Why Parts of China Are Facing Power Outages Amid Energy Crisis

China is in an energy crisis as it aims to reduce carbon emissions. Many companies and regions have faced power rations and power outages to help meet emissions goals.

Sept. 27 2021, Published 12:59 p.m. ET

Many households in China have been facing power outages in recent weeks. The government would usually target industrial energy users in times of lack (for example, Apple and Tesla suppliers announced temporary factory closures to save energy). However, the energy crisis in China is impacting ordinary citizens as well.

The power curbs have been enacted in response to Chinese provinces failing to meet energy emissions goals. Like many nations around the world, China aims to reduce carbon emissions to combat climate change. The prices of coal and gas have also impacted China’s energy availability.

Some of the blackouts have included northern provinces cutting power to traffic signals and street lights, which led to traffic jams in multiple cities. Some high-rise buildings suspended elevator service to save power. Guangdong residents were asked to turn off air conditioning and electric light bulbs over the weekend.

China is in an energy crisis.

Reuters reported that for the first half of 2021, only 10 out of 30 Chinese mainland regions attained their emissions targets, while nine regions increased their usage on an annual basis. In July, China introduced a new carbon emissions trading market to incentivize firms to cut their emissions. The country even introduced an element of competition among companies, according to The New York Times.

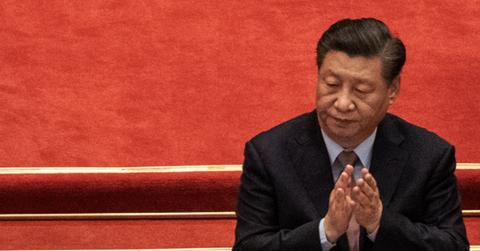

President Xi Jinping committed to China’s emissions peaking prior to 2030. In addition, he stated that the nation would achieve carbon neutrality by 2060.

China's southern and northern regions are seeing different impacts from the energy outages because they depend on different types of energy. Fortune reported that in the south, hydropower is running low, while increased coal prices are impacting northern China.

Hydropower was drained during the warm summer months in southern provinces like Yunnan. The demand increased there as metalworks companies relocated, which added to the competition for green energy.

In the north, coal plants are providing electricity and saw increased emissions in the spring. The prompted energy rationing, first in Bitcoin mining and aluminum smelting, which have high energy use.

David Fishman, an energy consultant with Lantau Group, stated that China’s emission-reduction plans aren't the main cause of the outages, but rather the increase in coal and gas prices.

Chinese power companies

In August, 11 northern Chinese power producers petitioned the government to allow price increases to be imposed on end-users, according to Fortune. This was after a 2019 freeze on energy rate hikes imposed by the National Development and Reform Commission. The firms warned that they all faced bankruptcy if they weren't able to meet increasing costs by charging more.

“Making consumers pay more for pollution will help spur that transition” to a carbonless future. However, the government will need to figure out how to handle power disruptions such as blackouts and their impacts.

Chinese cryptocurrency ban

Meanwhile, cryptocurrency mining is viewed as a major offender in terms of environmental impact. The computer systems used to power the mining process use a great deal of energy.

Beijing recently enacted a ban on cryptocurrency trading and mining. Reuters reported that although some crypto exchanges originated in China, authorities in the country view cryptocurrencies as “speculative instruments lacking in intrinsic value, prone to acute price moves and a means to circumvent capital controls.”