Best Vertical Farming Stocks for the Agricultural Shift

As agriculture moves in an upward direction, vertical farming stocks remain central to the shift. What are the best vertical farming stocks?

June 2 2022, Updated 1:33 p.m. ET

There are points in the stock market where impact investing and value investing intersect. That's the case with vertical farming stocks. They help fund the expansion of food production without relying on an immense amount of land and resources to get the job done. Amid agricultural shortages around the world, vertical farming might be more important than ever.

Many startups are still in the venture funding phase, but these vertical farming public companies might be a good investment now.

AppHarvest is one of the newer vertical farming stocks.

AppHarvest (NASDAQ:APPH) went public in February last year via a reverse SPAC merger. It was the first publicly traded agriculture technology company in the U.S. The company claims to use 90 percent less water than traditional open-field farming by recycling rain water.

The agriculture tech firm had about a $1.58 billion market cap around June 2021, but now its valuation has taken a hit and is around $330.20 million.

AppHarvest had a rough earnings report for the first quarter of 2022. The firm has massive expansion plans, which include building three new high-tech indoor facilities and partnering with vendors across the U.S. AppHarvest has heavily invested in tomatoes. It secured about $91 million last year to build indoor tomato farm facilities and now produces over 45 million tomatoes a year.

Hydrofarm Holdings is a vertical farming stock out of Pennsylvania.

Pennsylvania isn't all big oil and fracking. The state also produces environmental advancements like vertical farming, and Hydrofarm Holdings Group Inc. (NASDAQ:HYFM) is evidence. The 45-year-old brand went public at the end of 2020 and has gone on a bit of a ride. However, the stock has lots of potential.

Hydrofarm agreed to purchase House & Garden, a multi-touchpoint operation for $125 million, according to the terms of the deal. House & Garden is known for its quality nutrient production. Many hydroponic systems rely on a nutrient solution instead of soil to grow the plants. The commercial indoor agriculture company also purchased Innovative Growers Equipment in late 2021 for $58 million. Innovative Growers Equipment specializes in providing equipment for plant growers.

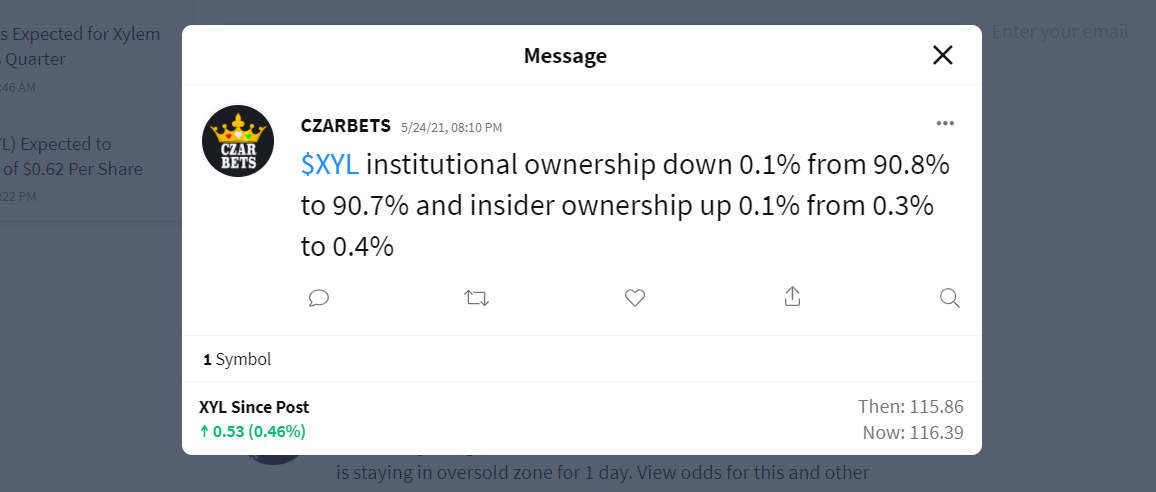

Looking at vertical farming from a different lens with Xylem.

Indoor vertical farms require water desalination technology, which is exactly where Xylem Inc. (NYSE:XYL) comes into play. This is just one example of a water treatment company functioning at a publicly traded, commercial scale. The dividend yield of 0.96 percent can be enticing to potential investors, offering an annual dividend of about $1.12 per share.

Xylem stock had a strong run in 2021, and is looking to make a significant rebound from its slump in early 2022. Vertical farming doesn't have to be the be-all-end-all for a company. Multiple MLS soccer teams have extended their partnership with Xylem to help tackle global water issues around the country. Investors can diversify with brands like Xylem, which are contributing to vertical farming's rise.

Expect more public vertical farming stocks to come.

This niche agricultural sector is just getting started. Aerofarms was expected to go public via a SPAC called Spring Valley Acquisition Corp. (NASDAQ:SV) last year. The company called off the SPAC late last year, but could opt for a different path of going public. As land becomes harder to come by and efficient, eco-minded farming becomes the norm, vertical farming stocks will be at the forefront.