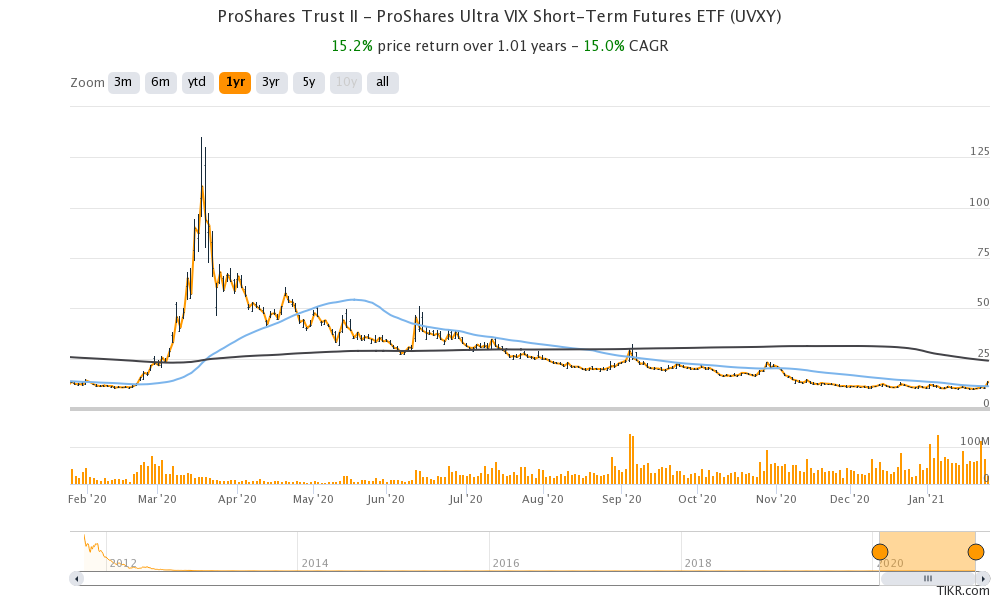

UVXY Is a Good Buy as Earnings and WSB Drive Volatility

UVXY, which tracks the movement in the VIX Index, rose 31.5 percent on Jan. 27. Should you buy UVXY amid the rising volatility in markets?

Jan. 28 2021, Updated 8:50 a.m. ET

The ProShares Ultra VIX Short-Term Futures ETF (UVXY) gained 31.5 percent on Jan. 28 and is up 27 percent YTD. UVXY is an ETF that tracks the movement in the VIX Index. VIX spiked over 61 percent on Jan. 27. Should you buy UVXY amid the rising volatility?

Before discussing whether to buy UVXY ETF, it's important to understand the underlying VIX index. Being a passive ETF, UVXY captures the long-term price movement of VIX after accounting for tracking errors.

Why the VIX Index is rising

VIX Index was created by the Chicago Board Options Exchange. The futures started trading in 2004, while the options launched in 2006. In technical terms, the VIX Index measures what the market expects from volatility over the next 30 days.

When it comes to investing in stocks, volatility and risk are the two key elements that you should watch out for. If you want to bet on the rise in volatility in stock markets, you can play it by trading in VIX derivatives or buying an ETF like UVXY. The VIX Index is also known as the “Volatility Index,” “Fear Gauge,” and “Fear Index.” Recently, VIX has risen amid increased stock market volatility. There are multiple reasons why the volatility has been going up.

Why is stock market volatility rising?

There are four main reasons why stock market volatility is rising:

- A new administration in the White House

- Earnings season

- Fears of a stock market bubble

- An unexplained rally in some stocks, especially those discussed on Reddit community WSB (WallStreetBets)

The Biden administration will likely reverse some of Trump’s policies. If President Biden goes ahead with his planned tax hikes, it would be negative for the markets.

Earnings season leads to volatility

Usually, market volatility increases during the earnings season. We are in the fourth-quarter earnings season and there have been some major earnings this week. Microsoft reported its earnings on Jan. 26, while Apple and Tesla reported theirs on Jan. 27. The earnings of these mega-cap companies can drive the broader markets and volatility. Apple and Tesla are trading sharply lower in pre-market on Jan. 28 after their earnings release.

There are also fears of a stock market bubble. There has been a rally in penny stocks, which signals a bubble. While fears of a bubble have been cropping up intermittently over the last year, they have risen over the last few weeks.

WSB versus the rest

Many shares like AMC Theatres and GameStop have risen sharply in 2021, which leads to market volatility. Many of these stocks are hot discussions on popular Reddit community WallStreetBets. The sharp rise in these beaten-down names is a key driver of volatility and is leading to a rise in many other penny stocks.

What to expect from volatility

Volatility is expected to be elevated over the next few trading sessions as more mega-cap companies report their earnings. Also, the tug of war between WSB stocks and short-sellers will only intensify over the next few trading sessions.

UVXY is a buy to bet on volatility

If you want to bet on volatility and play it through an ETF, there are multiple options available. ETFdb lists 32 ETFs that are based on the VIX Index. In terms of asset size, UVXY is the biggest with assets of $1.7 billion. It's also the most liquid ETF in the category with an average volume of almost 54 million. High liquidity helps lower the bid-ask spread. Also, UVXY's expense ratio is almost half of its nearest competitor, the Barclays iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX).

From a technical perspective, UVXY is trading below its 50-day SMA of $11.31. The 50-day SMA has been strong resistance for UVXY. If it can break above the line, we could see a new uptrend emerge in UVXY.