A Roundup of the Best Debit Cards for Kids and the Perks They Offer

If you’re a parent who's considering getting a debit card for your child, here are a few solid choices for you to consider. The debit cards even offer perks.

June 2 2022, Published 11:18 p.m. ET

The personal finance category is gaining more interest these days. Women are speaking more openly on the topic and parents are encouraging their children to become better educated on spending and saving. Certain financial institutions and fintech companies are beginning to cater more to the younger crowd by offering kids’ debit cards.

If you’re a parent who's interested in getting a debit card for your child, here are a few options for you to consider.

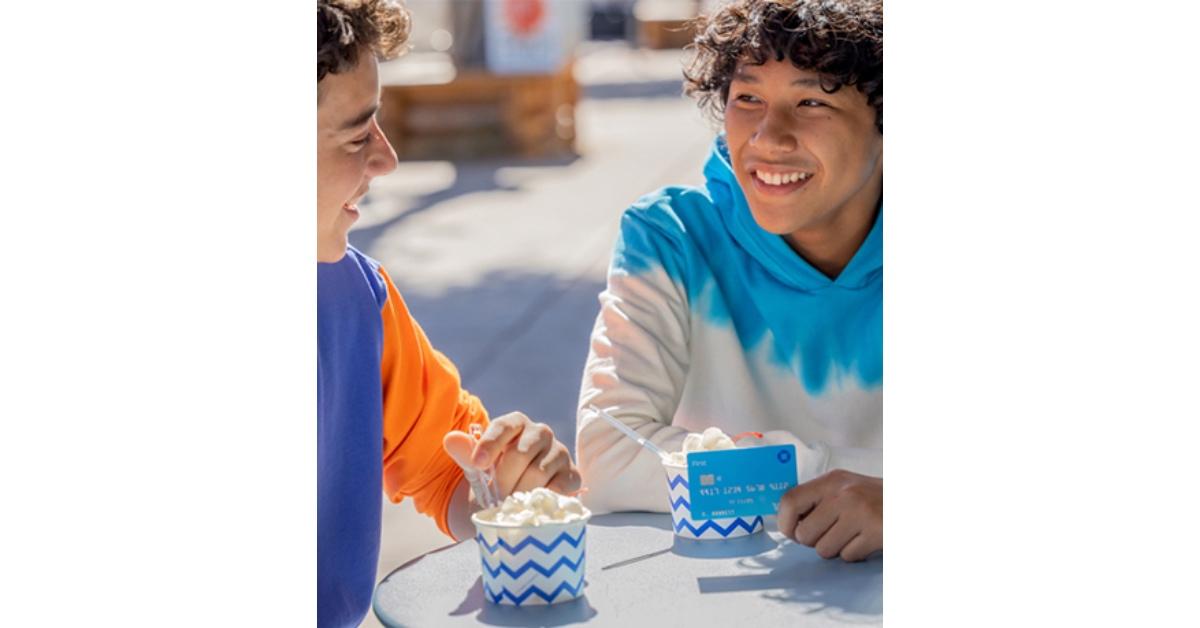

Chase gives existing customers the option to get a kids’ debit card for their child.

Want to teach your child about financial responsibility? You can start by getting a kids’ debit card from JPMorgan Chase. Chase currently gives its existing customers the option to enroll their child in the Chase First Banking Program. With this program, parents are able to open an account for their child, which gives them the flexibility to save and spend.

While your child will receive their very own debit card, you’ll be able to set limits on where and how much they can spend. You can also set up alerts, such as when their balance gets too low, and even place a limit on the amount they can withdraw from an ATM. The Chase First Banking Program has a $0 monthly service fee and is for children between the ages of 6 and 17.

GoHenry

GoHenry is a fintech company that provides your child with the opportunity to gain a better understanding of basic money management skills. In addition to issuing your child a debit card, GoHenry also has an app that lets your child monitor their account, track their spending, and even access in-app lessons.

Parents who pay their child an allowance can easily send money to them by linking their debit card to their child’s account. You can either set up regular transfers, make one-time payments to your child, or even set tasks for them that give them the opportunity to make more money.

GoHenry debit cards are available to children between the ages of 6 and 18 and cost $3.99 per month, per child. Children are given the opportunity to customize their debit cards, which makes the experience even more exciting for them and you.

Greenlight

If you’re looking for a kids’ debit card that carries more perks, you may want to check out Greenlight. Greenlight is a kids’ banking app that lets your child make deposits, spend, save, and even invest. You can set up payments for completed chores and even set savings goals together and allow them to receive rewards.

What’s even more exciting is that Greenlight gives working teens the option to set up direct deposit so their paychecks come directly to them. If they decide to spend a little here and there, Greenlight will give them 1 percent cash back for each purchase they make.

Greenlight plans start at just $4.99 a month for the whole family (up to five kids) and there isn't a minimum age limit to join. If you aren't ready to make the commitment, Greenlight offers a one-month free trial before the monthly fee kicks in.