Got FFEL Loans? Consider These Student Loan Forgiveness Options

President Biden’s student loan forgiveness decision leaves out a group of borrowers with FFEL loans. What are their options? Here's what we know.

Aug. 31 2022, Published 11:37 a.m. ET

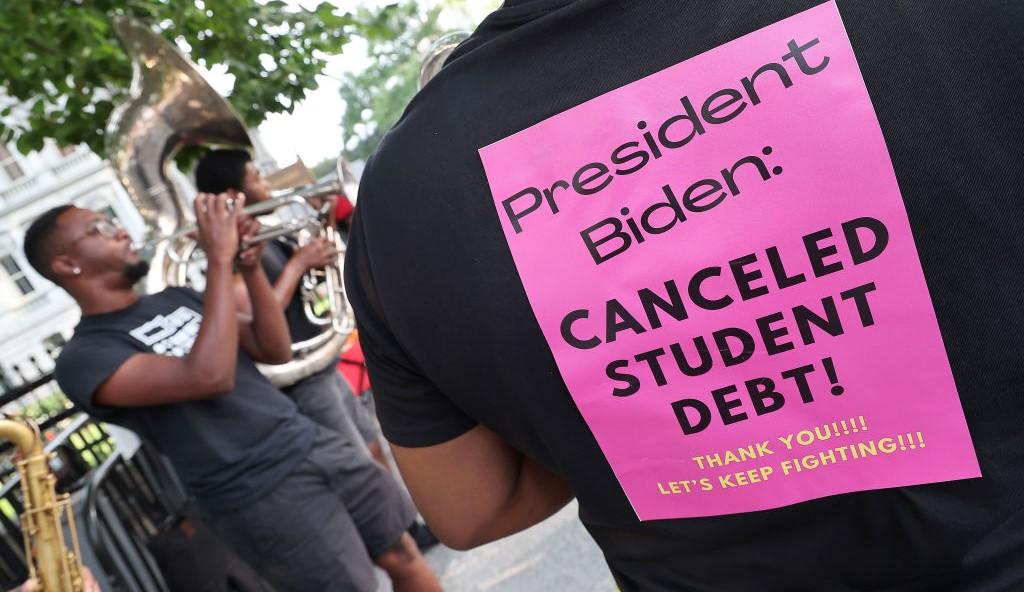

President Joe Biden’s decision to forgive $10,000–$20,000 worth of student loans is great for most borrowers. However, it leaves out a group of people: those with FFEL loans.

The Federal Family Education Loans (FFEL) program has been cut out of the ongoing student loan payment moratorium. Now, FFEL borrowers may also be left out of forgiveness. Here are options for FFEL borrowers.

What is FFEL — and why are these borrowers left out of the conversation?

For years, the FFEL program provided government-guaranteed, privately owned student loans. Today, about half of all FFEL borrowers have commercially held loans (rather than being owned by the Department of Education), which amounts to about 5 million borrowers falling in this camp. The FFEL program started in the 1960s and ended in 2010 when the government replaced the program with direct federal student loan funding.

According to Studentaid.gov, “Loans included in the FFEL program include Subsidized Federal Stafford Loans, Unsubsidized Federal Stafford Loans, FFEL PLUS Loans, and Consolidated Loans. No new FFEL Program loans have been made since July 1, 2010, but you may have an FFEL if you were attending school before that date.”

FFEL borrowers with commercially held loans have been required to make loan payments throughout the pandemic while other federal student loan borrowers were eligible for the moratorium.

Because FFEL borrowers have been excluded throughout the process, the Biden administration has left a loophole open for them to access $10,000 in student loan forgiveness.

Here's how to qualify for student loan forgiveness as an FFEL borrower.

About half of FFEL borrowers have federally owned loans. The remaining half with commercially held loans are the ones who aren’t eligible for government programs. If you fall in the latter camp (which you can find out about at Studentaid.gov, the Federal Student Aid website), consolidating your loan may make you eligible for forgiveness.

By consolidating into the Direct Loan Program through the federal government, your FFEL loan transfers from being owned by a private company to the federal government.

This pathway to forgiveness adds to another route for FFEL borrowers. Those who have repaid the loan for 10+ years while working at a qualifying non-profit or government job for the entire time can have their full loan forgiven.

It's important for FFEL borrowers to act now.

FFEL borrowers who need to consolidate their loans in order to qualify for forgiveness should start the process now. While there isn't a deadline in place, consolidation can take 4–6 weeks. Getting ahead of the curve could shorten your timeline.

Unfortunately for FFEL borrowers, the again-extended moratorium on student loan repayments doesn't apply to commercially held loans in the FFEL program. That makes moving quickly for forgiveness even more important for FFEL loan holders.

As of mid-2021, FFEL student loan debt was at $238 billion. While that number is now slightly lower due to ongoing payments, it’s still a hefty amount.