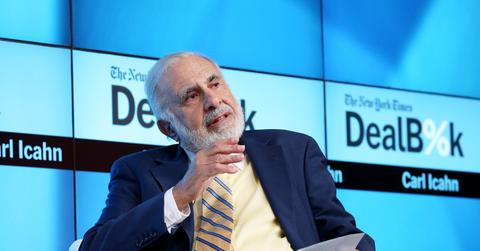

Carl Icahn Doesn’t Invest in Bitcoin but Sees Potential in the Token

Carl Icahn doesn't invest in Bitcoin, but sees the cryptocurrency's potential as a hedge for inflation.

Oct. 21 2021, Published 7:14 a.m. ET

It seems billionaire Carl Icahn isn't investing in Bitcoin after all. After hinting that he could possibly invest billions in cryptocurrency in May 2021, Icahn has walked back on that statement. In an interview with CNBC, the businessman said that he and his partners don't understand Bitcoin, and they're not “going to invest in something we don’t get.”

Icahn did mention, however, that Bitcoin could act as a hedge if inflation across the U.S. continues to increase. With supply shortages continuing to occur, along with production costs being more expensive, inflation could very well rise. Similarly, billionaire investor John Paulson sees gold as a good hedge against inflation. Many billionaires seem to share similar sentiments on cryptocurrency.

What has Carl Icahn invested in?

Icahn primarily invests in the industrial and energy sectors, which makes sense because many of the companies he owns are involved in those industries. The billionaire has invested in over 15 companies, including Xerox Holdings (XRX) and Icahn’s own company, Icahn Enterprises LP.

The companies that hold the most weight in his portfolio are Icahn Enterprises, Occidental Petroleum (OXY), and Cheniere Energy. As of Aug. 2021, Icahn’s company makes up to most, comprising 53.80 percent of the portfolio, according to The Investor’s Podcast Network. The billionaire owns most of his company’s shares, holding over 237 million shares worth over $13 million.

Occidental Petroleum is the second-largest holding in Icahn’s portfolio, comprising 6.32 percent. That holding is 49 million shares, which is equal to over $1.5 million. The energy company is one of the largest oil producers in America and provides resources for countries around the world. Occidental plans to have net-zero emissions from its operations by 2040, and for the use of its products to reach net-zero emissions by 2050.

Cheniere Energy is Icahn's third-largest holding, comprising 5.77 percent of his portfolio (or 16.1 million shares worth approximately $1.4 million). Cheniere specializes in producing liquid natural gas (LNG), and in 2016 it was the first U.S. company to export it. LNG is much cleaner and cheaper than traditional liquid petroleum gas.

What companies does Carl Icahn own?

According to Icahn Enterprises data, under his Icahn Enterprises conglomerate, Icahn fully or majority owns over five companies, including his investment firm, Icahn Capital LP. The firm holds over $4.7 billion in investment funds.

PSC Metals, another Icahn subsidiary, specializes in metal recycling and facilitating the sale of scrap metal for cash. Viskase Companies, a world leader in food packaging solutions and services, is another company under the conglomerate’s holdings. The conglomerate even has operations in the real estate industry through American Real Estate Partners, a fund manager that focuses on real estate development.