What's the Highest Fed Interest Rate Ever? All the Details

As the Federal Reserve prepares to announce another rate hike, many wonder about other high interest rates. What's the highest interest rate ever?

July 27 2022, Published 11:21 a.m. ET

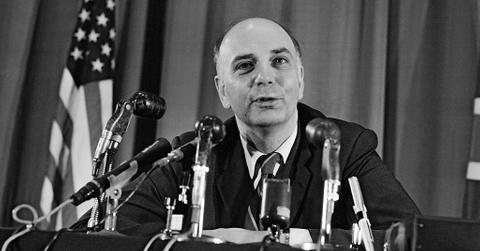

Former Chair of the Federal Reserve Paul Volcker (Served 1979 to 1987)

In the throes of record-high inflation, the U.S. Federal Reserve is hiking interest rates to attempt to ease what will likely be a bumpy economic landing. Experts anticipate Fed Chair Jerome Powell will announce another rate hike of 75 basis points (0.75 percent), in line with last month’s increase.

Looking back on federal interest rates over the years, the current rate remains well below the historic peak. Still, conditions suggest an upward trajectory is on the horizon — though for Americans’ sake, hopefully ending well below the record high.

The Fed rate hike history shows we’re still well below record highs.

Chair of the Federal Reserve Jerome "Jay" Powell

The COVID-19 pandemic sent federal interest rates near zero (at 0.25 percent, to be precise) for 21 months. This is the lowest in U.S. history and shows how severe of an economic impact the pandemic had.

In contrast, the highest-ever federal interest rate was 20 percent, which the U.S. reached in 1980. At the time, the GDP was negative at -0.3 percent, unemployment was high at 7.2 percent, and inflation was in the double digits at as much as 14.2 percent. A recession began in January 1980, with the record-high federal interest rate announced by March.

The move came under the leadership of then-Fed Chair Paul Volcker, who was credited for ending double-digit inflation, which fell to 3.2 percent by 1983. Volcker’s method of using high interest rates worked to combat inflation because the Fed hadn't started the practice of quantitative easing (QE) yet. The Fed started using QE in 2008, a practice that floods the market with money and interrupts the impact of interest rates on inflation. At this point, experts suggest the Fed’s ability to tame inflation may be limited due to its use of QE.

Will the Fed be able to tame inflation?

In June, the Fed set the target federal fund rate at 1.75 percent. That’s still well below the record high of 20 percent, but more rate hikes are on the horizon. Powell is set to announce a rate hike on July 27 that would bring the federal interest rate up to 2.5 percent, which is where it stood in December 2018 when the Fed promised to stop raising interest rates. That year, inflation was only around 2.4 percent, which is much lower than the 9.1 percent as of June.

The 30-year fixed mortgage rate currently sits around 5.65 percent while the mortgage refinance rate sits at 5.59 percent. Home purchase applications are falling (down a full percentage point for the week) while demand for mortgage refinances has shrunk 83 percent YoY.

Meanwhile, inflation has yet to quell, though it could be at or near its peak as the Fed takes stronger action. Forthcoming consumer price indices will help determine where inflation is headed in the near and long term.

At the end of the day, the Fed interest rate has major implications on the U.S. economy, not to mention the nation’s securities and commodities markets that feed off of it.