p.m. ET

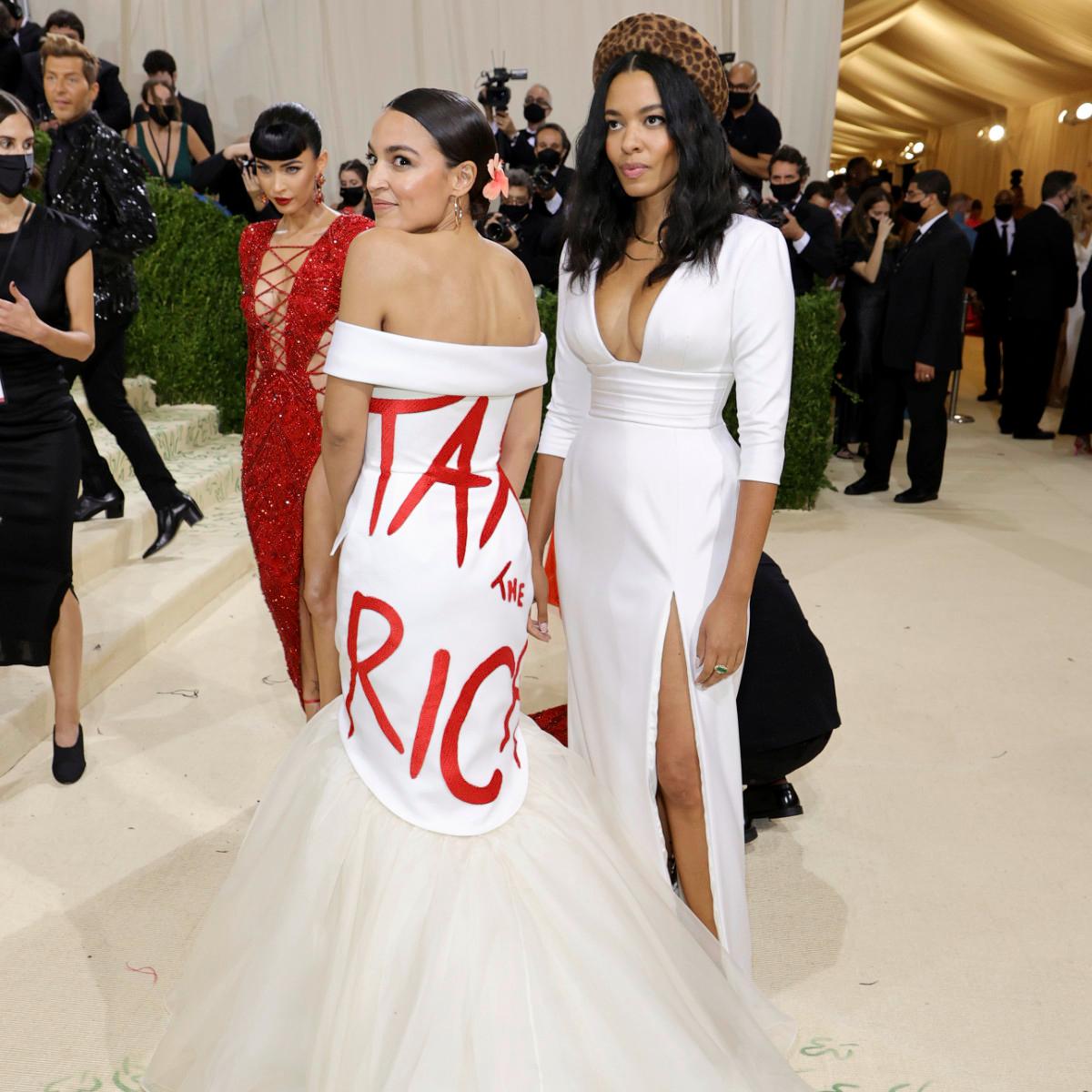

Rep. Alexandria Ocasio-Cortez (D–N.Y.) wore a Brother Vellies dress printed with the words “Tax the Rich” to the 2021 Met Gala on Monday, Sept. 13. An income tax rate increase for wealthy Americans would apply to many of Ocasio-Cortez’s Congressional colleagues. Congresspeople do pay taxes, and yes, many of them are very rich.

To be clear, AOC isn’t a millionaire, but many other members of Congress are. OpenSecrets reported the estimated net worths of the wealthiest senators and representatives last year: $260 million for Sen. Rick Scott (R–Fla.), $214 million for Sen. Mark Warner (D–Va.), $189 million for Greg Gianforte (R–Mont.). The site noted that the top 10 percent of wealthiest lawmakers have three times more wealth than the bottom 90 percent.

Congresswomen and congressmen do pay taxes.

According to the Congressional Institute, a not-for-profit corporation that helps constituents better understand the national legislature, U.S. senators and representatives “must pay their federal income taxes like all citizens,” whether their income comes from private business, government salaries, military pay, or even unemployment checks.

Until recently, members of Congress could deduct $3,000 from their income taxes for living expenses, but the Tax Cuts and Jobs Act of 2017 eliminated that tax deduction. The current tax code says that “amounts expended by such Members within each taxable year for living expenses shall not be deductible for income tax purposes.” (In 2017, BuzzFeed News reported that dozens of members of Congress were sleeping in their offices, often to avoid the high cost of housing in Washington D.C.)

Members of Congress also have to pay for Social Security, and they don’t get free housing.

In a 2019 opinion piece for The Hill, former Rep. Steve Israel dispelled what he called the top myths about the perks of serving in Congress.

For starters, Israel said it’s a myth that members of Congress are exempt from Obamacare. “The only way out is the same for every American, which is receiving health care through a spouse or parent, or purchasing a health plan without a federal contribution to premiums.”

It’s also a myth, Israel wrote, that members of Congress receive a pension equal to their salary after a year of service. Instead, they can receive a pension after serving for five years, reaching the age of 62, and contributing to the pension plan along the way. Israel revealed that his pension is “nowhere near” his Congressional salary.

As for the other three myths, Israel told readers that Congress members aren’t exempt from paying into Social Security, they don’t often vote to increase their salary, and they don’t get free housing. (“They pay rent or mortgages for accommodations in Washington, just like everyone else,” he added. “Some do sleep on their couches in their offices, but that is weird.”)

Israel clarified that he wasn’t saying that serving in Congress was a thankless job. “It is a privilege and an honor to represent our communities in the halls of the United States Capitol,” he wrote. “But the fact is that all those lavish perks you read about on the internet are not always true.”