The Big Question: What Caused the Amplify Energy Oil Spill?

Amplify Energy is at the helm of a disastrous California oil spill. What caused the massive leak?

Oct. 4 2021, Published 10:43 a.m. ET

The state of California hadn't experienced a massive oil spill in years—until now. The Elly oil rig broke off the coast of southern California, and the outcome is already deadly.

What caused the tragic oil spill? And what can investors expect for the environment and the company at the helm of the disaster, Amplify Energy?

The cause of the California oil spill

Elly is at the core of the spill. Right now, investigators know that a breach in the rig caused the damage, but they're not sure exactly how. It may be related to new drilling near the leak's starting point that the platform was planning to commence in Q4 2021. Older infrastructure in the industry is also a big concern.

How much oil spilled at the Elly oil rig?

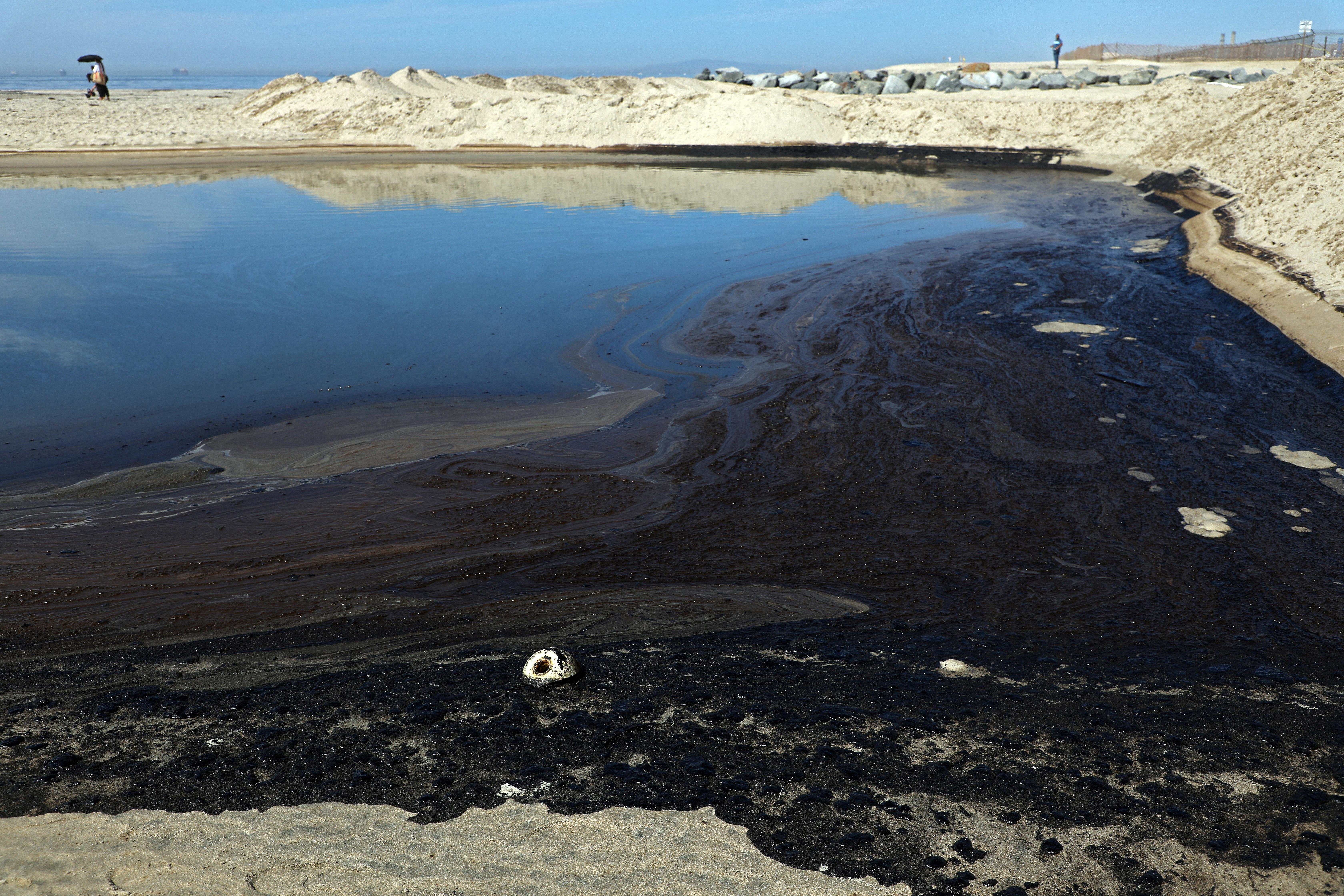

An offshore platform called Elly is the source of a 126,000-gallon oil spill that runs off the coast of southern California from Huntington Beach to Newport Beach. That's equivalent to 3,000 barrels, which had spread over 13 square miles of the Pacific Ocean as of Oct. 4. The spill is a "potential ecological disaster," according to Huntington Beach mayor Kim Carr.

The owners of the platform reported they've resolved the leak. Now, it's just a matter of finding out precisely how it happened and cleaning up the environment.

Who owns the Elly oil rig?

Beta Operating operates the Elly oil rig in the Beta Field, where the spill occurred. Beta Operating is a subsidiary of Amplify Energy (NYSE:AMPY). The Houston, Tex.-based corporation owns eight subsidiaries in the energy vertical.

A more complex picture emerges for Amplify Energy

This accident is not the first obstacle Amplify has faced in recent years. Amplify-owned Beta Operating has a rap sheet of federal noncompliance incidents and violations, according to the Los Angeles Times.

In 2013–2014, Beta paid $85,000 in fines for worker injuries and violations. The company has also been the target of 125 noncompliance violations found during inspections by the Bureau of Safety and Environmental Enforcement.

Meanwhile, Beta's former parent company, Memorial Production Partners, filed for Chapter 11 bankruptcy in 2017. The parent company ultimately restructured as Amplify.

Now, local political leaders are vowing to hold the oil companies accountable for the spill that is likely to impact the ecosystem for years to come. Governor Gavin Newsom is environmentally focused and could home in on ending oil drilling in the state even sooner than the 2045 deadline already in place.

Investors want nothing to do with AMPY stock. What's the forecast?

Within the first half-hour of trading on Oct. 4, AMPY stock was down 47 percent. That number continues to fluctuate, but the consensus is clear: Amplify stock is a get-out-of-dodge situation right now. Any existing analyst forecasts are a moot point as sentiment for Amplify sours. Even Roth Capital Partners has suspended its forecast.