December’s Child Tax Credit Could Be Larger—Will It Be The Last One?

The final child tax credit is set to hit bank accounts in December. Paper checks will be mailed out and should be expected by the end of the month.

Nov. 24 2021, Published 11:18 a.m. ET

The advanced child tax credit has helped many Americans struggling through the COVID-19 pandemic afford things such as child care services, food, and other essential items for their children. The IRS began issuing child tax credit payments on July 15, 2021, and they're expected to continue through the end of 2021.

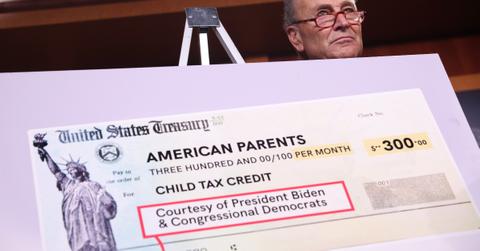

The American Rescue Plan Act of 2021 approved child tax credits of up to $3,600 ($300 monthly) for children under the age of 6 and $3,000 ($250 monthly) for those between the ages of 6 and 17. The other half of the credit, either $1,800 or $1,500, can be claimed on your 2021 taxes. When will the IRS deposit your December payment, and will child tax credit payments be extended through 2022?

December’s child tax credit is scheduled to hit bank accounts on Dec. 15, and some will be for $1,800

Many taxpayers received their second-to-last round of the child tax credit on Nov. 15, though some had their money deposited a few days earlier. Americans should expect what could be their final advanced payment to be deposited in the bank account they have on file with the IRS on Dec. 15.

If you haven’t signed up for direct deposit through the IRS’s Child Tax Credit Portal but filed your 2020 taxes, your payment will likely arrive in the mail sometime before the end of December. Paper checks might be delayed a bit longer than usual, with holiday shipments clogging up the mail system.

While many taxpayers can expect to receive either $300 or $250 per child, depending on their children’s age on Dec. 15, others might receive up to $1,800, which is equivalent to half the child tax credit. Eligible individuals or couples who don’t typically file taxes who provide the IRS with their information before Nov. 29 may still be able to collect half of the advanced child credit on Dec. 15.

If you're eligible to receive the child tax credit, which is currently being issued in monthly installments, and you provide the IRS with your updated information, you can collect the first half of the credit on Dec. 15 if you sign up for direct deposit or by mail sometime before the end of December. Nov. 29 also marks the last day to unenroll from advanced child tax credit payments.

Will the child tax credit be extended through 2022?

Advanced child tax credits are expected to end in Dec. 2021, though you can still collect the remaining half of your credit (either $1,800 or $1,500) when you file your 2021 tax return in 2022. The $1.75 trillion Build Back Better Act could allow for the advanced child tax credits to extend through 2022, though the bill has only been approved by House Democrats, reports CNBC.

In order for advance payments of the child tax credit to extend through 2022, the Senate will need to pass the bill with its current terms. That would allow joint filers who make up to $150,000 annually or unmarried filers who earn up to $112,500 to collect their child tax credit in monthly installments through 2022. If the bill is passed, eligible individuals could continue receiving $250 per child under the age of 6 or $300 per child if they're between the ages of 6 and 17.