Is BioAtla’s IPO Risky or a Good Investment?

BioAtla, a clinical-stage pharma company, has filed its prospectus. What is BioAtla’s IPO date and price? Should you invest in the IPO?

Dec. 14 2020, Published 8:15 a.m. ET

Apart from being a very busy year for IPOs, 2020 is turning out to be a year for many biotech IPOs as well. In August, a Crunchbase report said, “So far in 2020, at least 37 venture-backed North American life sciences companies have carried out IPOs (see list), raising a total of $6.7 billion.” Right now, 2020 is on track to have the highest biotech IPO numbers in five years. BioAtla is a clinical-stage pharma company, that's planning to do an IPO soon.

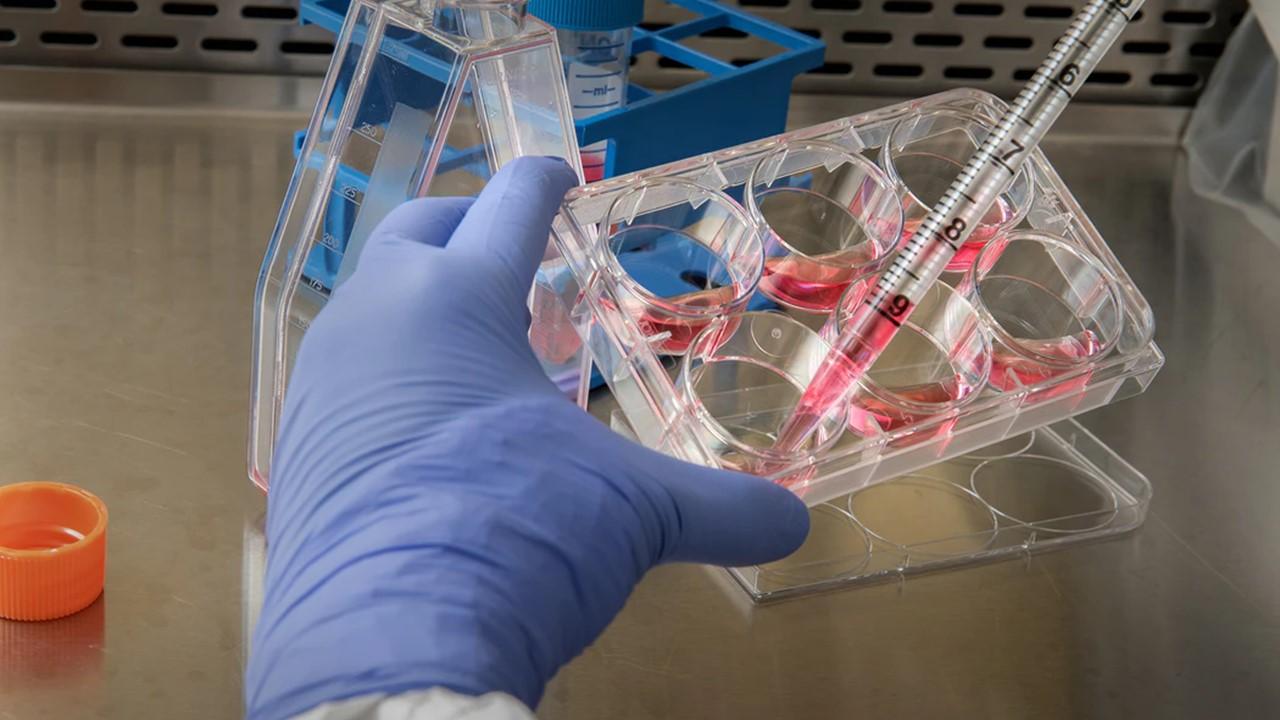

BioAtla filed its preliminary prospectus on Nov. 13 and set the terms of its IPO on Dec. 9. The company is involved in antibody-based therapeutics for treating solid tumor cancers. What is BioAtla’s IPO date and price?

Who owns BioAtla?

BioAtla is a clinical-stage pharma company that's developing highly specific and selective antibody-based therapeutics for treating solid tumor cancers. The company has started Phase 2 trials for its two latest stage antibody-drug conjugate candidates. The interim data is expected in 2021. The San Diego-based company was founded in 2007. Jay Short is the company's co-founder, chairman, and CEO. Previously, he was the president and CEO of Diversa Corporation, which is a biotech company that he co-founded. Short and Carolyn Anderson Short are the principal owners of BioAtla.

What is BioAtla's price and valuation?

The company announced the terms of its IPO on Dec. 9 after filing its prospectus on Nov. 13. BioAtla plans to offer 9.4 million shares at a price range of $15–$17 and raise nearly $150 million. At the mid-point of the indicated price range, the company would have a market capitalization of $527 million. BioAtla plans to list on Nasdaq under the ticker symbol "BCAB." Although the company hasn’t priced its IPO yet, it's expected to do so this week.

When does BioAtla go public?

According to IPOScoop, BioAtla is expected to start trading on Dec. 16. The company is offering two classes of shares — common stock with one vote per share and Class B stock with zero votes per share.

Is BioAtla’s IPO a risky investment?

The overall market for BioAtla's target technologies is large with considerable growth potential. According to Grand View Research's 2017 report, the global NSCLC (non-small cell lung cancer) therapeutics market size was valued at $6.2 billion in 2016. The market size is projected to grow at a compound annual growth rate of 7.5 percent over the forecast period. Increasing air pollution and people's smoking habits will likely contribute to the growth rate.

BioAtla is working with its partner, BeiGene, to initiate Phase 1 trials in multiple cancer indications by the end of 2020 or early 2021. The company also has several candidates in the preclinical pipeline including CAB bispecific antibodies targeting unmet medical needs in multiple types of solid tumors. The market sizes of these cancer conditions vary but would be worth billions of dollars in size.

While the potential opportunity for the company is huge, it has considerable risks like any other clinical-stage biopharma company. BioAtla doesn't have any products approved for commercial sale. Also, the company doesn't generate any revenue from product sales.